Managerial Accounting

3rd Edition

ISBN: 9780077826482

Author: Stacey M Whitecotton Associate Professor, Robert Libby, Fred Phillips Associate Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 4.1GBP

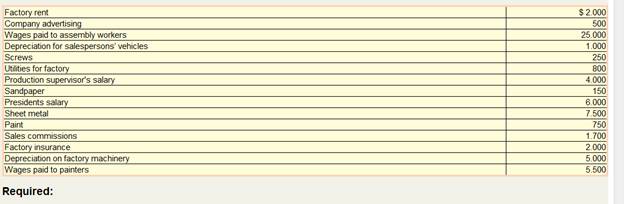

Classifying Costs, Calculating Total Costs, and Identifying Impact of Classifications Assume that Maria Cottonwood (PBl-2) has decided to begin production of her fire extinguisher. Her company is Blaze Be Gone, whose costs for last month follow.

Identify each of the preceding cost as either a product or a period cost. If the cost is a product cost, decide whether it is direct materials (DM), direct labor (DL), or manufacturing

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need help with last three requirement

I need help with last 3 requirement

please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)

Allocating and adjusting manufacturing overhead

Selected cost data for Classic Print Co. are as follows:

Requirements

Compute the predetermined overhead allocation rate per direct labor dollar.

Prepare the journal entry to allocate overhead costs for the year.

Use a T-account to determine the amount of underallocated or overallocated manufacturing overhead.

Prepare the journal entry to adjust for the underallocated or overallocated manufacturing overhead.

Required:i) Using the above information derive a cost function that can be used to predict the total production overheads cost using the high-low cost estimation method.

Chapter 1 Solutions

Managerial Accounting

Ch. 1 - What is the primary difference between financial...Ch. 1 - Prob. 2QCh. 1 - Why are traditional, GAAP-based financial...Ch. 1 - Prob. 4QCh. 1 - consider the area within a 3-mile radius of your...Ch. 1 - What are the three basic functions of management?Ch. 1 - How are the three basic management functions...Ch. 1 - What are ethics and why is ethical behavior...Ch. 1 - Prob. 9QCh. 1 - Prob. 10Q

Ch. 1 - Prob. 11QCh. 1 - Prob. 12QCh. 1 - Why are businesses starting to incorporate...Ch. 1 - What factors does sustainability accounting...Ch. 1 - Think about your activities over the last week....Ch. 1 - Prob. 16QCh. 1 - Why is it important for managers to be able to...Ch. 1 - Prob. 18QCh. 1 - Prob. 19QCh. 1 - Explain the difference between relevant and...Ch. 1 - Prob. 21QCh. 1 - What are prime costs? Why have they decreased in...Ch. 1 - Prob. 23QCh. 1 - Why can't prime cost and conversion cost be added...Ch. 1 - Prob. 25QCh. 1 - Prob. 26QCh. 1 - Prob. 27QCh. 1 - Prob. 28QCh. 1 - Prob. 29QCh. 1 - Prob. 1MCCh. 1 - Prob. 2MCCh. 1 - Prob. 3MCCh. 1 - Prob. 4MCCh. 1 - Prob. 5MCCh. 1 - What is Garcia's total manufacturing cost? a....Ch. 1 - Prob. 7MCCh. 1 - What is Garcia's manufacturing overhead? a....Ch. 1 - Prob. 9MCCh. 1 - Which of the following would not be treated as a...Ch. 1 - MINI-EXERCISES Comparing Financial and Managerial...Ch. 1 - Prob. 4MECh. 1 - Prob. 5MECh. 1 - Prob. 6MECh. 1 - Prob. 8MECh. 1 - Prob. 9MECh. 1 - Prob. 10MECh. 1 - Identifying Direct and Indirect Costs for a...Ch. 1 - Prob. 12MECh. 1 - Identify sustainability issues affecting the...Ch. 1 - Classifying Costs Seth's Skateboard Company incurs...Ch. 1 - Calculation Costs Cotton White, Inc., makes...Ch. 1 - Prob. 7ECh. 1 - Prob. 8ECh. 1 - Classifying Costs Blockett Company makes...Ch. 1 - Prob. 10ECh. 1 - Prob. 12ECh. 1 - Prob. 13ECh. 1 - Explaining Effects of Cost Misclassification Donna...Ch. 1 - Prob. 4.1GAPCh. 1 - Prob. 4.2GAPCh. 1 - Prob. 4.3GAPCh. 1 - Prob. 3.1GBPCh. 1 - Prob. 3.2GBPCh. 1 - Classifying Costs, Calculating Total Costs, and...Ch. 1 - Prob. 4.2GBPCh. 1 - Classifying Costs, Calculating Total Costs, and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- a) Compute the predetermined overhead rate under the current method of allocation and determine the unit product cost of each product for the current year b) The company's overhead costs can be attributed to four major activities. These activities and the amount of overhead cost attributable to each for the current year are given below. Using the data below and an activity-based costing approach, determine the unit product cost of each product for the current year. Expected Activity Activity Cost Estimated Product B Product H Total Pools Overhead Costs Machine setups required Purchase orders issued $180,000 600 1,200 1,800 38,382 500 100 600 Machine- 92,650 6,800 10,200 17,000 hours required Maintenance 138.968 693 907 1,600 requests ued $450,000arrow_forward1. Determine the total estimated overhead cost for each of the producing departments after allocating the cost of the service department. A. Using employee headcount as the allocation base. B. Using occupied space as the allocation base. C. Using productive capacity as the allocation base. D. Using the 3-year average use as the allocation base.arrow_forwardNeed A-D completedarrow_forward

