Managerial Accounting

3rd Edition

ISBN: 9780077826482

Author: Stacey M Whitecotton Associate Professor, Robert Libby, Fred Phillips Associate Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 9E

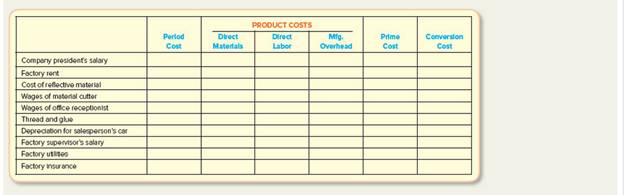

Classifying Costs

Blockett Company makes automobile sunshades and the costs listed in the table below.

Required:

Use an X to categorize each of the costs. You may have more than one X for each item.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Classifying costs

Classify each cost by placing an X in the appropriate columns. The first cost is completed as an example.

Please do not give image format thank you

Cost Relationships The following costs are for Optical View Inc., a contact lens manufacturer:

Required

Calculate and graph total costs, the total variable cost, and total fixed cost.

For each level of output calculate the per-unit total cost, per-unit variable cost, and per-unit fixed cost.

Using the results from requirement 2, graph the per-unit total cost, per-unit variable cost, and per-unit fixed cost, and discuss the behavior of the per-unit costs over the given output levels.

Chapter 1 Solutions

Managerial Accounting

Ch. 1 - What is the primary difference between financial...Ch. 1 - Prob. 2QCh. 1 - Why are traditional, GAAP-based financial...Ch. 1 - Prob. 4QCh. 1 - consider the area within a 3-mile radius of your...Ch. 1 - What are the three basic functions of management?Ch. 1 - How are the three basic management functions...Ch. 1 - What are ethics and why is ethical behavior...Ch. 1 - Prob. 9QCh. 1 - Prob. 10Q

Ch. 1 - Prob. 11QCh. 1 - Prob. 12QCh. 1 - Why are businesses starting to incorporate...Ch. 1 - What factors does sustainability accounting...Ch. 1 - Think about your activities over the last week....Ch. 1 - Prob. 16QCh. 1 - Why is it important for managers to be able to...Ch. 1 - Prob. 18QCh. 1 - Prob. 19QCh. 1 - Explain the difference between relevant and...Ch. 1 - Prob. 21QCh. 1 - What are prime costs? Why have they decreased in...Ch. 1 - Prob. 23QCh. 1 - Why can't prime cost and conversion cost be added...Ch. 1 - Prob. 25QCh. 1 - Prob. 26QCh. 1 - Prob. 27QCh. 1 - Prob. 28QCh. 1 - Prob. 29QCh. 1 - Prob. 1MCCh. 1 - Prob. 2MCCh. 1 - Prob. 3MCCh. 1 - Prob. 4MCCh. 1 - Prob. 5MCCh. 1 - What is Garcia's total manufacturing cost? a....Ch. 1 - Prob. 7MCCh. 1 - What is Garcia's manufacturing overhead? a....Ch. 1 - Prob. 9MCCh. 1 - Which of the following would not be treated as a...Ch. 1 - MINI-EXERCISES Comparing Financial and Managerial...Ch. 1 - Prob. 4MECh. 1 - Prob. 5MECh. 1 - Prob. 6MECh. 1 - Prob. 8MECh. 1 - Prob. 9MECh. 1 - Prob. 10MECh. 1 - Identifying Direct and Indirect Costs for a...Ch. 1 - Prob. 12MECh. 1 - Identify sustainability issues affecting the...Ch. 1 - Classifying Costs Seth's Skateboard Company incurs...Ch. 1 - Calculation Costs Cotton White, Inc., makes...Ch. 1 - Prob. 7ECh. 1 - Prob. 8ECh. 1 - Classifying Costs Blockett Company makes...Ch. 1 - Prob. 10ECh. 1 - Prob. 12ECh. 1 - Prob. 13ECh. 1 - Explaining Effects of Cost Misclassification Donna...Ch. 1 - Prob. 4.1GAPCh. 1 - Prob. 4.2GAPCh. 1 - Prob. 4.3GAPCh. 1 - Prob. 3.1GBPCh. 1 - Prob. 3.2GBPCh. 1 - Classifying Costs, Calculating Total Costs, and...Ch. 1 - Prob. 4.2GBPCh. 1 - Classifying Costs, Calculating Total Costs, and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the data in P4-2 and Microsoft Excel: 1. Separate the variable and fixed elements. 2. Determine the cost to be charged to the product for the year. 3. Determine the cost to be charged to factory overhead for the year. 4. Determine the plotted data points using Chart Wizard. 5. Determine R2. 6. How do these solutions compare to the solutions in P4-2 and P4-3? 7. What does R2 tell you about this cost model?arrow_forwardProduct Cost Method of Product Costing. Can you please help A-D? Thank Youarrow_forwardPART A Classify each cost below as being either variable (VC) or fixed (FC) with respect to the number of units produced or sold. Also classify each cost as either a direct material (DM), a direct labour (DL), production overheads (OH) or a selling and administrative (SA) cost. Magnitos Factory produces ice cream. Write your answers in the appropriate columns to show the proper classification of each cost. Cost Cost Classification Behaviour (VC or FC) (DM/DL/OH/SA) 1. Depreciation of delivery van. 2. Cost of milk in making ice-cream. 3. Lubricants for machineries. 4. Wages of operatives in cooling department. 5. Insurance for factory building. 6. Rent of finished goods warehouse. 7. Electricity cost at factory. 8. Salary of receptionist at regional office. 9. Commission paid to salesman. 10. Factory manager's salary.arrow_forward

