Concept explainers

a.

The

a.

Answer to Problem 24PSB

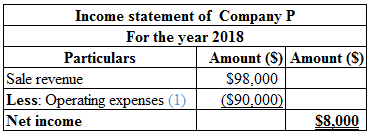

The calculation of income statement of Company P is as follows:

Table (1)

Hence, the net income of Company P is $8,000.

The calculation of balance sheet of Company P is as follows:

Table (2)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The entire $90,000 is treated as operating expenses.

(1)

The total cash is calculated as follows:

Hence, the total cash is $128,000.

(2)

b.

The balance sheet and income statement of Company P according to GAAP.

b.

Answer to Problem 24PSB

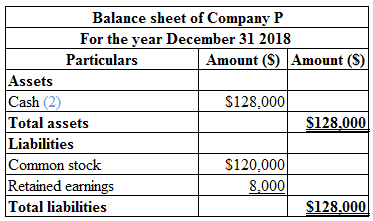

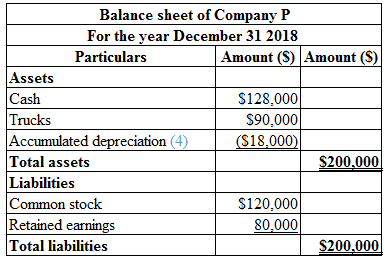

The calculation of income statement of Company P is as follows:

Table (3)

Hence, the net income of Company W is $,000.

The calculation of balance sheet of Company P is as follows:

Table (4)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The

(3)

The depreciation amount $18,000 must be adjusted in the balance sheet as

(4)

c.

The balance sheet and income statement of Company P according to GAAP.

c.

Answer to Problem 24PSB

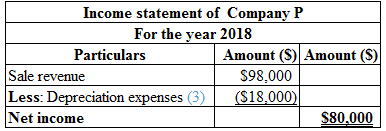

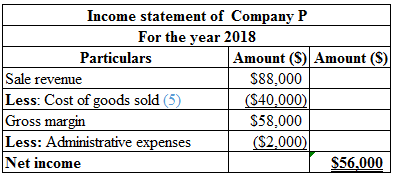

The calculation of income statement of Company P is as follows:

Table (5)

Hence, the net income of Company P is $56,000.

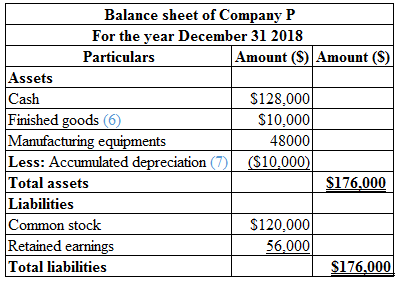

The calculation of balance sheet of Company P is as follows:

Table (6)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The depreciation on the manufacturing equipment is calculated as follows:

Hence, the depreciation cost is $10,000.

The cost per unit is calculated as follows:

Hence, the cost per unit is $20.

The cost of goods sold is calculated as follows:

Hence, the cost of goods sold is $40,000.

(5)

The total finished goods are calculated as follows:

Hence, the finished goods are $10,000.

(6)

The depreciation on the manufacturing equipment is calculated as follows:

Hence, the accumulated depreciation cost is $10,000.

(7)

d.

Explain the reason why management might be more interested in average cost than the actual cost.

d.

Explanation of Solution

The exact cost of the product cannot be determined because the labor and material usage will differ among the same products. Cost average is an element that smoothens these differences.

Want to see more full solutions like this?

Chapter 1 Solutions

Fundamental Managerial Accounting Concepts

- History 口 AA 1 ୪ Fri Feb 14 2:45 PM Mc Gw Mini Cases Qmcgrow hill goodweek tires pr × | Ask a Question | bartleby × + Bookmarks Profiles Tab Window Help Graw McGraw Hill MC ☑ Hill prod.reader-ui.prod.mheducation.com/epub/sn_d82a5/data-uuid-0e12dd568f3f4e438c00faed4ea436f1 Chrome File Edit View Λ LTI Launch 88 Netflix YouTube A BlackBoard Mail - Stiffler, Zac... SBI Jobs E Aa Finish update: ☐ All Bookmarks Goodweek Tires, Inc. After extensive research and development, Goodweek Tires, Inc., has recently developed a new tire, the SuperTread, and must decide whether to make the investment necessary to produce and market it. The tire would be ideal for drivers doing a large amount of wet weather and off-road driving in addition to normal freeway usage. The research and development costs so far have totaled about $10 million. The SuperTread would be put on the market beginning this year, and Goodweek expects it to stay on the market for a total of four years. Test marketing costing $5…arrow_forwardDamerly Company (a Utah employer) wants to give a holiday bonus check of $375 to each employee. As it wants the check amount to be $375, it will need to gross-up the amount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to John Rolen if his cumulative earnings for the year are $46,910. Besides being subject to social security taxes and federal income tax (supplemental rate), a 4.95% Utah income tax must be withheld on supplemental payments.arrow_forwardPlease given correct answer general Accountingarrow_forward

- How much will you accumulated after 35 year?arrow_forwardOn a particular date, FedEx has a stock price of $89.27 and an EPS of $7.11. Its competitor, UPS, had an EPS of $0.38. What would be the expected price of UPS stock on this date, if estimated using the method of comparables? A) $4.77 B) $7.16 C) $9.54 D) $10.50arrow_forwardHow much will you accumulated after 35 year? General accountingarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education