FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

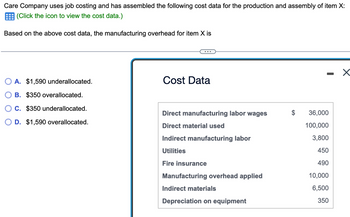

Transcribed Image Text:Care Company uses job costing and has assembled the following cost data for the production and assembly of item X:

(Click the icon to view the cost data.)

Based on the above cost data, the manufacturing overhead for item X is

A. $1,590 underallocated.

B. $350 overallocated.

C. $350 underallocated.

D. $1,590 overallocated.

Cost Data

Direct manufacturing labor wages

Direct material used

Indirect manufacturing labor

Utilities

Fire insurance

Manufacturing overhead applied

Indirect materials

Depreciation on equipment

$

36,000

100,000

3,800

450

490

10,000

6,500

350

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Swifty Company applies overhead on the basis of machine hours. Given the following data, what is the overhead applied and the under- or overapplication of overhead for the period? Estimated annual overhead cost Actual annual overhead cost Estimated machine hours Actual machine hours $1660000 $1555000 320000 100000 O $1660000 applied and $1036250 overapplied O $1555000 applied and neither under-nor overapplied O $518750 applied and $1036250 underapplied O $518750 applied and $1036250 overappliedarrow_forwardHow to do Question 3arrow_forwardDetermine the missing amount for each separate situation involving manufacturing cost flows. Direct materials used Direct labor used Factory overhead Total manufacturing costs Work in process inventory, beginning Total cost of work in process Work in process inventory, ending Cost of goods manufactured (1) 75,000 122,000 243,500 289,325 265,420 (2) $ 150,480 $ 32,840 238,700 56,920 22,545 (3) 33,890 45,720 60,275 8,245 11,250arrow_forward

- 1 Determine if each item is a period or product cost. Also determine whether the costs are selling/administrative if a period cost, or direct/indirect if product cost. Period cost Product cost Selling expense General and administrative expense Direct cost Indirect cost A. Paid $77,500 for materials used for the product B. Paid sales commissions of $58,200. C. Paid $38,800 in salaries for factory employees that make the product D. Paid $88,300 in salaries for executives (president and vice presidents). E. Recorded depreciation 16,400 was depreciation on factory equipment F. Recorded depreciationcost of 14,000 on the headquarters building where sales/admin are staffed F. Paid $3,100 for various supplarrow_forward2arrow_forwardIvano Company has collected cost accounting information for the following subset of items forYears 1 and 2. Required:Calculate the values of the missing Items a through e.arrow_forward

- Manufacturing cost data for Sheffield Company are presented below. (a) Indicate the missing amounts for each letter (a) through (i). Direct materials used Direct labor Manufacturing overhead Total manufacturing costs Work in process 1/1/20 Total cost of work in process Work in process 12/31/20 Cost of goods manufactured $ Option A 51,200 44,600 179,400 203,000 $170,800 (a) (b) (c) $ Option B $93,900 43,200 43,800 23,600 32,100 (e) $ Alamat Option C $75,200 50,200 179,100 200,000 34,200 (h) ()arrow_forwardSporty Manufacturing Co. assembled the following cost data for job #26: (Click the icon to view the cost data.) What are the total manufacturing costs for job #26 if the company uses normal job costing? A. $209,100 B. $207,400 C. $209,700 D. $205,900 Cost Data Direct manufacturing labor Indirect manufacturing labor Equipment depreciation Other indirect manufacturing costs Direct materials Indirect materials Manufacturing overhead overapplied $ 100,000 17,000 600 1,000 85,000 3,800 2,300 Xarrow_forward1arrow_forward

- Please help complete parts of question 1 1a. If 8,000 units are produced, what is the total amount of manufacturing overhead cost incurred to support this level of production at is this total amount expressed on a per unit basis? (Round your "per unit" answer to 2 decimal places.) Total manufacturing overhead cost: Manufacturing overhead per unit it: 1b. If 12,500 units are produced, what is the total amount of manufacturing overhead cost incurred to support this level of production? What is this total amount expressed on a per unit basis? (Round your "per unit" answer to 2 decimal places.) Total manufacturing overhead cost: Manufacturing overhead per unit: 1c. If the selling price is $22 per unit, what is the contribution margin per unit? (Do not round intermediate calculations. Round you answer to 2 decimal places.) 1d. If 11,000 units are produced, what are the total amounts of direct and indirect manufacturing costs incurred to support this leve production? (Do not round…arrow_forwardCoronado Company applies overhead on the basis of machine hours. Given the following data, what is the overhead applied and the under-or overapplication of overhead for the period? Estimated annual overhead cost Actual annual overhead cost Estimated machine hours Actual machine hours $3100000 $2940000 350000 280000 O $2480000 applied and $460000 overapplied O $2940000 applied and neither under- nor overapplied O $2480000 applied and $460000 underapplied O $3100000 applied and $460000 overappliedarrow_forwardWatson Company has the following data: Work in process inventory, beginning Work in process inventory, ending Direct labor costs incurred Cost of goods manufactured Factory overhead Determine the amount of direct materials used. $18,000 25,000 5,000 9,000 7,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education