- Wheels, Inc. manufactures wheels for bicycles, tricycles, and scooters. For each cost given below, determine if the cost is a product cost or a period cost. If the cost is a product cost, further determine if the cost is direct materials (DM), direct labor (DL), or manufacturing overhead (MOH) and then determine if the product cost is a prime cost, conversion cost, or both. If the cost is a period cost, further determine if the cost is a selling expense or administrative expense (Admin). Cost (a) is answered as a guide. (If an answer does not apply, leave the box blank.) Product Product Period Cost DM DL MOH Prime Conversion Selling Admin. a. Metal used for rims X X b. Sales salaries c. Rent on factory d. Wages of assembly workers e. Salary…arrow_forwardCan you please help me solve all 5 parts of this question using the following using the images provided: 1. With respect to cost classifications for preparing financial statements: a. What is the total product cost? b. What is the total period cost? 2. With respect to cost classifications for assigning costs to cost objects: a. What is total direct manufacturing cost? b. What is the total indirect manufacturing cost? 3. With respect to cost classifications for manufacturers: a. What is the total manufacturing cost? b. What is the total nonmanufacturing cost? c. What is the total conversion cost and prime cost? 4. With respect to cost classifications for predicting cost behavior: a. What is the total variable manufacturing cost? b. What is the total fixed cost for the company as a whole? c. What is the variable cost per unit produced and sold? 5. With respect to cost classifications for decision making: a. If Dozier had produced 1,001 units instead of 1,000 units, how much…arrow_forwardCase 1-26 (Algo) Cost Classification and Cost Behavior [LO1-1, LO1-2, LO1-3, LO1-4] The Dorilane Company produces a set of wood patio furniture consisting of a table and four chairs. The company has enough customer demand to justify producing its full capacity of 4,100 sets per year. Annual cost data at full capacity follow: Direct labor Advertising Factory supervision Property taxes, factory building Sales commissions Insurance, factory Depreciation, administrative office equipment Lease cost, factory equipment Indirect materials, factory Depreciation, factory building Administrative office supplies (billing) Administrative office salaries Direct materials used (wood, bolts, etc.) Utilities, factory $ 89,000 $ 104,000 $ 66,000 $ 22,000 $ 58,000 6,000 2,000 $ $ 12,000 $ 16,000 $ 102,000 $ Required 1 Required 2 Required 3 3,000 $ 106,000 $ 434,000 $ 46,000 Required: 1. Enter the dollar amount of each cost item under the appropriate headings. Note that each cost item is classified in two…arrow_forward

- Instructions Classify each cost as either a product cost or a period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a factory overhead cost. Indicate whether each period cost is a selling expense or an administrative expense. Use the following tabular headings for your answer, placing an “X” in the appropriate column: Production Cost Period Cost Cost Direct Materials Cost Direct Labor Costs Factory Overhead Cost Selling Expense Administrative Expense The following is a list of costs that were incurred in the production and sale of lawn mowers: Attorney fees for drafting a new lease for headquarter offices Cash paid to outside firm for janitorial services for factory Commissions paid to sales representatives, based on the number of lawn mowers sold. Cost of advertising in a national magazine Cost of boxes used in packaging…arrow_forwardIdentify whether each of the following costs should be classified as product costs or period costs. (a) Period CostsProduct Costs Manufacturing overhead. (b) Period CostsProduct Costs Selling expenses. (c) Period CostsProduct Costs Administrative expenses. (d) Period CostsProduct Costs Advertising expenses. (e) Period CostsProduct Costs Direct labor. (f) Period CostsProduct Costs Direct materials.arrow_forwardWhich one is a product cost Select one: a. Travel Expenses b. Power c. Rent Factory Building d. Salesmen Salariesarrow_forward

- Following is a list of cost terms described in the chapter as well as a list of brief descriptive settings for each item.Cost terms:a. Opportunity costb. Period costc. Product costd. Direct labor coste. Selling costf. Conversion costg. Prime costh. Direct materials costi. Manufacturing overhead costj. Administrative costSettings:1. Marcus Armstrong, manager of Timmins Optical, estimated that the cost of plastic, wagesof the technician producing the lenses, and overhead totaled $30 per pair of single-visionlenses.2. Linda was having a hard time deciding whether to return to school. She was concernedabout the salary she would have to give up for the next 4 years.3. Randy Harris is the finished goods warehouse manager for a medium-sized manufacturingfirm. He is paid a salary of $90,000 per year. As he studied the financial statementsprepared by the local certified public accounting firm, he wondered how his salary wastreated.4. Jamie Young is in charge of the legal department at company…arrow_forwardA report that lists the types and amounts of costs incurred in manufacturing is a: Multiple Choice Manufacturer balance sheet. Manufacturer period cost statement. Schedule of cost of goods manufactured. Sales journal. Balanced scorecard.arrow_forwardWhich of the following statements is true? (You may select more than one answer.)a. Conversion costs include direct materials and direct labor.b. Indirect materials are included in manufacturing overhead.c. Prime costs are included in manufacturing overhead.d. Selling costs are considered period costsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY