Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

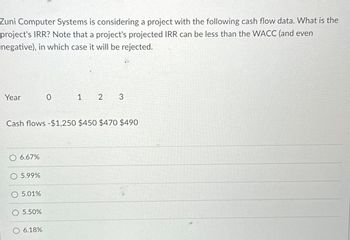

Transcribed Image Text:Zuni Computer Systems is considering a project with the following cash flow data. What is the

project's IRR? Note that a project's projected IRR can be less than the WACC (and even

negative), in which case it will be rejected.

Year

6.67%

Cash flows -$1,250 $450 $470 $490

5.99%

5.01%

5.50%

0

6.18%

1 2 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Nast Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost. O WACC: CFS CFL O a. $199.41 O b. $0.00 O c. $109.03 O d. $7.51 Oe. $8.32 10.75% 0 -$1,100 -$2,200 1 $375 $725 2 $375 $725 3 $375 $725 st 4 $375 $725arrow_forwardI need solutions for questions d, e, f, g, h and i. Thanks d. Are this project’s cash flows likely to be positively or negatively correlated withreturns on Cory’s other projects and with the economy, and should this matter in youranalysis? Explain.e. Unrelated to the new product, Cory is analyzing two mutually exclusive machines thatwill upgrade its manufacturing plant. These machines are considered average-riskprojects, so management will evaluate them at the firm’s 10% WACC. Machine Xhas a life of 4 years, while Machine Y has a life of 2 years. The cost of each machineis $60,000; however, Machine X provides after-tax cash flows of $25,000 per year for4 years and Machine Y provides after-tax cash flows of $42,000 per year for 2 years. Themanufacturing plant is very successful, so the machines will be repurchased at the endof each machine’s useful life. In other words, the machines are “repeatable” projects.1. Using the replacement chain method, what is the NPV of the better machine?2.…arrow_forwardThe payback method helps firms establish and identify a maximum acceptable payback period that helps in their capital budgeting decisions. Consider the case of Cold Goose Metal Works Inc.: Cold Goose Metal Works Inc. is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Beta’s expected future cash flows. To answer this question, Cold Goose’s CFO has asked that you compute the project’s payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year. Complete the following table and compute the project’s conventional payback period. For full credit, complete the entire table. (Note: Round the conventional payback period to two decimal places. If your answer is negative, be sure to use a minus sign in your answer.) Year 0 Year 1 Year 2 Year 3 Expected cash flow -$4,500,000 $1,800,000 $3,825,000 $1,575,000…arrow_forward

- ZLY calculates that a project with conventional cash flows and a required return of 14% has a negative NPV. What do we then know about the project's internal rate of return? A) equal to 21% B) greater than 14% C) less than 14% D) equal to zeroarrow_forwardWhich of the following statements is most FALSE? A. If a project with normal cash flows has a positive NPV, it will definitely have an MIRR greater than the cost of capital. B. If a project with normal cash flows has an IRR that is greater than the cost of capital, then taking on that project would decrease the value of the firm. C. If a project has normal cash flows, then the MIRR has to be between k and IRR if the project has positive interim cash flows (cash flows between t=0 and the end of the project). D. If a project with normal cash flows does not have any interim cash flows, the project's IRR will equal the project's MIRR. E. Multiple IRRS can exist for a project if the project has nonnormal cash flows. OA OB OCarrow_forwardBasic NPV methods tell us that the value of a project today is NPV0. Time value of money issues also lead us to believe that if we choose not to do the project that it will be worth NPV1 one period from now, such that NPV0 > NPV1. Why then do we see some firms choosing to defer taking on a project. Be complete and thorough in your answer.arrow_forward

- Tesar Chemicals is considering Projects S and L, whose cash flows are shown below. These projects are mutuallyexclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFOadvocates the NPV. If the decision is made by choosing the project with the higher IRR rather than the one with thehigher NPV, how much, if any, value will be forgone, i.e., what's the chosen NPV versus the maximum possible NPV?Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs. NPV will have noeffect on the value gained or lost.WACC: 7.50%Year 0 1 2 3 4CFS −$1,100 $550 $600 $100 $100CFL−$2,700 $650 $725 $800 $1,400arrow_forwardDatta Computer Systems is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC (and even negative), in which case it will be rejected. Year Cash flows O 7.93% 8.31% 9.46% 9.94% 9.55% -$1,175 $450 $470 دیا $490arrow_forwardH5. Discuss the following statement: If a firm has only independent projects, a constant WACC, and projects with normal cash flows, the NPV and IRR methods will always lead to identical capital budgeting decisions. What does this imply about the choice between IRR and NPV? If each of the assumptions were changed (one by one), how would your answer change? Explain with detailsarrow_forward

- Dupont Chemicals is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive equally sky and not repeatable The CEO believes the IRR is the best selection criterion, while the CFO advocates the NPV. If the decision is made by choosing the project with the highor RR rather than the one with the higher NPV, how much, if any, the value will be forgone, Le, what's the chosen NPV versus the maximum possible NPV? Note that (1) "bue value is med by NPV and (2) under some conditions the choice of IRR vs. NPV will have no effect on the value gained or lost WACC 7.50% Year CFS CFL 1 4 0 $1,500 $550 2 3 $600 $100 $200 $3,000 $650 $725 $800 $1,600arrow_forwardI'm not sure if I am doing this right.arrow_forwardThis is a multiple choice question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education