Evaluate divisional performance (Learning Objective 3)

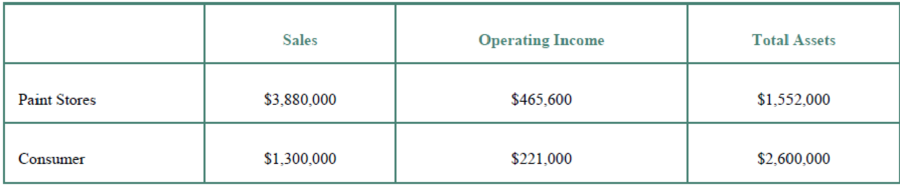

Sacramento Paints is a national paint manufacturer and retailer. The company is segmented into five divisions: Paint Stores (branded retail locations), Consumer (paint sold through stores like Sears, Home Depot, and Lowe’s), Automotive (sales to auto manufacturers), International, and Administration. The following is selected hypothetical divisional information for its two largest divisions: Paint Stores and Consumer (in thousands of dollars).

Assume that management has specified a 21% target

Requirements

Round all calculations to four decimal places.

- 1. Calculate each division’s

ROI . - 2. Calculate each division’s sales margin. Interpret your results.

- 3. Calculate each division’s capital turnover. Interpret your results.

- 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results.

- 5. Calculate each division’s RI. Interpret your results and offer recommendations for any division with negative RI.

- 6. Total asset data were provided in this problem. If you were to gather this information from an annual report, how would you measure total assets? Describe your measurement choices and some of the pros and cons of those choices.

- 7. Describe some of the factors that management considers when setting its minimum target rate of return.

- 8. Explain why some firms prefer to use RI rather than ROI for performance measurement.

- 9. Explain why budget versus actual performance reports are insufficient for evaluating the performance of investment centers.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Managerial Accounting (5th Edition)

Additional Business Textbook Solutions

Financial Accounting (11th Edition)

INTERMEDIATE ACCOUNTING

Principles Of Taxation For Business And Investment Planning 2020 Edition

Accounting for Governmental & Nonprofit Entities

Advanced Financial Accounting

- Evaluating Divisional Performance The three divisions of Delicious Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year: Which division is making the best use of invested assets and should be given priority for future capital investments? Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain. Identify opportunities for improving the company's financial performance. Requirements: I- TITLE OF THE CASE II - TIME CONTEXT (The approximate time when the case happened. Consider only this time period when you analyze the case.) III - VIEWPOINT (Consider always the point of view by the concerned officer/s based on the course being undertaken example: Marketing Director if the subject is marketing management, CEO if business Policy/…arrow_forwardDakota Security Systems (DSS) is a decentralized organization that evaluates divisional management based on measures of divisional contribution margin. Residential Division and Commercial Division both sell security and monitoring equipment. Residential sells primarily to home owners and apartment management companies. Commercial focuses on small to medium- sized businesses. Residential sells a particular alarm to the outside market for $255 per unit. The outside market can absorb up to 48,300 units per year. These units require 3 direct labor-hours each. If Residential modifies the units with an additional 0.75 hour of labor time, it can sell them to Commercial for $282 per unit. Commercial will accept up to 41,400 of these units per year. If Commercial does not obtain 41,400 units from Residential, it purchases them for $291 each from the outside. Commercial incurs $147 of additional labor and other out-of-pocket costs to convert the alarm (either from Residential or outside) into…arrow_forwardUsing ROI and RI to evaluate investment centers Tiger Paints is a national paint manufacturer and retailer. The company is segmented into five divisions: Paint Stores (branded retail locations), Consumer (paint sold through home improvement stores), Automotive (sales to auto manufacturers), International, and Administration. The following is selected divisional information for its two largest divisions: Paint Stores and Consumer: Management has specified a 19% target rate of return. Requirements Calculate each division’s ROI. Round all of your answers to four decimal places. Calculate each division’s profit margin ratio. Interpret your results. Calculate each division’s asset turnover ratio. Interpret your results. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. Calculate each division’s RI. Interpret your results, and offer a recommendation for any division with negative RI. Describe some of the factors that management considers when…arrow_forward

