FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

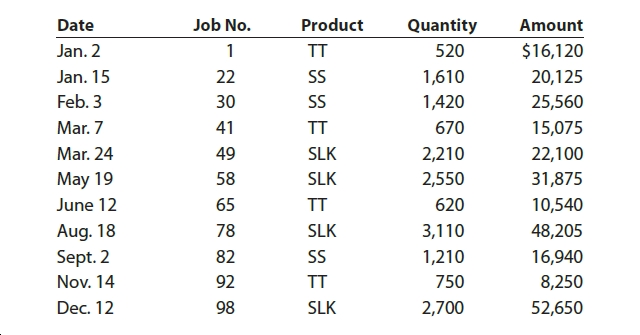

Alvarez Manufacturing Inc. is a job shop. The management of Alvarez Manufacturing Inc. uses the cost information from the job sheets to assess cost performance. Information on the total cost, product type, and quantity of items produced is as follows:

See Attachment

a. Develop a graph for each product (three graphs) with Job Number (in date order) on the horizontal axis and Unit Cost on the vertical axis. Use this information to determine Alvarez

b. What additional information would you require in order to investigate Alvarez Manufacturing Inc.’s cost performance more precisely?

Transcribed Image Text:Job No.

Product

Quantity

Date

Amount

$16,120

Jan. 2

1

TT

520

1,610

Jan. 15

22

20,125

Feb. 3

30

1,420

25,560

Mar. 7

670

15,075

41

TT

Mar. 24

SLK

2,210

49

22,100

SLK

31,875

May 19

58

2,550

June 12

65

TT

620

10,540

Aug. 18

Sept. 2

78

SLK

3,110

48,205

82

SS

1,210

16,940

750

Nov. 14

92

TT

8,250

52,650

Dec. 12

98

SLK

2,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need Correct answer please provide itarrow_forwardFrame Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine- hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates: Machine-hours Direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour O $24,000 O $110,400 $86,400 Casting Customizing 19,000 1,000 $ 138,700 $ 1.60 The estimated total manufacturing overhead for the Customizing Department is closest to: $60,379 11,000 8,000 $ 86,400 S 3.00arrow_forwardTech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm’s direct labor includes salaries of consultants that work at the client’s job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 77,500 direct labor-hours would be required for the period’s estimated level of client service. The company also estimated $775,000 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm’s actual overhead cost for the year was $789,800 and its actual total direct labor was 83,350 hours. Required: 1. Compute the predetermined…arrow_forward

- Clapton Guitar Company entered into the following transactions during the year. [The transactions were properly recorded in permanent (balance sheet) accounts unless otherwise indicated.] Date Transaction Jan. 25 Purchased $480 of office supplies. Feb. 1 Rented a warehouse from Hendrix Company, paying 1 year’s rent of $3,600 in advance. Recorded the $3,600 payment as rent expense. Mar. 1 Borrowed $10,000 from the bank, signing a 1-year note at an annual interest rate of 12%. The bank insisted on collecting the interest in advance, so it withheld the interest amount from the funds disbursed to Clapton. The company recorded the transaction as a debit to Cash, $8,800, a debit to Interest Expense, $1,200, and a credit to Notes Payable, $10,000. May 1 Purchased office equipment for $15,000, paying $3,000 down and signing a 2-year, 12% (annual rate) note payable for the balance. The office equipment is expected to have a useful life of 10 years and a residual value of $1,500. Straight-line…arrow_forward1. How much overhead would have been charged to the company’s Work-in-Process account during the year? 2. Comment on the appropriateness of the company’s cost drivers (i.e., the use of machine hours in Machining and direct-labor cost in Assembly).arrow_forwardJackson Foundry uses a predetermined overhead allocation rate to allocate overhead to individual jobs, based on the machine hours required. (Click the icon to view the costs.) Requirements 1. 2. 3. Compute Jackson's predetermined overhead allocation rate. Prepare the journal entry to allocate manufacturing overhead. Post the manufacturing overhead transactions to the Manufacturing Overhead T-account. Is manufacturing overhead underallocated or overallocated? By how much? 4. Prepare the journal entry to adjust for the underallocated or overallocated manufacturing overhead. Does your entry increase or decrease Cost of Goods Sold? Print Allocated overhead to WIP Done - X Data table At the beginning of 2024, the company expected to incur the following: Manufacturing overhead costs Direct labor costs $880,000 1,540,000 Machine hours 80,000 hours At the end of 2024, the company had actually incurred: Direct labor costs Depreciation on manufacturing plant and equipment Property taxes on plant…arrow_forward

- Which one of the following best describes a job cost sheet? A. It is a form used to record the costs chargeable to a specific job and to determine the total and unit costs of the completed job. B. It is used to track manufacturing overhead costs for specific jobs. C. It is used by management to understand how direct costs affect profitability. D. It is a daily form that management uses for tracking worker productivity on which employee raises are based.arrow_forwardDetermine whether each of the following companies is best suited for a job order cost system or a process costing system, or both. Explain why a. Delillo Construction Co. b. Dell Computer Co. (the big computer manufacturer in Texas) c. BP Gasoline Refinery d. Buzzeo & Co. CPAs (an accounting firm)arrow_forwardCare Company uses job costing and has assembled the following cost data for the production and assembly of item X: (Click the icon to view the cost data.) Based on the above cost data, the manufacturing overhead for item X is A. $1,590 underallocated. B. $350 overallocated. C. $350 underallocated. D. $1,590 overallocated. Cost Data Direct manufacturing labor wages Direct material used Indirect manufacturing labor Utilities Fire insurance Manufacturing overhead applied Indirect materials Depreciation on equipment $ 36,000 100,000 3,800 450 490 10,000 6,500 350 Xarrow_forward

- 1. Which type of cost system, process or job order, would be best suited for each of the following: (a) TV assembler, (b) building contractor, (c) automobile repair shop, (d) paper manufacturer, (e) custom jewelry manufacturer? Give reasons for your answers. 2. In a job order cost system, direct labor and factory overhead applied are debited to individual jobs. How are these items treated in a process cost system and why?arrow_forwardThe following figure depicts the complete system that Office Inc. uses to estimate the total cost of each office desk and office chair that it produces. How many cost pools does Office Inc.'s 2-stage costing system use for Office Chair objects? A. 7 B. 0 C. 6 D. 5 E. 4 F. 2 G. 1 H. 3 I. 8arrow_forwardNeed help with this questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education