Concept explainers

The Mixing Department manager of Malone Company is able to control all

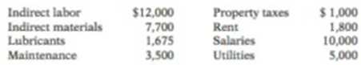

Actual costs incurred for January 2017 are indirect labor S 12,250; indirect materials $10,200; lubricants $1,650; maintenance $3,500; property taxes $1,100; rent $1,800; salaries $10,000; and utilities $6,400.

Instructions

(a) Prepare a responsibility report for January 2017.

(b) What would be the likely result of management's analysis of the report?

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Managerial Accounting: Tools for Business Decision Making

Additional Business Textbook Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Financial Accounting

Financial Accounting, Student Value Edition (4th Edition)

Principles of Accounting Volume 2

Financial Accounting (11th Edition)

- For 2017, Looz Supply Manufacturing uses machine-hours as the only overhead cost-allocation base. The accounting records contain the following information: Estimated Actual Manufacturing overhead costs $400,000 $480,000 Machine-hours 80,000 100,000 Using job costing, the 2017 budgeted manufacturing overhead rate is:arrow_forwardCarla Vista Limited is a company that produces machinery to customer orders, using a normal job-order cost system. It applies manufacturing overhead to production using a predetermined rate. This overhead rate is set at the beginning of each fiscal year by forecasting the year's overhead and relating it to direct labour costs. The budget for 2022 was as follows: Direct labour Manufacturing overhead $1,804,000 902,000 As at the end of the year, two jobs were incomplete. These were 1768B, with total direct labour charges of $113,600, and 1819C, with total direct labour charges of $390,100. Machine hours were 287 hours for 17688 and 647 hours for 1819C. Direct materials issued for 1768B amounted to $220,000, and for 1819C they amounted to $420,500. Total charges to the Manufacturing Overhead Control account for the year were $898,500, and direct labour charges made to all jobs amounted to $1,583,600, representing 247,500 direct labour hours. There were no beginning inventories. In…arrow_forwardFor 2017, Looz Supply Manufacturing uses machine-hours as the only overhead cost-allocation base. The accounting records contain the following information: Estimated Actual Manufacturing overhead costs $400,000 $480,000 Machine-hours 80,000 100,000 Using job costing, the 2017 budgeted manufacturing overhead rate is: Select one: a. $5.160 per machine-hour b. $8.00 per machine-hour C. $10.00 per machine-hour d. $12.00 per machine-hourarrow_forward

- Bonita Corporation accumulates the following data relative to jobs started and finished during the month of June 2022. Costs and Production Data Actual Standard Raw materials unit cost $2.20 $2 Raw materials units 11,300 10,900 Direct labor payroll $166,500 $159,600 Direct labor hours 15,000 15,200 Manufacturing overhead incurred $210,420 Manufacturing overhead applied $214,320 Machine hours expected to be used at normal capacity 43,500 Budgeted fixed overhead for June $73,950 Variable overhead rate per machine hour $3.00 Fixed overhead rate per machine hour $1.70 Overhead is applied on the basis of standard machine hours. Three hours of machine time are required for each direct labor hour. The jobs were sold for $473,000. Selling and administrative expenses were $44,400. Assume that the amount of raw materials purchased equaled the amount used. Compute the total overhead variance. Total overhead variance $arrow_forwardCrane Corporation accumulates the following data relative to jobs started and finished during the month of June 2025. Costs and Production Data Raw materials unit cost Raw materials units Direct labor payroll Direct labor hours Manufacturing overhead incurred Manufacturing overhead applied Machine hours expected to be used at normal capacity Budgeted fixed overhead for June Variable overhead rate per machine hour Fixed overhead rate per machine hour Actual Standard $2.00 $1.90 11,000 10,600 $162,800 $159,600 14,800 15,200 $201,200 $205,200 41,500 $62,250 $3 $1.50 Overhead is applied on the basis of standard machine hours. Three hours of machine time are required for each direct labor hour. The jobs were sold for $450,000. Selling and administrative expenses were $35,000. Assume that the amount of raw materials purchased equaled the amount used.arrow_forwardAvery Company uses a predetermined overhead rate based on direct labor hours. For the month of October, Avery’s budgeted overhead was P300,000 based on a budgeted volume of 100,000 direct labor hours. Actual overhead amounted to P325,000 with actual direct labor hours totaling 110,000. Compute for the following: __________1. Factory overhead charged to Work in Process accountarrow_forward