- Using ROI and RI to evaluate investment centers Wolf Paints is a national paint manufacturer and retailer. The company is segmented into five divisions: Paint Stores (branded retail locations), Consumer (paint sold through home improvement stores), Automotive (sales to auto manufacturers), International, and Administration. The following is selected divisional information for its two largest divisions: Paint Stores and Consumer. Management has specified a 21% target rate of return. Requirements Calculate each division’s ROI. Round all of your answers to four decimal places. Calculate each division’s profit margin ratio. Interpret your results. Calculate each division’s asset turnover ratio. Interpret your results. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. Calculate each division’s RI. Interpret your results, and offer a recommendation for any division with negative RI. Describe some of the factors that management considers when…arrow_forwardAustin BBQ has seen rapid growth in the last five years. It started with one store and is now located in 15 different locations across five cities. The CEO has noticed that costs are increasing and so is beginning to standardize practices across the various locations. Which of the following perspectives is most consistent with the CEO's efforts? Group of answer choices 1.Rational System 2.Natural System 3.Open System 4.Operational Systemarrow_forwardThese questions relate to the Integrated Analytics Case: Bene Petit. Select the appropriate eBook link to open the Case Overview, Case Background, and Part 3: Managerial Decision Making. The following table summarizes the operating results for Bene Petit's first year of operations: Bene Petit First Year Operating Data: Single (1 serving) Dual (2 servings) Family (4 servings) Total Customer Meals Sold 3,000 5,000 12, 000 20,000 Total Customer Servings 3,000 10, 000 48,000 61, 000 Customer Orders (Average = 4 meals per order) 750 1,250 3,000 5,000 Number of Donated Meals (1 per customer meal) 3, 000 5,000 12, 000 20,000 Number of Donated Deliveries (500 meals per delivery) 6 10 24 40 Additional information about selling prices, variable costs, and fixed costs is summarized below: The average sales price for customer meals is $5 per serving. The average direct materials (ingredients) cost of customer meals is $1 per serving. Direct labor costs average $0.75 per customer meal. Variable…arrow_forward

- The three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year: a. Which division is making the best use of invested assets and should be given priority for future capital investments? b. b. Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain. c. c. Identify opportunities for improving the companys financial performance.arrow_forwardDantrell Palmer has just been appointed manager of Kirchner Glass Products Division. He has two years to make the division profitable. If the division is still showing a loss after two years, it will be eliminated, and Dantrell will be reassigned as an assistant divisional manager in another division. The divisional income statement for the most recent year is as follows: Upon arriving at the division, Dantrell requested the following data on the divisions three products: He also gathered data on a proposed new product (Product D). If this product is added, it would displace one of the current products; the quantity that could be produced and sold would equal the quantity sold of the product it displaces, although demand limits the maximum quantity that could be sold to 20,000 units. Because of specialized production equipment, it is not possible for the new product to displace part of the production of a second product. The information on Product D is as follows: Required: 1. Prepare segmented income statements for Products A, B, and C. 2. Determine the products that Dantrell should produce for the coming year. Prepare segmented income statements that prove your combination is the best for the division. By how much will profits improve given the combination that you selected? (Hint: Your combination may include one, two, or three products.)arrow_forwardElsinore Electronics is a decentralized organization that evaluates divisional management based on measures of divisional contribution margin. Home Audio (Home) Division and Mobile Electronics (Mobile) Division both sell electronic equipment, primarily for video and audio entertainment. Home focuses on home and personal equipment; Mobile focuses on components for automobile and other, nonresidential equipment. Home produces an audio player that it can sell to the outside market for $72 per unit. The outside market can absorb up to 89,000 units per year. These units require 3 direct labor-hours each. If Home modifies the units with an additional hour of labor time, it can sell them to Mobile for $81 per unit. Mobile will accept up to 77,000 of these units per year. If Mobile does not obtain 77,000 units from Home, it purchases them for $84 each from the outside. Mobile incurs $36 of additional labor and other out-of-pocket costs to convert the player into one that fits in the…arrow_forward

- Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center). Average Invested Assets Sales Income Electronics $63,460,000 $3,173,000 $16,700,000 Sporting goods 19,050,000 2,286,000 12,700,000 Investment Center Exercise 22-10 Computing return on investment and residual income; investing decision LO A1 1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company? 2. Assume a target income level of 12% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company? 3. Assume the Electronics department is presented with a new investment opportunity that will yield a 14% return on…arrow_forwardCookies and Cream Milkshakes are my Favorite (CCMF) has three investment centers within their organization. The ROI achieved by each division is provided below: Division Operating Income Assets Division A $160,000 $800,000 Division B $57,600 $320,000 Division C $81,000 $540,000 CCMF has an additional $200,000 to invest in one of their divisions. Which division with CCMF invest in, and how much operating income will be generated? Cookies and Cream Milkshakes are my Favorite (CCMF) has three investment centers within their organization. The ROI achieved by each division is provided below: Division Operating Income Assets Division A $160,000 $800,000 Division B $57,600 $320,000 Division C $81,000 $540,000 CCMF has an additional $200,000 to invest in one of their divisions. Which division with CCMF invest in, and how much operating income will be generated? CCMF will invest in Division C; it will earn operating income of $30,000…arrow_forwardDriver Sports Company makes snowboards, downhill skis, cross-country skis, skateboards, surfboards, and in-line skates. The company has found it beneficial to split operations into two divisions based on the climate required for the sport: Snow Sports and Non-Snow Sports. The following divisional information is available for the past year: E (Click the icon to view the information.) Read the requirements. Requirements Data table 1. Calculate each division's ROI. Sales Operating Income Total Assets Current Liabilities 2. Top management has extra funds to invest. Which division will most likely receive those funds? Why? 3. Can you explain why one division's ROI is higher? How could management gain more insight? Snow Sports $ 5,300,000 $ 990,000 $ 4,400,000 $ 400,000 Non-Snow Sports 8,400,000 $ 816,000 $ 3,400,000 $ 650,000 Driver's management has specified a target 15% rate of return. Print Done Print Donearrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub