a.

Classify the items that will come under the product cost and calculate the amount of cost of goods sold for the year 2017 income statement.

a.

Answer to Problem 2ATC

The items that will be classified under the product cost are as follows:

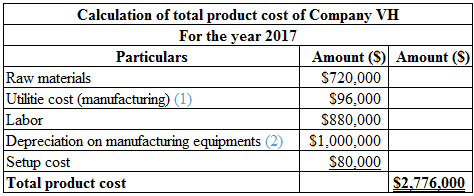

Table (1)

Hence, the total product cost of Company VH is $2,776,000.

The calculation of cost of goods sold is as follows:

Hence, the cost of goods sold is $2,400,000.

Explanation of Solution

The cost of goods sold:

The cost of goods sold is the total of all the expenses incurred by a company to sell the goods during the given period.

Working notes:

Calculate the per square foot as follows:

Hence, the per square foot value is $1.60.

Calculate the utility cost for manufacturing as follows:

Hence, the utility cost for manufacturing is $96,000.

(1)

Calculate the

Hence, the depreciation cost is $1,000,000.

(2)

Calculate the cost per unit as follows:

Hence, the cost per unit is $40.

(3)

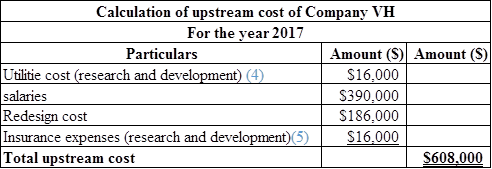

Classify the items that will come under the upstream cost and calculate the amount of upstream cost expensed for the year 2017 income statement.

Answer to Problem 2ATC

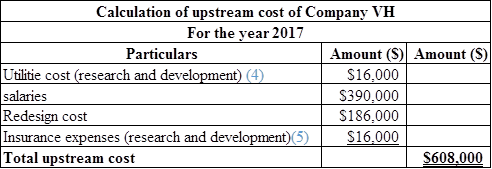

The items that will be classified under the upstream cost are as follows:

Table (2)

Hence, the total upstream expenses are $608,000.

Explanation of Solution

Upstream cost:

This cost is incurred before starting the manufacturing process. For example: research and development, and product design.

Working notes:

Calculate the per square foot as follows:

Hence, the per square foot value is $1.60.

Calculate the utility cost for manufacturing as follows:

Hence, the utility cost for manufacturing is $16,000

(4)

Calculate the amount of prepaid insurance as follows:

Hence, the prepaid insurance is $48,000.

Calculate the rate for insurance expenses as follows:

Hence, the rate for insurance expenses per employee is $4,000.

Calculate the insurance expenses on research and development as follows:

Hence, the insurance expenses on research and development is $16,000.

(5)

Note:

The accrued engineer’s salary $10,000 comes under the upstream cost but it is not considered for calculating the upstream cost because it is previous year’s cost.

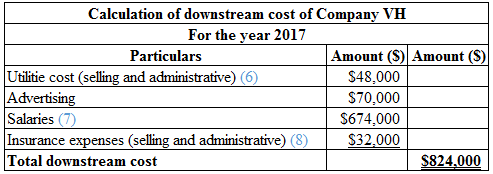

Classify the items that will come under the downstream cost and calculate the amount of downstream cost expensed for the year 2017 income statement.

Answer to Problem 2ATC

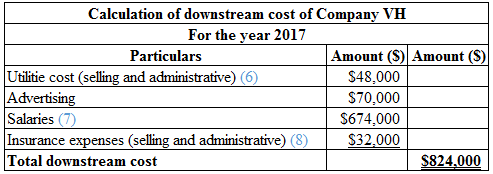

The items that will be classified under the downstream cost are as follows:

Table (3)

Hence, the total downstream expenses are $824,000.

Explanation of Solution

Downstream:

This cost is incurred after starting the manufacturing process. For example: marketing, distribution, and customer service.

Working notes:

Calculate the per square foot as follows:

Hence, the per square foot value is $1.60.

Calculate the utility cost for selling and administrative as follows:

Hence, the utility cost for selling and administrative cost is $48,000.

(6)

Calculate the amount of prepaid insurance as follows:

Hence, the prepaid insurance is $48,000.

Calculate the total salary as follows:

Hence, the total salary is $674,000.

(7)

Calculate the rate for insurance expenses as follows:

Hence, the rate for insurance expenses per employee is $4,000.

Calculate the insurance expenses on selling and administrative as follows:

Hence, the insurance expenses on selling and administrative is $32,000.

(8)

b.

Prepare the income statement.

b.

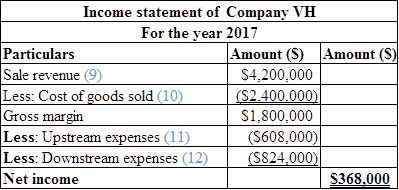

Answer to Problem 2ATC

The calculation of the income statement is as follows:

Table (4

Hence, the net income of Company VH is $368,000.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Working notes:

Calculate the revenue as follows:

Hence, the revenue is $4,200,000.

(9)

Calculate the cost of goods sold as follows:

The calculation of cost of goods sold is as follows:

Hence, the cost of goods sold is $2,400,000.

(10)

Calculate the upstream expenses as follows:

Table (5)

Hence, the total upstream expenses are $608,000.

(11)

Calculate the downstream expenses as follows:

Table (6)

Hence, the total downstream expenses are $824,000.

(12)

Want to see more full solutions like this?

Chapter 1 Solutions

Fundamental Managerial Accounting Concepts

- Company inventory would be carriedarrow_forwardTutor need your helparrow_forwardour firm has been the auditor of Caribild Products, a listed company, for a number of years. The engagement partner has asked you to describe the matters you would consider when planning the audit for the year ended 31January 2022. During recent visit to the company you obtained the following information: (a) The management accounts for the 10 months to 30 November 2021 show a revenue of $260 million and profit before tax of $8 million. Assume sales and profits accrue evenly throughout the year. In the year ended 31 January 2021 Caribild Products had sales of $220 million and profit before tax of $16 million. (b) The company installed a new computerised inventory control system which has operated from 1 June 2021. As the inventory control system records inventory movements and current inventory quantities, the company is proposing: (i) To use the inventory quantities on the computer to value the inventory at the year-end (ii) Not to carry out an inventory count at the year-end (c) You…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education