- The cost accountant for Kenner Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning May 1 would be $765,700, and total direct labor costs would be $589,000. During May, the actual direct labor cost totaled $51,000, and factory overhead cost incurred totaled $68,950. A)What is the predetermined factory overhead rate based on direct labor cost? Enter your answer as a whole percent not in decimals. b) Journalize the entry to apply factory overhead to production for May. Work in Process-Blending Department Factory Overhead-Blending Department C) What is the May 31 balance of the account Factory Overhead—Blending Department? Amount:arrow_forwardSwifty Corporation accumulates the following data relative to jobs started and finished during the month of June 2022. Costs and Production Data Raw materials unit cost Raw materials units Direct labor payroll Direct labor hours Manufacturing overhead incurred Manufacturing overhead applied Machine hours expected to be used at normal capacity Budgeted fixed overhead for June Variable overhead rate per machine hour Fixed overhead rate per machine hour Actual Standard $4.10 $4.00 11,000 10,600 $149,000 $142,880 14,900 15,200 $178,700 $182,400 46,600 $46,600 $3.00 $1.00 Overhead is applied on the basis of standard machine hours. 3.00 hours of machine time are required for each direct labor hour. The jobs were sold for $488,000. Selling and administrative expenses were $35,600. Assume that the amount of raw materials purchased equaled the amount used. Compute the overhead controllable variance and the overhead volume variance. Overhead controllable variance 50300 Favorable Overhead volume…arrow_forwardMurphy manufacturing estimated total manufacturing a overhead for 2017 to be $100,000 and uses direct labor-hours as the allocation base. They estimated that 5,000 hours would be used. Actual overhead for 2017 was $120,000 and actual direct labor- hours were 7,500. How much overhead for 2017 was applied to a job completed during 2017 that used 200 direct labor-hours?arrow_forward

- Midwest Corporation has provided the following data concerning manufacturing overhead for 2020: Estimated manufacturing overhead for the year $ 30,000 Estimated direct labor hours for the year 2,000 Two jobs were worked on during the year: Job A-101 and Job A-102. The number of direct labor-hours spent on Job A-101 and Job A-102 were 1,200 and 1,000, respectively. The actual manufacturing overhead was $37,000.What is the amount of the under- or overapplied manufacturing overhead? A $3,000 overapplied. B $4,000 underapplied. C $7,000 overapplied. D $1,000 underapplied.arrow_forwardMidwest Corporation has provided the following data concerning manufacturing overhead for 2020: Estimated manufacturing overhead for the year $ 30,000 Estimated direct labor hours for the year 2,000 Two jobs were worked on during the year: Job A-101 and Job A-102. The number of direct labor-hours spent on Job A-101 and Job A-102 were 1,200 and 1,000, respectively. The actual manufacturing overhead was $37,000.What is the amount of the under- or overapplied manufacturing overhead?arrow_forwardMidwest Corporation has provided the following data concerning manufacturing overhead for 2020: Estimated manufacturing overhead for the year $ 30,000 Estimated direct labor hours for the year 2,000 Two jobs were worked on during the year: Job A-101 and Job A-102. The number of direct labor-hours spent on Job A-101 and Job A-102 were 1,200 and 1,000, respectively. The actual manufacturing overhead was $37,000.What was the amount of manufacturing overhead applied to Job A-101? $24,000. $44,000. $18,000. $16,000.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub