Financial accounting

3rd Edition

ISBN: 9780077506902

Author: David J Spieceland Wayne Thomas Don Herrmann

Publisher: Mcgraw-Hill

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 1.4AP

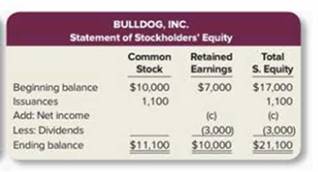

Below are-incomplete financial statements for Bulldog Inc.

| BULLDOG. INC. Income Statement |

|

| Revenues | $39,000 |

| Expenses: | |

| Salaries | (a) |

| Advertising | 6,000 |

| Utilities | 4,000 |

| Net income | (b) |

Required:

Calculate the missing amounts.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Tisdale Incorporated reports the following amounts in its December 31, 2024, income statement.

Sales revenue

Nonoperating revenue

Selling expenses

$310,000 Income tax expense

112,000 Cost of goods sold

62,000 Administrative expenses

52,000

General expenses

Required:

1. Prepare a multiple-step income statement.

2. Indicate whether the statement "Tisdale Incorporated does not appear to have much profit-generating potentia

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Prepare a multiple-step income statement. (Losses should be indicated by a minus sign.)

TISDALE INCORPORATED

Multiple-Step Income Statement

For the Year Ended December 31, 2024

Prev

$32,000

192,000

42,000

2 of 6

Next

USE THE FOLLOWING INFORMATION

FOR THE FOLLOWING

REQUIREMENTS. NUMBER FORMAT:

1,000 (NO NEED TO USE PESO SIGN

OR LETTER P)

EASSY Manufacturing Company presents the following:

Statement of Comprehensive Income

December 31, 2018

Sales

480,000

Cost of sales

336,000

Gross profit

Operating expenses

Income before taxes

144,000

57,600

86,400

12,960

Income tax (30%)

Net income

73,440

Statement of Financial Position

December 31, 2018

Current assets

420,000

Non-current assets

500,000

920,000

Total assets

Current liabilities

90,000

Non-current liabilities

250,000

490,000

Ordinary shares

Retained earnings

Total liabilities and shareholders' equity

90,000

P

920,000

Additional information:

1. Dividends payout is 60%.

2. Only current assets and current liabilities are directly related to sales.

3. The business expects a 30% increase in sales next year.

4. The business is expecting to retain 40% of the earning next year.

Expected increase in assets

Spontaneous increase in current

liabilities.

[The following information applies to the questions displayed below.]

The following data were provided by Mystery Incorporated for the year ended December 31:

Cost of Goods Sold

$ 156,000

Income Tax Expense

Net Sales

15, 120

253,890

18,100

36,600

Office Expense

Salaries and Wages Expense

Required:

1. Prepare a multistep income statement for external reporting purposes.

MYSTERY INCORPORATED

Income Statement

---

Chapter 1 Solutions

Financial accounting

Ch. 1 - Explain what it means to say that an accounting...Ch. 1 - Identify some of the people interested in making...Ch. 1 - What is the basic difference between financial...Ch. 1 - What are the two primary functions of financial...Ch. 1 - What are line three basic business activities that...Ch. 1 - Prob. 6RQCh. 1 - What are a few of the typical investing activities...Ch. 1 - Prob. 8RQCh. 1 - Prob. 9RQCh. 1 - Provide the basic definition for each of the...

Ch. 1 - Prob. 11RQCh. 1 - What are the four primary financial statements?...Ch. 1 - What does it mean to say that the income...Ch. 1 - Prob. 14RQCh. 1 - What is the accounting equation? Which financial...Ch. 1 - Prob. 16RQCh. 1 - The retained earnings account is a link between...Ch. 1 - Prob. 18RQCh. 1 - Prob. 19RQCh. 1 - Prob. 20RQCh. 1 - Prob. 21RQCh. 1 - Prob. 22RQCh. 1 - Prob. 23RQCh. 1 - Prob. 24RQCh. 1 - Prob. 25RQCh. 1 - What are the three primary objectives of financial...Ch. 1 - Prob. 27RQCh. 1 - Prob. 28RQCh. 1 - Prob. 29RQCh. 1 - What is meant by the term cost effectiveness in...Ch. 1 - Prob. 31RQCh. 1 - Prob. 1.1BECh. 1 - Match each business activity with its description....Ch. 1 - Prob. 1.3BECh. 1 - Prob. 1.4BECh. 1 - For each transaction, indicate whether each...Ch. 1 - For each transaction, indicate whether each...Ch. 1 - Describe each financial statement (LO13) Match...Ch. 1 - Determine the location of items in financial...Ch. 1 - Prob. 1.9BECh. 1 - Indicate which of the following are objectives of...Ch. 1 - Prob. 1.11BECh. 1 - Prob. 1.12BECh. 1 - Prob. 1.13BECh. 1 - The following provides a list of transactions and...Ch. 1 - Falcon Incorporated has the following transactions...Ch. 1 - Prob. 1.3ECh. 1 - Eagle Corp. operates magnetic resonance imaging...Ch. 1 - Prob. 1.5ECh. 1 - Below are the account balances for Cowboy Law Firm...Ch. 1 - At the beginning of the year (January 1), Buffalo...Ch. 1 - Wolfpack Construction has the following account...Ch. 1 - Tiger Trade has the following cash transactions...Ch. 1 - Prob. 1.10ECh. 1 - Prob. 1.11ECh. 1 - Squirrel Tree Services reports the following...Ch. 1 - Prob. 1.13ECh. 1 - During its first five years of operations, Red...Ch. 1 - Below are approximate amounts related to retained...Ch. 1 - Below are approximate amounts related to balance...Ch. 1 - Below are approximate amounts related to cash flow...Ch. 1 - Prob. 1.18ECh. 1 - Prob. 1.19ECh. 1 - Prob. 1.20ECh. 1 - A Below are typical transactions for...Ch. 1 - Account classifications include assets,...Ch. 1 - Longhorn Corporation provides low-cost food...Ch. 1 - Below are-incomplete financial statements for...Ch. 1 - Prob. 1.5APCh. 1 - Prob. 1.6APCh. 1 - Listed below are nine terms and definitions...Ch. 1 - Below are typical transactions for Caterpillar...Ch. 1 - Prob. 1.2BPCh. 1 - Prob. 1.3BPCh. 1 - Prob. 1.4BPCh. 1 - Prob. 1.5BPCh. 1 - Prob. 1.6BPCh. 1 - Prob. 1.7BPCh. 1 - Prob. 1.1APCPCh. 1 - Prob. 1.2APFACh. 1 - Prob. 1.3APFACh. 1 - Prob. 1.4APCACh. 1 - Prob. 1.5APECh. 1 - Prob. 1.7APWC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the net income for the BlueDragon company given the following list of accounting itens? note: write the number with at most 2 decimal płaces (eg. 95.17) unsorted Profit & Loss items For the year 2020 (in thousand Php) cost of goods sold (192) wage expense (31) communication expense (5) sales 171 office supplies expense |(6) depreciation & amortization (2) repair & maintenance (10) interest income 49 computer expense (5)arrow_forwardThe following financial statement information for Peal Company as for the year 2021: Required: Fill the missing amounts. (Hint: There are 6 missing amounts). Note: Write only the final amount. Do not show your calculation. Peal Company Income Statement For the year ended 2021 Net Sales $12,000 -1- Cost of goods sold Gross profit 6,500 Operating expenses Selling -2- expenses General and administrative expense S Total operating expenses Income from operations Other expenses Interest expense Net income 1,800 4,000 2,500 500 $2,000 Peal Company Statement of Owner's equity For 2021 Capital, Beginning $3,000 balance Add: Investment 10,000 Net income 2,000 Less: Drawings -3- Capital, Ending balance 5,000 Assets Cash $35,000 Prepaid rent 10,000 Office Furniture 10,000 Computer 5,000 Equipment Peal Company Balance Sheet As of Dec 31, 2021 Liabilities and Equity Notes Payable -6- Owner's equity. Owner's capital -5-arrow_forwardThe following financial statement information for Peal Company as for the year 2021: Required Fill the missing amounts. (Hint: There are 6 missing amounts) Note: Write only the final amount. Do not show your calculation. Peal Company Income Statement For the year ended 2021 Net Sales $20,000 -1- Cost of goods sold Gross profit 10,500 Operating expenses -2- Selling expenses General and administrative 2,800 expense S Total operating expenses Income from operations Other expenses Interest expense Net income Moving to another question will save this response. 7,300 3,200 1,200 $2,000 Peal Company Statement of Owner's equity For 2021 $4,000 6,000 2,000 -3- 8,000 Capital, Beginning balance Add Investment Net income Less: Drawings Capital, Ending balance LG Assets Cash Prepaid rent Office Furniture Computer Equipment Total Assets $35,000 10,000 10,000 5,000 $60,000 Peal Company Balance Sheet As of Dec 31, 2021 Liabilities and Equity Notes Payable -6- Owner's equity Owner's capital -5- Total…arrow_forward

