Financial and Managerial Accounting - With CengageNow

14th Edition

ISBN: 9781337577809

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 1.3BPR

Financial statements

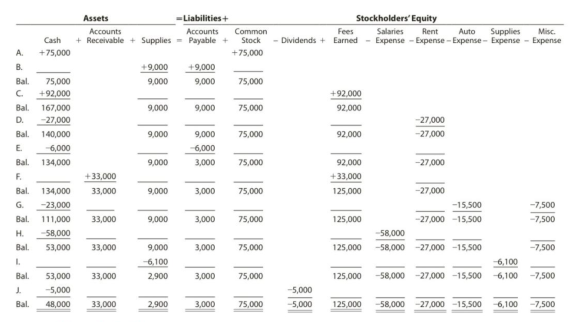

Jose Loder established Bronco Consulting on August 1, 2018. The effect of each transaction and the balances after each transaction for August follow:

Instructions

- 1. Prepare an income statement for the month ended August 31, 2018.

- 2. Prepare a

retained earnings statement for the month ended August 31, 2018. - 3. Prepare a

balance sheet as of August 31, 2018. - 4. (Optional) Prepare a statement of

cash flows for the month ending August 31, 2018.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the depreciation expense for 2019?

Subject:-- general accounting

The Flapjack Corporation had 8,350 actual direct labor hours at an actual rate of $14.50 per hour. Original production had been budgeted for 1,300 units, but only 1,200 units were actually produced. Labor standards were 8.3 hours per completed unit at a standard rate of $16.00 per hour. Compute the direct labor cost variance.

Chapter 1 Solutions

Financial and Managerial Accounting - With CengageNow

Ch. 1 - Name some users of accounting information.Ch. 1 - Prob. 2DQCh. 1 - Prob. 3DQCh. 1 - Prob. 4DQCh. 1 - On July 12, Reliable Repair Service extended an...Ch. 1 - Prob. 6DQCh. 1 - Describe the difference between an account...Ch. 1 - A business had revenues of 679,000 and operating...Ch. 1 - Prob. 9DQCh. 1 - The financial statements are interrelated. What...

Ch. 1 - Prob. 1.1BECh. 1 - Prob. 1.2BECh. 1 - Transactions Interstate Delivery Service is owned...Ch. 1 - Income statement The revenues and expenses of...Ch. 1 - Prob. 1.5BECh. 1 - Balance sheet Using the following data for...Ch. 1 - Statement of cash flows A summary of cash flows...Ch. 1 - Types of businesses The following is a list of...Ch. 1 - Prob. 1.2EXCh. 1 - Prob. 1.3EXCh. 1 - Accounting equation The total assets and total...Ch. 1 - Prob. 1.5EXCh. 1 - Accounting equation Determine the missing amount...Ch. 1 - Prob. 1.7EXCh. 1 - Asset, liability, and stockholders equity items...Ch. 1 - Effect of transactions on accounting equation What...Ch. 1 - Effect of transactions on accounting equation A. A...Ch. 1 - Effect of transactions on stockholders equity...Ch. 1 - Transactions The following selected transactions...Ch. 1 - Nature of transactions Teri West operates her own...Ch. 1 - Net income and dividends The income statement for...Ch. 1 - Net income and stockholders equity for four...Ch. 1 - Balance sheet items From the following list of...Ch. 1 - Income statement items From the following list of...Ch. 1 - Prob. 1.18EXCh. 1 - Income statement Imaging Services was organized on...Ch. 1 - Missing amounts from balance sheet and income...Ch. 1 - Balance sheets, net income Financial information...Ch. 1 - Financial statements Each of the following items...Ch. 1 - Statement of cash flows Indicate whether each of...Ch. 1 - Statement of cash flows A summary of cash flows...Ch. 1 - Financial statements We-Sell Realty, organized as...Ch. 1 - Transactions On September 1 of the current year,...Ch. 1 - Financial statements The amounts of the assets and...Ch. 1 - Financial statements Seth Feye established...Ch. 1 - Transactions; financial statements On August 1,...Ch. 1 - Transactions; financial statements DLite Dry...Ch. 1 - Missing amounts from financial statements The...Ch. 1 - Transactions Amy Austin established an insurance...Ch. 1 - Financial statements The amounts of the assets and...Ch. 1 - Financial statements Jose Loder established Bronco...Ch. 1 - Prob. 1.4BPRCh. 1 - Transactions; financial statements Bevs Dry...Ch. 1 - Missing amount from financial statements The...Ch. 1 - Peyton Smith enjoys listening to all types of...Ch. 1 - Prob. 1ADMCh. 1 - Home Depot: Ratio of liabilities to stockholders'...Ch. 1 - Lowes: Ratio of liabilities to stockholders equity...Ch. 1 - Prob. 4ADMCh. 1 - Ethics in Action Marco Brolo is one of three...Ch. 1 - Prob. 1.3TIF

Additional Business Textbook Solutions

Find more solutions based on key concepts

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Much of risk management consists of reducing risky behavior. What kinds of risky behavior have you observed amo...

Understanding Business

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

10-10 What challenges do managers face in managing global teams? How should those challenges be handled?

Fundamentals of Management (10th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Real options and its types. Introduction: The net present value is the variation between present cash inflows v...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please solve this problemarrow_forwardGary receives $51,000 worth of Quantro, Inc., common stock from his late grandmother's estate. Early in the year, he receives a $250 cash dividend. Four months later, he received a 2% stock dividend. Near the end of the year, Gary sells the stock for $55,000. Due to these events only, how much must Gary include in his gross income for the year?arrow_forwardTechTools has a standard of 1.8 pounds of materials per unit, at $3.50 per pound. In producing 2,500 units, TechTools used 4,700 pounds of materials at a total cost of $16,450. TechTools' materials quantity variance is _.helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License