Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Assuming the U.S. dollar is the functional currency, what is the remeasurement gain or loss for 2020? The December 31, 2019, U.S. dollar-translated

Assuming the foreign currency is the functional currency, what is the translation adjustment for 2020? The December 31, 2019, U.S. dollar-translated balance sheet reported retained earnings of $107,500 and a cumulative translation adjustment of $24,550 (credit balance).

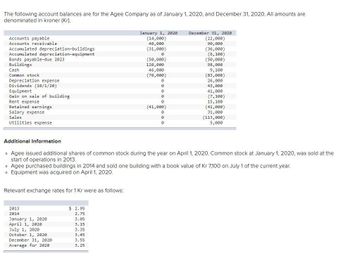

Transcribed Image Text:The following account balances are for the Agee Company as of January 1, 2020, and December 31, 2020. All amounts are

denominated in kroner (Kr).

Buildings

Accounts payable

Accounts receivable

Accumulated depreciation-buildings

Accumulated depreciation-equipment

Bonds payable-due 2023

Cash

January 1, 2020

(14,000)

December 31, 2020

(22,000)

40,000

(31,000)

0

(50,000)

120,000

46,000

Common stock

(70,000)

90,000

(36,000)

(6,100)

(50,000)

98,000

9,100

(83,000)

Depreciation expense

Ө

26,000

Dividends (10/1/20)

0

43,000

Equipment

0

41,000

Gain on sale of building

0

(7,100)

Rent expense

0

15,100

Retained earnings

(41,000)

(41,000)

Salary expense

Sales

Utilities expense

0

0

0

31,000

(113,000)

5,000

Additional Information

⚫ Agee issued additional shares of common stock during the year on April 1, 2020. Common stock at January 1, 2020, was sold at the

start of operations in 2013.

⚫ Agee purchased buildings in 2014 and sold one building with a book value of Kr 7,100 on July 1 of the current year.

Equipment was acquired on April 1, 2020.

о

Relevant exchange rates for 1 Kr were as follows:

2013

2014

$ 2.95

2.75

January 1, 2020

3.05

April 1, 2020

3.15

July 1, 2020

3.35

October 1, 2020

3.45

December 31, 2020

3.55

Average for 2020

3.25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2021, the general ledger of Tripley Company included the following sccount balances: Accounts Debit Credit $250, 0e 78,0ee Cash Accounts receivable Allowance for uncollectible accounts Inventory Building Accunulated depreciation Land $ 35,800 33,000 223,0ee 48, e00 248,6e0 Accounts payable Notes payable (8x, due in 3 years) 170, e00 216,e00 113,600 242, e00 Conmon stock Retained earnings Totals $816,680 $816, 600 The $33,000 beginning balance of inventory consists of 330 units, esch costing $100. During January 2021, the company had the following transsctions: January 2 Lent $58,000 to an employee by accepting a 6% note due in six Tonths. 5 Purchased 5,000 units of inventory on account for $550,eee ($110 cach) with terms 1/1e, n/30. 8 Returned 100 defective units of inventory purchased on January 5. 15 Sold 4,8ae units of inventory on account for $768,000 ($16e cach) with terms 2/10, n/30. 17 Customers returned 20e units sold on January 15. These units were initially…arrow_forwardPlease help mearrow_forwardPrepare the income statements and balance sheets for years 2018 and 2019 for Thompson Company using the following information. The balance sheet numbers are at the end of year figures.Item20182019Accounts Payable120.0150.0Accounts Receivable150.0180.0Accumulated Depreciation330.0360.0Cash & Cash Equivalents10.012.0Common Stock150.0200.0Cost of Goods Sold750.0850.0Depreciation25.030.0Interest Expense30.033.0Inventory200.0180.0Long-term Debt150.0150.0Gross Plant & Equipment650.0780.0Retained Earnings208.5225.0Sales1,500.01,700.0SG&A Expenses500.0570.0Notes Payable51.567.0Tax Rate21%21%(2) Answer the following questions:(a) How much did Thompson Company spend in acquiring fixed assets in 2019?(b) How much dividend did Thompson Company pay out during 2019?(c) Using the end of year numbers, did the long-term solvency ratios improve or deteriorate from 2018 to 2019? Answer this question using at least two long-term solvency ratios.(d) Using the end of year numbers, did the asset…arrow_forward