- Answer C& D I. Presented here are the components in Sanders Company's income statement. Determine the missing amounts. Sales Cost of Sales Gross Profit Net Income Operating Expenses (b) P75,000 (a) P40,000 P17,000 (d) (c) P56,000 P64,000 P48,000arrow_forwardWhat are total amount of operating expenses? Refer to the Income Statement shown. The data was taken from an Exercise in Chapter 1 of the text. LESSING TOY & HOBBY Northern Division For the Year Ending January 31 ($000) $12,040 Sales revenue Costs Cost of goods sold Advertising Administrative salaries Sales commissions Rent and occupancy expense Allocated corporate support Total costs Net loss before tax benefit. Tax benefit at 25% Net loss. 4,982 $ 6,020 490 810 1,624 2,058 1,330 $12,332 $ (292) (73) $ (219)arrow_forwardThe income statement and selected balance sheet information for Direct Products Company for the year ended December 31 are presented below. Income Statement Sales Revenue $ 42,600 Expenses: 18,000 1,400 8,400 3,900 1,600 Cost of Goods Sold Depreciation Expense Salaries and Wages Expense Rent Expense Insurance Expense Interest Expense Utilities Expense 1,500 1,100 $ 6,700 Net Income Selected Balance Sheet Accounts Ending Beginning Balances Balances Accounts Receivable $ 565 $ 590 830 Inventory Accounts Payable Prepaid Rent Prepaid Insurance Salaries and Wages Payable Utilities Payable 690 425 470 27 21 26 30 68 44 22 16 Required: Prepare the cash flows from operating activities section of the statement of cash flows using the direct method. (Amounts to be deducted should be indicated with a minus sign.) Answer is not complete. DIRECT PRODUCTS COMPANY Statement of Cash Flows (Partial) For the Year Ended December 31 Cash Flows from Operating Activities: Cash Receipts from Customers 42,625…arrow_forward

- The following information is available for Blue Corp. for the year ended December 31, 2022: Other revenues and gains Other expenses and losses Cost of goods sold $11,100 14,000 164,000 Sales revenue Operating expenses Sales returns and allowances Prepare a multiple-step income statement for Blue Corp. (List other revenues before other expenses. Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg (45).) BLUECORP. Income Statement $616,000 197,000 40,000 $arrow_forwardFinancial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. Pretax income ? Gross profit ? Allocated costs (uncontrollable) $2,030 Labor expense 41,590 Sales 189,000 Research and development (uncontrollable) 320 Depreciation expense 18,000 Net income/(loss) ? Cost of goods sold 119,070 Selling expense 1,250 Total expenses ? Marketing costs (uncontrollable) 780 Administrative expense 700 Income tax expense (21% of pretax income) ? Other expenses 310 A. Prepare the income statement to include all costs, but separate out uncontrollable costs using the above information. Round your answers to the nearest dollar. BDS Enterprises Income Statement For the Year Ended December…arrow_forwardFinancial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. Pretax income ? Gross profit ? Allocated costs (uncontrollable) $2,035 Labor expense 41,590 Sales 189,000 Research and development (uncontrollable) 315 Depreciation expense 16,000 Net income/(loss) ? Cost of goods sold 119,070 Selling expense 1,250 Total expenses ? Marketing costs (uncontrollable) 780 Administrative expense 700 Income tax expense (21% of pretax income) ? Other expenses 330 A. Prepare the income statement using the above information. Round your answers to the nearest dollar. BDS Enterprises Income Statement For the Year Ended Dec. 31, 20xx Sales $fill in the blank c8599b09205f02e_2 Cost of…arrow_forward

- The entry to close Income Summary to Nova, Capital includes The income statemernt for the year 2008 of Nova Ca contains the following information: P70,000 Revenues Expenses: Wages Expense P45,000 Rent Expense 12,000 Advertising Exponse 6,000 Supplies Expense 6,000 USities Expense 2,500 Insurance Expense 2,000 Total expenses Not income (losa) 73,500 P3.500) O a debit to Revenue for P70,000. credits to Expenses totalling P73,500. a credit to Income Summary for P3,500. a credit to Nova, Capital for P3,500.arrow_forwardFinancial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. Pretax income ? Gross profit ? Allocated costs (uncontrollable) $2,035 Labor expense 41,590 Sales 189,000 Research and development (uncontrollable) 315 Depreciation expense 16,000 Net income/(loss) ? Cost of goods sold 119,070 Selling expense 1,260 Total expenses ? Marketing costs (uncontrollable) 780 Administrative expense 690 Income tax expense (21% of pretax income) ? Other expenses 320 A. Prepare the income statement using the above information. Round your answers to the nearest dollar. BDS Enterprises Income Statement For the Year Ended Dec. 31, 20xx $fill in the blank cfa9a806dfac049_2 fill in…arrow_forwardUse the following Year 3 data: Other Selling and Administrative Expenses Other Expenses Sales Revenue Advertising and Promotion Expenses Salaries and Wages Expense Income Tax Expense Interest Expense. Required: Prepare the annual income statement for Kvass, Incorporated Revenues: KVASS, INCORPORATED Income Statement For the Year Ended December 31, Year 3 Total Revenues Expenses: $ 1,050,300 247,600 4,885,300 552,500 2,524,400 166,500 113,900arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY