GEN COMBO ADVANCED ACCOUNTING; CONNECT ACCESS CARD

13th Edition

ISBN: 9781260087383

Author: Joe Ben Hoyle

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 12P

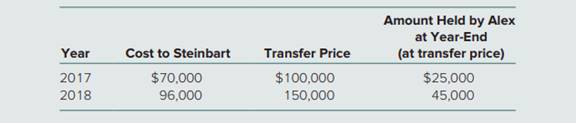

Alex, Inc., buys 40 percent of Steinbart Company on January 1, 2017, for $530,000. The equity method of accounting is to be used. Steinbart’s net assets on that date were $1.2 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Steinbart immediately begins supplying inventory to Alex as follows:

Inventory held at the end of one year by Alex is sold at the beginning of the next.

Steinbart reports net income of $80,000 in 2017 and $110,000 in 2018 and declares $30,000 in dividends each year. What is the equity income in Steinbart to be reported by Alex in 2018?

a. $34,050

b. $38,020

c. $46,230

d. $51,450

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Alex, Inc., buys 40 percent of Steinbart Company on January 1, 2017, for $530,000. The equity method of accounting is to be used. Steinbart’s net assets on that date were $1.2 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Steinbart immediately begins supplying inventory to Alex as follows:Inventory held at the end of one year by Alex is sold at the beginning of the next.Steinbart reports net income of $80,000 in 2017 and $110,000 in 2018 and declares $30,000 in dividends each year. What is the equity income in Steinbart to be reported by Alex in 2018?a. $34,050b. $38,020c. $46,230d. $51,450

Alex, Incorporated, buys 30 percent of Steinbart Company on January 1, 2023, for $599,000. The equity method of accounting is to be used. Steinbart’s net assets on that date were $1.65 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Steinbart immediately begins supplying inventory to Alex as follows:

Year

Cost to Steinbart

Transfer Price

Amount Held by Alex at Year-End (at transfer price)

2023

$ 171,760

$ 226,000

$ 56,500

2024

118,320

174,000

53,000

The inventory held at the end of one year by Alex is sold at the beginning of the next.

Steinbart reports net income of $104,500 in 2023 and $139,300 in 2024 and declares $20,000 in dividends each year. What is the equity income in Steinbart to be reported by Alex in 2024?

Alex, Inc., buys 40 percent of Steinbart Company on January 1, 2020, for $530,000. The equity method of accounting is to be used. Steinbart’s net assets on that date were $1.2 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Steinbart immediately begins supplying inventory to Alex as follows:

Year

Cost to Steinbart

Transfer Price

Amount Held by Alex at Year-End (at transfer price)

2020

70,000

100,00

25,000

2021

96,000

150,000

45,000

Inventory held at the end of one year by Alex is sold at the beginning of the next. Steinbart reports net income of $80,000 in 2020 and $110,000 in 2021 and declares $30,000 in dividends each year. What is the equity income in Steinbart to be reported by Alex in 2021? How do you get the answer and how do you get trade name price?

a. $34,050

b. $38,020

c. $46,230

d. $51,450

Chapter 1 Solutions

GEN COMBO ADVANCED ACCOUNTING; CONNECT ACCESS CARD

Ch. 1 - A company acquires a rather large investment in...Ch. 1 - What accounting treatments are appropriate for...Ch. 1 - Prob. 3QCh. 1 - Why does the equity method record dividends from...Ch. 1 - Prob. 5QCh. 1 - Smith. Inc., has maintained an ownership interest...Ch. 1 - Prob. 7QCh. 1 - Because of the acquisition of additional investee...Ch. 1 - Prob. 9QCh. 1 - Prob. 10Q

