FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Can you please provide correct answer the general accounting question?

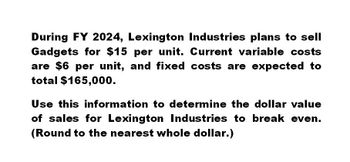

Transcribed Image Text:During FY 2024, Lexington Industries plans to sell

Gadgets for $15 per unit. Current variable costs

are $6 per unit, and fixed costs are expected to

total $165,000.

Use this information to determine the dollar value

of sales for Lexington Industries to break even.

(Round to the nearest whole dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During FY 2020, Dorchester Company plans to sell Widgets for $14 a unit. Current variable costs are $6 a unit and fixed costs are expected to total $146,000. Use this information to determine the dollar value of sales for Dorchester to break even. (Round to the nearest whole dollar.)arrow_forwardSolve this general accounting questionarrow_forwardIn 2019, Vaughn sold 3000 units at $500 each. Variable expenses were $250 per unit, and fixed expenses were $490000. The same selling price is expected for 2020. Vaughn is tentatively planning to invest in equipment that would increase fixed costs by 20%, while decreasing variable costs per unit by 20%. What is Vaughn’s break-even point in units for 2020? 2450. 2352. 2940. 1960.arrow_forward

- PT Manunggal sells its production during 2022 as many as 15,000 units with a selling price of Rp. 10,000 per unit. To produce 15,000 units, the fixed costs are Rp. 50 million and variable costs are Rp. 4,000 per unit. For 2023, it is estimated that the number of units sold will increase by 10%. Requested: Assuming the selling price, fixed costs and variable costs do not change, calculate the estimated operating profit/loss for 2023. Notes : Write it down along with the complete way of workingarrow_forwardAnswer the following with proper solutions:arrow_forwardLipsion Ltd company is thinking about investing in one of two potential new productsfor sale. The projections are as follows: year revenue/ product s revenue/ product v0 (150,000) outlay (150000) outlay1 14000 150002 24000 253333 44000 520004 84000 63333 Calculate NPV of both products (to 1 d.p.) assuming a discount rate of 7%. Then decide which product should be selected and why ?arrow_forward

- A company is considering buying a CNCmachine. In today’s dollars, it is estimated that themaintenance costs for the machine (paid at the endof each year) will be $25,000, $26,000, $28,000,$30,000, and $32,000 for years 1 to 5, respectively.The general inflation rate ( f ) is estimated to be5% per year, and the company will receive 13%return (interest) per year on its invested funds during the inflationary period. The company wants topay for maintenance expenses in equivalent equalpayments (in actual dollars) at the end of each ofthe five years. Find the amount of the company’spaymentsarrow_forwardHyperion, Inc. currently sells its latest high-speed color printer, the Hyper 500, for $350. It plans to lower the price to $300 next year. Its cost of goods sold for the Hyper 500 is $200 per unit, and thi year's sales are expected to be 20,000 units.a) Suppose that if Hyperion drops the price to $300 immediatley, it can increase this year's sales by 25% to 25,000 units. What would be the incremental impact on this eyar's EBIT of such a price drop?b) Suppose that for each printer sold, Hyperion expects additional sales of $75 per year on ink cartridges for the next years, and Hyperion has a gross profit margin of 70% on ink cartridges. What is the incremntal impact on EBIT for the next three years of a priced drop this year?arrow_forwardThe manufacturer of commercial jets has a cost index equal to 94.9 per aircraft in 2013. The anticipated cost index for the airplane in 2018 is 106.8. The average compound rate of growth should hold steady for the next 15 years. If an aircraft costs $10.2 million to build in 2014, what is its expected cost in 2016? State your assumptions.arrow_forward

- The ABC Corporation is considering introducing a new product, which will require buying new equipment for a monthly payment of $5,000. Each unit produced can be sold for $20.00. ABC incurs a variable cost of $10.00 per unit. Suppose that ABC would like to realize a monthly profit of $50,000. How many units must they sell each month to realize this profit?arrow_forwardSolve this problemarrow_forwardIn 2023 , Sandy's Sandwich Shoppe had a capacity of $10,000,000 of sales , actual sales of $6,000,000 , break -even sales of $4,500,000 , fixed costs of $ 1,800,000 , and variable costs of 60% of actual sales What was Sandy's margin of safety expressed in terms of dollars ? $300,000 $ 2,700,000 None of the listed choices are correct $ 1,800,000 $ 1,500,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education