- How do I solve for the chart on Required 3?arrow_forwardConcepts and Terminology From the choices presented in parentheses, choose the appropriate term for completing each of the following sentences: Appr Sentence comp a. An example of factory overhead is (electricity used to run assembly line, CEO salary). b. Direct materials costs combined with direct labor costs are called (prime, conversion) costs. c. Long-term plans are called (strategic, operational) plans. d. Materials for use in production are called (supplies, materials inventory). e. The phase of the management process that uses process information to eliminate the source of problems in a process so that the process delivers the correct product in the correct quantities is called (directing, improving). f. The plant manager's salary would be considered (direct, indirect) to the product. g. The salaries of salespeople are normally considered a (period, product) cost. Previous Nextarrow_forwardAssume the following costs were incurred during Bene Petit's first year of operations: Main ingredients Miscellaneous ingredients and supplies Direct labor (part-time workers) Indirect labor/supervision Packaging materials (direct) Depreciation on kitchen equipment Depreciation on delivery trucks Website development and maintenance Fuel for delivery trucks Insurance expense Required: Compute the following: a. Direct materials cost: b. Prime cost c. Manufacturing overhead cost d. Conversion cost e. Total manufacturing (product) cost f. Total nonmanufacturing (period) expenses g. Total variable cost h. Total fixed cost $ 41,000 3,000 18,000 20,000 15,000 12,000 6,000 5,000 8,000 4,000arrow_forward

- Please help me with correct answer thankuarrow_forwardSage Hill Company reports the following costs and expenses in May. Factory utilities Depreciation on factory equipment Depreciation on delivery trucks Indirect factory labor Indirect materials Direct materials used Factory manager's salary From the information: $16,900 13,870 4,540 54,120 88,640 152,080 9,400 Direct labor Sales salaries Property taxes on factory building Repairs to office equipment Factory repairs Advertising Office supplies used $76,280 50,620 2,750 1,490 2,200 16,500 2,860arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Classify each cost as either a product cost or a period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a factory Indicate whether each period cost is a selling expense or an administrative expense. Costs a. Annual bonus paid to the chief financial officer of the company b. Annual fee to a celebrity to promote the aircraft c. Cost of electronic guidance system installed in the airplane cockpit d. Cost of the flight data recorder (the black box) for the airplane e. Cost of normal scrap from production of the airplane body f. Cost of small replicas of the airplane used to promote and market the airplane g. Cost of paving the headquarters employee parking lot h. Decals for cockpit door, the cost of which is immaterial to the cost of the final product 1. Depreciation on factory equipment j. Hourly wages for janitorial staff for the factory k. Hydraulic pumps used in the airplane's flight control system 1. Instrument panel installed in the…arrow_forwardSuki Company uses activity-based costing to compute product costs for external reports. The company has three activity cost pools and applies overhead using predetermined overhead rates for each activity cost pool. Estimated costs and activities for the current year are presented below for the three activity cost pools: Estimated Overhead Cost Activity 1 Activity 2 Activity 3 Actual activity for the current year was as follows: Actual Activity Activity 1 Activity 2 Activity 3 $34,300 $20,520 $36,112 O a. $30,026.50 O b. $36,112.00 OC. $36,107.00 O d. $35,773.45 1,415 1,805 1,585 0 Expected Activity 1,400 1,800 1,600 The amount of overhead applied for Activity 3 during the year was closest to: Øarrow_forwardListed below are several costs incurred during the year. For each cost match the classification that best describes this cost. • Plant insurance costs of Nespresso. • Sales commissions paid to the sales force of X-cite Kuwait. . Tire costs incurred by Tesla Motor Company. ✓ Choose... Period cost Manufacturing Overhead Direct material Choose... →arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License