FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

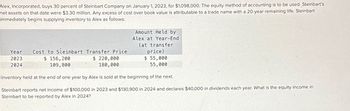

Transcribed Image Text:Alex, Incorporated, buys 30 percent of Steinbart Company on January 1, 2023, for $1,098,000. The equity method of accounting is to be used. Steinbart's

net assets on that date were $3.30 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Steinbart

immediately begins supplying inventory to Alex as follows:

Amount Held by

Alex at Year-End

(at transfer

price)

$ 55,000

55,000

Inventory held at the end of one year by Alex is sold at the beginning of the next.

Steinbart reports net income of $100,000 in 2023 and $130,900 in 2024 and declares $40,000 in dividends each year. What is the equity income in

Steinbart to be reported by Alex in 2024?

Year Cost to Steinbart Transfer Price

2023

2024

$ 156,200

109,800

$ 220,000

180,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- provide solution of this questionarrow_forwardIn 2018, Evan Company spent $3,900,000 to acquire 100% of the outstanding stock of Haven Company, i.e., Evan bought Haven. As a result of the acquisition, Evan took over 100% of Haven’s assets AND Even became responsible for 100% of Haven’s liabilities. At the time of the purchase, Haven’s balance sheet reflected the following: Cash $ 300,000 Accounts receivable, net 1,300,000 Investments 900,000 Property, plant, and equipment, net 1,100,000 TOTAL ASSETS $3,600,000 Accounts payable and accrued liabilities $ 750,000 Bonds payable…arrow_forward29. Lion Company purchased inventory from Dove Corporation for P120,000 on October 4, 2020, and resold 80% to outsider before end of the year, for P140,000. Dove manufactured the inventory sold to Lion for the following costs: Direct materials - P40,000; Direct labor - P20,000; Overhead - applied at 75% of direct labor costs. Lion owns 70% of Dove. Assume that there are no other transactions occur đuring 2020. How much is the consolidated sales? a. P260,000 b. P120,000 c. P98,000 d. P140,000 30. How much is the consolidated cost of sales? a. P60,000 b. P96,000 c. P45,000 d. P75,000 31. The controlling interest in the consolidated gross profit is: a P45,000 b. P30,800 c. P69,500 d. P69,200 e. P71,200 32. The amount of inventory that will be shown in the consolidated statements is: a. P24,000 b. P16,800 c. P39,000 d. P15,000arrow_forward

- Company P purchases an 80% interest in Company S on January 1, 2015, for $480,000. Company S had equity of $450,000 on that date. Any excess of cost over book value was attributed to equipment with a 10-year life. On July 1, 2020, Company P purchased another 10% interest for $160,000. Company S’s equity was $550,000 on January 1, 2020, and it earned $50,000 evenly during 2020. Company P had internally generated net income of $120,000 during 2020. Calculate consolidated income for 2020 and the distribution of consolidated income to the noncontrolling and controlling interests.arrow_forwardP Corporation owns 80 percent of S Inc.’s common stock. During 2020, P sold Inventory to S for $250,000 on the same terms as sales made to third parties. S sold all of the inventory purchased from P in 2020 The following information pertains to S and P sales for 2020 P s Sales $1,000,000 $ 700,000 Cost of Sales (400,000) (350,000) Gross Profit $ 600,000 $ 350,000 What amount should P report as cost of sales in its 2021 consolidated income statement Select one: a. $680,000 b. $430,000 c. $750,000 d. $500,000arrow_forward3. Abbot Company purchased 80% of Costello Company on January 1, 20X1. The purchase price paid was $600,000. On that day, the book value of Costello was $500,000. Excess of cost over book value is due to goodwill. Included in Costello's income are intercompany sales to Abbot of $40,000 with a cost to Costello of $25,000. 30% of this inventory is on hand in the Abbot inventory at December 31, 20X3. In addition, inventory sold at a profit of $5,000 was in the inventory of Abbot at December 31, 20X2. Complete the consolidation worksheet. First, complete the financial statements below. Below are the balances of accounts of Abbot and Costello at December 31, 20X3. Consolidation Entries Consolidated Bal. Abbot Costello Dr. Cr. Sales $50,000 $250,000 Expenses 30,000 150,000 Income from S.…arrow_forward

- Paneer owns 30% of Lassi and has done so for many years. During the year ended 31 December 20X1, Lassi made a net profit of £1.5m. Lassi sold inventory costing £1m to Paneer at a mark-up of 50%. 40% of the goods are still in Paneer's inventory at the year end. What is the "Income from associates" to be shown in the consolidated Statement of profit or loss for the year ended 31 December 20X1? a. £1,300,000 b. £450,000 C. £360,000 d. £390,000 O e. £150,000 O f. £300,000 g. £250,000arrow_forwardPit Coporation owns 75% of Stop Company's outstanding common stock. On 08/28/21, Pit sold inventory to Stop in exchange for $540,000 cash. Pit had purchased the inventory on 05/02/21 at a cost of $324,000. On 12/21/21, Stop sold 80% of the inventory to 3rd parties at a cash price of $720,000. The other 20% of the inventory remains on hand at 12/31/21. Pit's Journal Entries would include: To Acquire The Inventory: A debit to Inventory and a credit to Cash in the amount of: To Sell the Inventory to Stop: A debit to Cash and a credit to Sales in the amount of: A debit to Cost of Goods Sold and a credit to Inventory in the amount of:arrow_forwardEaster Company manufactures Easter chocolates and has been in operation for the pst 5 years. During the 2023 fiscal year, Easter Company purchased the following assets using a variety of financing alternatives. Easter Company follows FRS and has a December 319 year - end. Asset 1Easter Company obtained a new photocopier worth $215,000 in exchange for 9,000 common shares. At that time, the common shares of Easter Company were trading on the stock market for $25 each. Asset 2On September 1, 2023 Easter Company purchased new equipment for $500,000. The company plans on using the equipment for 10 years. During that time, it is expected the equipment will be used for a total of 30,000 machi hours. At the end of 10 years, it is estimated that the equipment will be sold for 550,000. During 2023, the equipment was used for a totall of 4, 500 machine hours. Assets 3 & 4and building were acquired for a lump sum price of $1,500,000 which was paid in cash. At the time of the land was appraised at…arrow_forward

- what is the interim report of a company?arrow_forwardP Company owns 60% of the outstanding common stock of S Company. On January 1, 2016, P Company sold equipment to S Company for $300,000. The equipment cost P Company $1,000,000 on January 1st, 2010. The useful life at the time of sale was determined to be 10 years. After the sale from P to S, the management of S Company estimated that the equipment had a remaining useful life of 8 years. To solve: Prepare all journal entries for P and S (from initial purchase of equipment from 3rd parties, depreciation from initial purchase to sale between the related parties) on January 1, 2016 . In addition, prepare the w/p entry to eliminate the intercompany sale of equipment as of January 1, 2016. Finally, prepare the adjustment to depreciation on Dec. 31, 2016.arrow_forwardLemon Ltd has a December 31 year end. On January 1, 2018 Lemon acquires 4000 shares of Nike Inc at a cost of $150 per share. Transaction cost is $1200. The Investment is classified as available for Sale. On December 31, 2018 the Fair Value of Nike share has decreased to $120/share. On March 1, 2019 Lemon Ltd sells the shares for $135 per share. Transaction cost for the sale is $2000. Record the journal entries in the books of Lemon Ltd.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education