Accounting (Text Only)

26th Edition

ISBN: 9781285743615

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 10.21EX

Book value of fixed assets

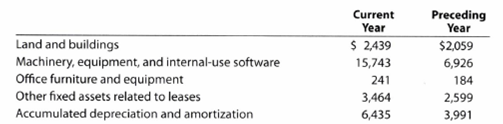

Apple Inc. designs, manufactures, and markets personal computers and related software. Apple also manufactures and distributes music players (iPod) and mobile phones (iPhone) along with related accessories and services, including online distribution of third-party music, videos, and applications. The following information was taken from a recent annual report of Apple:

Property, Plant, and Equipment (in millions):

a. Compute the book value of the fixed assets for the current year and the preceding year and explain the differences, if any.

b. Would you normally expect Apple’s book value of fixed assets to increase or decrease during the year?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please solve these general accounting question not use ai

None

None

Chapter 10 Solutions

Accounting (Text Only)

Ch. 10 - ONeil Office Supplies has a fleet of automobiles...Ch. 10 - Prob. 2DQCh. 10 - Prob. 3DQCh. 10 - Prob. 4DQCh. 10 - Immediately after a used truck is acquired, a new...Ch. 10 - Keyser Company purchased a machine that has a...Ch. 10 - Is it necessary for a business to use the same...Ch. 10 - Prob. 8DQCh. 10 - For some of the fixed assets of a business, the...Ch. 10 - a. Over what period of time should the cost of a...

Ch. 10 - Straight-line depreciation A building acquired at...Ch. 10 - Straight-line depreciation Equipment acquired at...Ch. 10 - Units-of-activity depreciation A truck acquired at...Ch. 10 - Units-of-activity depreciation A tractor acquired...Ch. 10 - Double declining-balance depreciation A building...Ch. 10 - Double-declining-balance depreciation Equipment...Ch. 10 - Revision of depreciation Equipment with a cost of...Ch. 10 - Revision of depreciation A truck with a cost of...Ch. 10 - Capital and revenue expenditures On February 14,...Ch. 10 - Capital and revenue expenditures On August 7,...Ch. 10 - Sale of equipment Equipment was acquired at the...Ch. 10 - Sale of equipment Equipment was acquired at the...Ch. 10 - Prob. 10.7BPECh. 10 - Prob. 10.7APECh. 10 - Prob. 10.8BPECh. 10 - Prob. 10.8APECh. 10 - Prob. 10.9APECh. 10 - Prob. 10.9BPECh. 10 - Costs of acquiring fixed assets Melinda Stoffers...Ch. 10 - Prob. 10.2EXCh. 10 - Determining cost of land Northwest Delivery...Ch. 10 - Prob. 10.4EXCh. 10 - Prob. 10.5EXCh. 10 - Capital and revenue expenditures Quality Move...Ch. 10 - Nature of depreciation Tri-City Ironworks Co....Ch. 10 - Prob. 10.8EXCh. 10 - Prob. 10.9EXCh. 10 - Prob. 10.10EXCh. 10 - Depreciation by units-of-output method Prior to...Ch. 10 - Depreciation by two methods A John Deere tractor...Ch. 10 - Depreciation by two methods A storage tank...Ch. 10 - Partial-year depreciation Sandblasting equipment...Ch. 10 - Revision of depreciation A building with a cost of...Ch. 10 - Capital expenditure and depreciation; parital-year...Ch. 10 - Entries for sale of fixed asset Equipment acquired...Ch. 10 - Prob. 10.18EXCh. 10 - Depletion entries Big Sky Mining Co. acquired...Ch. 10 - Prob. 10.20EXCh. 10 - Book value of fixed assets Apple Inc. designs,...Ch. 10 - Balance sheet presentation List the errors you...Ch. 10 - Prob. 10.24EXCh. 10 - Prob. 10.23EXCh. 10 - Asset traded for similar asset A printing press...Ch. 10 - Prob. 10.26EXCh. 10 - Entries for trade of fixed asset On July 1, Twin...Ch. 10 - Entries for trade of fixed asset On October 1,...Ch. 10 - Allocating payments and receipts to fixed asset...Ch. 10 - Comparing three depreciation methods Montes Coffee...Ch. 10 - Depreciation by three methods; partial years...Ch. 10 - Prob. 10.4APRCh. 10 - Transactions for fixed assets, including sale The...Ch. 10 - Amortization and depletion entries Data related to...Ch. 10 - Allocating payments and receipts to fixed asset...Ch. 10 - Comparing three depreciation methods Waylander...Ch. 10 - Depreciation by three methods; partial years...Ch. 10 - Depreciation by two methods; sale of fixed asset...Ch. 10 - Transactions for fixed assets, including sale The...Ch. 10 - Amortization and depletion entries Data related to...Ch. 10 - Prob. 10.1CPCh. 10 - Prob. 10.2CPCh. 10 - Effect of depreciation on net income Tuttle...Ch. 10 - Fixed asset turnover: three industries The...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Boom Lay Corp, has a current accounts receivable balance of $327,815. Credit sales for the year just ended were $4,238,720. What is the receivables turnover? What is the day's sales in receivables? How long did it take on average for credit customers to pay off their accounts during the past year?arrow_forwardHi expert provide correct answer general accountingarrow_forwardDon't use aiarrow_forward

- Can you please provide correct answer the general accounting question?arrow_forwardAccounting solve this questionarrow_forwardDave Ryan is the CEO of Ryan's Arcade. At the end of its accounting period, December 31, Ryan's Arcade has assets of $450,000 and liabilities of $125,000. Using the accounting equation, determine the following amounts: a. Stockholders' equity as of December 31 of the current year. b. Stockholders' equity as of December 31 at the end of the next year, assuming that assets increased by $65,000 and liabilities increased by $35,000 during the year.arrow_forward

- Boston Products has a production budget as follows: May, 19,000 units; June, 22,000 units; and July, 27,000 units. Each unit requires 2.5 labor hours at $10 per hour. What would be the budgeted direct labor cost for June?arrow_forwardBoston Products has a production budget as follows: May, 19,000 units; June, 22,000 units; and July, 27,000 units. Each unit requires 2.5 labor hours at $10 per hour. What would be the budgeted direct labor cost for June? I'm waiting for Answerarrow_forwardneed your help with questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Asset impairment explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=lWMDdtHF4ZU;License: Standard Youtube License