- The accounting records of Nettle Distribution show the following assets and liabilities as of December 31,2018 and 2019.December 31 2018 2019Cash . . . . . . . . . . . . . . . . . . . . . . . . $ 64,300 $ 15,640Accounts receivable . . . . . . . . . . . 26,240 19,100Office supplies . . . . . . . . . . . . . . . . 3,160 1,960Office equipment . . . . . . . . . . . . . . 44,000 44,000Trucks . . . . . . . . . . . . . . . . . . . . . . . 148,000 157,000December 31 2018 2019Building . . . . . . . . . . . . . . . . . . . . . $ 0 $80,000Land . . . . . . . . . . . . . . . . . . . . . . . . 0 60,000Accounts payable . . . . . . . . . . . . . 3,500 33,500Note payable . . . . . . . . . . . . . . . . . 0 40,000Required1. Prepare balance sheets for the business as of December 31, 2018 and 2019. Hint: Report only total equityon the balance sheet and remember that total equity equals the difference between assets and liabilities.2. Compute net income for 2019 by comparing total equity amounts for these…arrow_forwardThe current sections of rita Company's Statement of Financial Position as at 31 December 2019 and 2020, are presented below. rita net income for 2020 was RM203,000. Depreciation expense was RM25,000. 2019 2020 (RM) (RM) Current asset Cash 115,000 99,000 Accounts receivable 105,000 89,000 154,000 172,000 Inventory Prepaid expense 27,000 21.000 Total current assets 401,000 381.000 Current liabilities Accrued expenses payable Accounts payable 15,000 5,000 85.000 93.000 Total current liabilities 100,000 98,000 Prepare the net cash provided by operating activities section of the company's Statement of Cash Flows for the year ended 31 December 2020, using the indirect method.arrow_forwardShown below are selected accounts and their balances for the KTS Company as of December 31, 2021: Accounts payable-P980,000; Accounts receivable-P2,160,000; Allowance for bad debts-P250,000; Cash-P224,000; Wages payable-P108,000; Trademarks-P450,000; Long-term advances to officers-P1,500,000; Inventory-P830,000; Income taxes payable-P720,000; Notes receivable(short-term)-P970,000; Bond redemption fund-P1,800,000; Bonds payable-P5,000,000; Premium on bonds payable-P400,000; Treasury shares-P576,000. How much were the total current assets at December 31, 2021? A P5,434,000 B) P4,510,000 C) P3,934,000 D) P3,943,000arrow_forward

- Use the following information for Company COLTIB to create the BalanceSheet for 2020 and 2021arrow_forwardFollowing are the current asset and current liability sections of the balance sheets for Freedom Inc. at January 31, 2020 and 2019 (in millions): Current Assets Cash Accounts receivable Inventories Total current assets Current Liabilities Note payable Accounts payable Other accrued liabilities Total current liabilities January 31, 2020 Working capital Current ratio 6 EL EL $ 21 $ 15 January 31, 2019 01/31/2020 01/31/2019 9 18 $ 25 Required: a. Calculate the working capital and current ratio at each balance sheet date. (Enter "Working capital" in millions of dollars (1.e.. 10,000,000 should be entered as 10). Round your "Current ratio" to 2 decimal places.) $12 b. Evaluate the firm's liquidity at each balance sheet date. Based on the working capital and current ratio measures, the firm has become more liquid over the 2-year period. O Based on the working capital and current ratio measures, the firm has become less liquid over the 2-year period. c. Assume that the firm operated at a loss…arrow_forwardCompany presents the following selected general ledger accountsshowing balances at October 1, 2017: CashFinished GoodsWork in ProcessRaw materialsPrepaid Insurance Accumulated Depreciation Accounts PayableBalances at October 31, 2017 include: Accrued payrollFinished goodsWork in ProcessRaw MaterialsP 40,000 592,000 164,000 128,0004,000 280,000 108,000P 12,000 608,000 188,000 120,000 A summary of transactions for the month of October follows: a. Cash salesb. Raw materials purchased on account c. Direct materials usedd. Direct Labore. Factory insurance expiredf. Depreciation for factory equipment g. Factory utility service on accounth. Accounts payable paidi. Factory payroll paidP420,000 168,000 156,00064,000 1,200 6,80012,000 196,000 88,000Required: Indirect materials used.Indirect laborTotal factory overhead Cost of goods manufaarrow_forward

- Alex Corporation has the following account balances on December 31, 2020: Accounts receivable ₱ 400,000 Allowance for uncollectible accounts 8,400 Alex completed the following transactions in 2019: Net credit sales, ₱ 4,000,000. Collections on accounts, ₱ 3,870,000. Write-off of uncollectible accounts, ₱ 10,000. Recovery of accounts previously written-off, ₱ 2,000. Uncollectible accounts expense, 2/3 of 1% of net credit sales. REQUIRED: 1. Journalize the foregoing transactions. 2. Compute the balance of accounts receivable and allowance for uncollectible accounts at December 31, 2020. What amount of Accounts receivable, net would Alex report on its December 31, 2020 balance sheet? 3. Assume that Alex uses the aging of accounts instead of the percent of sales method in estimating uncollectible accounts. Analysis indicates that Php 30,800 of outstanding accounts on December 31, 2020 may prove to be uncollectible. Compute the uncollectible accounts expense and the…arrow_forwardThe following items are taken from the financial statements of the Metlock Service for the year ending December 31, 2020: Accounts payable $ 17900 Accounts receivable 11200 Accumulated depreciation - equipment 27700 Advertising expense 21000 Cash 14900 Owner's capital (1/1/20) 41500 Owner's drawings 13800 Depreciation expense 12000 Insurance expense 3100 Note payable, due 6/30/21 71300 Prepaid insurance (12-month policy) 6200 Rent expense 17000 Salaries and wages expense 32200 Service revenue 130800 Supplies 4100 Supplies expense 6000 Equipment 205300 What are total long-term liabilities at December 31, 2020? O 89200 O $71300 O $91200 O s0arrow_forwardZETA Company reported revenue of P6,000,000 under the cash basis for the year ended 2020. Additional information was made available; Accounts receivable, December 31, 2019 P1,250,000; Accounts receivable, December 31, 2020, P1,375,000. Under the accrual basis, how much should ZETA Company report as revenue for 2020?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning