FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

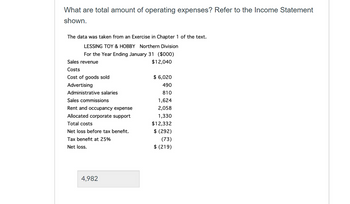

Transcribed Image Text:What are total amount of operating expenses? Refer to the Income Statement

shown.

The data was taken from an Exercise in Chapter 1 of the text.

LESSING TOY & HOBBY Northern Division

For the Year Ending January 31 ($000)

$12,040

Sales revenue

Costs

Cost of goods sold

Advertising

Administrative salaries

Sales commissions

Rent and occupancy expense

Allocated corporate support

Total costs

Net loss before tax benefit.

Tax benefit at 25%

Net loss.

4,982

$ 6,020

490

810

1,624

2,058

1,330

$12,332

$ (292)

(73)

$ (219)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Help me to this questionarrow_forwardFinancial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. Pretax income ? Gross profit ? Allocated costs (uncontrollable) $2,030 Labor expense 41,570 Sales 188,000 Research and development (uncontrollable) 310 Depreciation expense 17,000 Net income/(loss) ? Cost of goods sold 118,440 Selling expense 1,260 Total expenses ? Marketing costs (uncontrollable) 790 Administrative expense 700 Income tax expense (21% of pretax income) ? Other expenses 310 B. Calculate the profit margin, return on investment, and residual income. Assume an investment base of $100,000 and 6% cost of capital. Round your percentage answers to one decimal place. Profit margin fill in the blank…arrow_forwardGiven the following information: Revenue from Operations 3,40,000 Cost of Revenue from Operations 1,20,000 Selling expenses 80,000 Administrative Expenses 40,000 Calculate Gross profit ratio and Operating ratio.arrow_forward

- Financial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. Pretax income ? Gross profit ? Allocated costs (uncontrollable) $2,040 Labor expense 41,580 Sales 190,000 Research and development (uncontrollable) 310 Depreciation expense 17,000 Net income/(loss) ? Cost of goods sold 119,700 Selling expense 1,260 Total expenses ? Marketing costs (uncontrollable) 790 Administrative expense 690 Income tax expense (21% of pretax income) ? Other expenses 330 A. Prepare the income statement to include all costs, but separate out uncontrollable costs using the above information. Round your answers to the nearest dollar. BDS Enterprises Income Statement For the Year Ended December…arrow_forwardFinancial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. Pretax income ? Gross profit ? Allocated costs (uncontrollable) $2,030 Labor expense 41,580 Sales 190,000 Research and development (uncontrollable) 310 Depreciation expense 18,000 Net income/(loss) ? Cost of goods sold 119,700 Selling expense 1,260 Total expenses ? Marketing costs (uncontrollable) 800 Administrative expense 690 Income tax expense (21% of pretax income) ? Other expenses 330 Question Content Area A. Prepare the income statement using the above information. Round your answers to the nearest dollar. BDS EnterprisesIncome StatementFor the Year Ended Dec. 31, 20xx $Sales Cost of Goods Sold…arrow_forwardThe gross profit for the Rails Division isarrow_forward

- Financial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. Pretax income ? Gross profit ? Allocated costs (uncontrollable) $2,040 Labor expense 41,570 Sales 188,000 Research and development (uncontrollable) 315 Depreciation expense 18,000 Net income/(loss) ? Cost of goods sold 118,440 Selling expense 1,250 Total expenses Marketing costs (uncontrollable) 780 Administrative expense 690 Income tax expense (21% of pretax income) ? Other expenses 320 A. Prepare the income statement to include all costs, but separate out uncontrollable costs using the above information. Round your answers to the nearest dollar. BDS Enterprises Income Statement For the Year Ended December 31, 20xx Controllable Expenses: Total Controllable…arrow_forwardRevenue and expense data for the current calendar year for Sorenson Electronics Company and for the electronics industry are as follows. Sorenson Electronics Company data are expressed In dollars. The electronics Industry averages are expressed In percentages. Sorenson Electronics Electronics Industry Company Average Sales $870,000 100 % Cost of goods sold (504,600) (64) Gross profit $365,400 36 % Selling expenses $(217,500) (15) % Administrative expenses (87,000) (15) Total operating expenses $(304,500) (30) % Operating Income $60,900 6 % Other revenue and expense: Other revenue 17,400 Other expense (8,700) (3) Income before Income tax $69,600 7 % Income tax expense (26,100) (4) Net Income $43,500 3 % a. Prepare a common-sized Income statement comparing the results of operations for Sorenson Electronics Company with the Industry average. If required, round percentages to one decimal place. Sorenson Electronics Company Common-Sized Income Statement Sorenson Electronics Sorenson…arrow_forwardFinancial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. Pretax income ? Gross profit ? Allocated costs (uncontrollable) $2,040 Labor expense 41,580 Sales 190,000 Research and development (uncontrollable) 310 Depreciation expense 18,000 Net income/(loss) ? Cost of goods sold 119,700 Selling expense 1,260 Total expenses ? Marketing costs (uncontrollable) 780 Administrative expense 680 Income tax expense (21% of pretax income) ? Other expenses 320 A. Prepare the income statement using the above information. Round your answers to the nearest dollar. B.Calculate the profit margin, return on investment, and residual income. Assume an investment base of $100,000 and 6% cost of capital.…arrow_forward

- Prepare a schedule of cost of goods manufactured and an income statement for YNP corporation as of December 31, 2018. List whether the following fall primarily under managerial or financial accounting.arrow_forwardSuresh Company reports the following segment (department) income results for the year. Department N Department 0 Department P $36,000 $ 57,000 $ 43,000 Sales Expenses Avoidable. Unavoidable Total expenses Income (loss) Department M $ 64,000 otal increase in income 10,300 52,200 62,500 $1,500 37,000 13,200 50,200 $ (14,200) $ 30,000 22,700 4,300 27,000 $ 30,000 14,500 30,000 44,500 $ (1,500) Department T $ 29,000 38,700 10,500 49,200 $ (20,200) Total $ 229,000 123,200 110,200 Compute the total increase in income if the departments with sales less than avoidable costs, as identified in part a, are eliminated 233,400 $ (4,400)arrow_forwardThe following information is given to you relating to the operations of PrincehallCorporation: The income tax rate is 40%. Net sales $11,862 Cost of sales 8,321 Gross margin ? Selling, general, and administrative expenses $ 2,743 Depreciation, amortization, and asset write-offs 278 Total operating expenses: ? Income from operations : ? Interest expense 91 Interest and other income 11 Earnings before income taxes: ? Income taxes ? Net earnings: ? Determine the earnings before taxes:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education