Ch. 1 - Prob. 11QCh. 1 - In a stock acquisition accounted for by the equity...Ch. 1 - Prob. 13QCh. 1 - What is the difference between downstream and...Ch. 1 - Prob. 15QCh. 1 - Prob. 16QCh. 1 - What is the fair-value option for reporting equity...Ch. 1 - When an investor uses the equity method to account...Ch. 1 - Which of the following does not indicate an...Ch. 1 - Prob. 3PCh. 1 - Under fair-value accounting for an equity...Ch. 1 - When an equity method investment account is...Ch. 1 - Prob. 6PCh. 1 - In January 2017, Domingo, Inc., acquired 20...Ch. 1 - Prob. 8PCh. 1 - Evan Company reports net income of 140,000 each...Ch. 1 - Perez, Inc., applies the equity method for its 25...Ch. 1 - Prob. 11PCh. 1 - Alex, Inc., buys 40 percent of Steinbart Company...Ch. 1 - Prob. 13PCh. 1 - Prob. 14PCh. 1 - Prob. 15PCh. 1 - On January 1, 2017, Alison, Inc., paid 60,000 for...Ch. 1 - Prob. 17PCh. 1 - Prob. 18PCh. 1 - Prob. 19PCh. 1 - Prob. 20PCh. 1 - Prob. 21PCh. 1 - Echo, Inc., purchased 10 percent of ProForm...Ch. 1 - Prob. 23PCh. 1 - Prob. 24PCh. 1 - Prob. 25PCh. 1 - Prob. 26PCh. 1 - Belden, Inc. acquires 30 percent of the...Ch. 1 - Prob. 28PCh. 1 - Prob. 29PCh. 1 - On July 1, 2016, Killearn Company acquired 88,000...Ch. 1 - Prob. 31PCh. 1 - On January 1, 2017, Stream Company acquired 30...Ch. 1 - EXCEL CASE 1 On January 1, 2018, Acme Co. is...Ch. 1 - Access The Coca-Cola Companys SEC 10-K filing at...Ch. 1 - Prob. 4DYSCh. 1 - Prob. 5DYS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Alex, Incorporated, buys 30 percent of Steinbart Company on January 1, 2023, for $1,098,000. The equity method of accounting is to be used. Steinbart's net assets on that date were $3.30 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Steinbart immediately begins supplying inventory to Alex as follows: Amount Held by Alex at Year-End (at transfer price) $ 55,000 55,000 Inventory held at the end of one year by Alex is sold at the beginning of the next. Steinbart reports net income of $100,000 in 2023 and $130,900 in 2024 and declares $40,000 in dividends each year. What is the equity income in Steinbart to be reported by Alex in 2024? Year Cost to Steinbart Transfer Price 2023 2024 $ 156,200 109,800 $ 220,000 180,000arrow_forward15. Northridge, Inc., buys 40% of Matador Company on January 1, 2019. for $550,000. The equity method of accounting is to be used, Matador's net assets on that date were $1.2 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Matador immediately begins supplying inventory to Northridge as follows: Amount Held by Northridge Year Cost to Matador Transfer Price At Year End (at transfer price)2019 $70,000 $100,000 $25,0002020 $96,000 $150,000 $45,000Inventory held at the end of one year by Northridge is sold at the beginning of the next. Matador reports net income of $100,000 in 2019 and $150.000 in 2020 and declares (and pays)…arrow_forwardAcker Inc. bought 40% of Howell Co. on January 1, 2020 for $576,000. The equity method of accounting was used. The book value and fair value of the net assets of Howell on that date were $1,440,000. Acker began supplying inventory to Howell as follows: YEAR/ COST TO ACKER/ TRANSFER PRICE/ AMOUNT HELD BY HOWELL AT YEAR-END: 2020/ $55,000/ $75,000/ $15,000 2021/ $70,000/ $110,000/ $55,000 Howell reported net income of $100,000 in 2020 and $120,000 in 2021 while paying $40,000 in dividends each year. what is the equity in Howell income that should be reported by Acker in 2021? options are $32,000 - $41,600 - $48,000 - $49,600 - $50,600arrow_forward

- RAM, Inc., acquired a 60 percent interest in LMU Company several years ago. During 2017, LMU sold inventory costing $160,000 to RAM for $200,000. A total of 18 percent of this inventory was not sold to outsiders until 2018. During 2018, LMU sold inventory costing $297,500 to RAM for $350,000. A total of 30 percent of this inventory was not sold to outsiders until 2019. In 2018, RAM reported cost of goods sold of $607,500 while LMU reported $450,000. What consolidation entries will be made for these transactions in 2018 consolidation?arrow_forwardDetner International purchases 80% of the outstanding stock of Hardy Company for $1,600,000 on January 1, 2015. At the purchase date, the inventory, equipment, and patents of Hardy Company have fair values of $10,000, $50,000, and $100,000, respectively, in excess of their book values. The other assets and liabilities of Hardy Company have book values equal to their fair values. The inventory is sold during the month following the purchase. The two companies agree that the equipment has a remaining life of eight years and the patents 10 years. Onthe purchase date, the owners’ equity of Hardy Company is as follows:Common stock ($10 stated value) . . . . . . . . . . . . . . . . $1,000,000Additional paid-in capital in excess of par . . . . . . . . . 300,000Retained earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . 400,000Total equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,700,000During 2015 and 2016, Hardy Company has income and pays dividends as…arrow_forwardParkette, Inc., acquired a 60 percent interest in Skybox Company several years ago. During 2017, Skybox sold inventory costing $160,000 to Parkette for $200,000. A total of 18 percent of this inventory was not sold to outsiders until 2018. During 2018, Skybox sold inventory costing $297,500 to Parkette for $350,000. A total of 30 percent of this inventory was not sold to outsiders until 2019. In 2018, Parkette reported cost of goods sold of $607,500 while Skybox reported $450,000. What is the consolidated cost of goods sold in 2018? $698,950 $720,000 $1,066,050 $716,050arrow_forward

- Francis acquired 80% of Cole’s Co. equity shares for $300,000 on January 1, 2018. On 31 December 2018 Francis sold $100,000.00 worth of goods to Cole’s. These goods had cost Francis $80,000.00. On December 31, 2018, Cole still had 20% of worth of goods remaining in inventory (held at cost to Cole). The two companies draft income statements as at 31 December 2018 are shown below. Francis Cole’s $'000 $'000 Revenue 5,000.00 1,000.00 Cost of sales (2,900.00) (600.00) Gross profit 2,100.00 400.00 Administrative expense (1,000.00) (200.00) Distribution costs (700.00) (120.00) Profit before tax 400.00 80.00 Income tax expense (130.00) (25.00) Profit for the year 270.00 55.00 Required Prepare the consolidated income statement to incorporate Francis and Cole for the year ended 31 December 2018. Note: Show all workingsarrow_forwardTally, Inc., sold $200,000 in inventory to Merna Company during 2015 for $250,000. Mernal resold $175,000 of this merchandise in 2015 with the remainder to be disposed of during 2016. Assuming that Tally owns 40 percent of Merna and applies the equity method, what journal entry is recorded at the end of 2015 to defer the unrealized gross profit?arrow_forwardAcker Inc. bought 40% of Howell Co. on January 1, 2020 for $576,000. The equity method of accounting was used. The book value and fair value of the net assets of Howell on that date were $1,440,000. Acker began supplying inventory to Howell as follows: Year Cost to Acker Transfer Price Amount Held by Howell at Year-End 2020 $ 55,000 $ 75,000 $15,000 2021 $ 70,000 $ 110,000 $55,000 Howell reported net income of $100,000 in 2020 and $120,000 in 2021 while paying $40,000 in dividends each year. What is the Equity in Howell Income that should be reported by Acker in 2020? Multiple Choice $10,000. $24,000. $36,000. $38,400. $40,000.arrow_forward

- Rommel, Inc. acquired a 60% interest in Mikee Company several years ago. During 2020, Mikee sold inventory costing P75,000 to Rommel for P100,000. A total of 16% of this inventory was not sold to outsider until 2021. During 2021, Mikee sold inventory costing P96,000 to Rommel for P120,000. A total of 35% of this inventory was not sold to outsiders until 2022. In 2021, Rommel reported cost of sales of P380,000 while Mikee reported P210,000. What is the consolidated cost of sales?a. 522,400b. 474,400c. 473,400d. 594,400arrow_forwardParkette, Inc., acquired a 60 percent interest in Skybox Company several years ago. During 2020, Skybox sold inventory costing $90,200 to Parkette for $110,000. A total of 12 percent of this inventory was not sold to outsiders until 2021. During 2021, Skybox sold inventory costing $294,800 to Parkette for $335,000. A total of 29 percent of this inventory was not sold to outsiders until 2022. In 2021, Parkette reported cost of goods sold of $527,500 while Skybox reported $422,500. What is the consolidated cost of goods sold in 2021? Multiple Choice a $605,718. b $959,282. c $635,400. d $624,282.arrow_forwardBoboy, Inc. acquired 60 percent interest in Homer Co. several years ago. During 2020, Homer sold inventory costing P75,000 to Boboy for P100.000. A total of 16 percent of this inventory was not sold to outsider until 2021. During 2021, Homer sold inventory costing P96,000 to Boboy for P120,000. A total of 35 percent of this inventory was not sold to outsiders until 2022. In 2021, Boboy reported cost of sales of P380,000 while Homer reported P210,000. What is consolidated cost of sales?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License