FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Sell or Process Further

Zing Coffee Company produces Columbian coffee in batches of 5,600 pounds. The standard quantity of materials required in the process is 5,600

pounds, which cost $5.00 per pound. Columbian coffee can be sold without further processing for $8.40 per pound. Columbian coffee can also be

processed further to yield Decaf Columbian, which can be sold for $12.00 per pound. The processing into Decaf Columbian requires additional

processing costs of $12,650 per batch. The additional processing will also cause a 4% loss of product due to evaporation.

a. Prepare a differential analysis report for the decision to sell or process further.

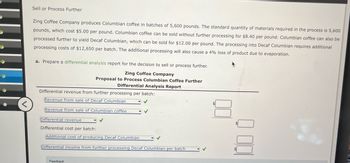

Zing Coffee Company

Proposal to Process Columbian Coffee Further

Differential Analysis Report

Differential revenue from further processing per batch:

Revenue from sale of Decaf Columbian

<

Revenue from sale of Columbian coffee

Differential revenue

Differential cost per batch:

Additional cost of producing Decaf Columbian

Differential income from further processing Decaf Columbian per batch

Feedback

000

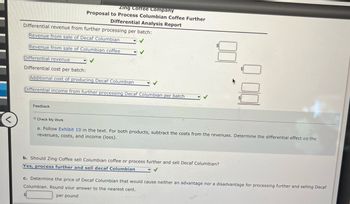

Transcribed Image Text:Zing Coffee Company

Proposal to Process Columbian Coffee Further

Differential Analysis Report

Differential revenue from further processing per batch:

Revenue from sale of Decaf Columbian

Revenue from sale of Columbian coffee

Differential revenue

Differential cost per batch:

Additional cost of producing Decaf Columbian

Differential income from further processing Decaf Columbian per batch

Feedback

Check My Work

a. Follow Exhibit 10 in the text. For both products, subtract the costs from the revenues. Determine the differential effect on the

revenues, costs, and income (loss).

b. Should Zing Coffee sell Columbian coffee or process further and sell Decaf Columbian?

Yes, process further and sell decaf Columbian

c. Determine the price of Decaf Columbian that would cause neither an advantage nor a disadvantage for processing further and selling Decaf

Columbian. Round your answer to the nearest cent.

per pound

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Define 'Decision making':

VIEW Step 2: (a) Prepare a differential analysis report for the decision to sell or process further:

VIEW Step 3: (b) Provide recommendation on further processing:

VIEW Step 4: (c) Determine the price of Decaf Columbian that would cause neither an advantage or disadvantage:

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Diamond Brands manufactures rice, wheat, and oat cereals. Sanders Company has approached Diamond Brands with a proposal to sell the company the rice cereals at a price of $22,000 for 20,000 pounds. The following costs are associated with production of 20,000 pounds of rice cereal: Direct material $13,000 Direct labor 5,000 Manufacturing overhead 7,000 Total $25,000 The manufacturing overhead consists of $5,000 of variable costs with the balance being allocated to fixed costs. What is the amount of avoidable costs if Diamond Brands buys rather than makes the rice cereal? $25,000 $23,000 $21,000 $20,000 $22,000arrow_forwardStinehelfer Beet Processors, Inc., processes sugar beets in batches. A batch of sugar beets costs $56 to buy from farmers and $13 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $24 or processed further for $12 to make the end product industrial fiber that is sold for $31. The beet juice can be sold as is for $43 or processed further for $29 to make the end product refined sugar that is sold for $91. What is the financial advantage (disadvantage) for the company from processing the intermediate product beet juice into refined sugar rather than selling it as is? Multiple Choicearrow_forward8.)arrow_forward

- Truly Delicious Inc. produces chocolate bars. The primary materials used in producing chocolate bars are cocoa, sugar, and milk. The standard costs for a batch of chocolate (1,457 bars) are as follows: Ingredient Quantity Price Cocoa 420 lbs. $0.30 per lb. Sugar 120 lbs. $0.60 per lb. Milk 90 gal. $1.20 per gal. Determine the standard direct materials cost per bar of chocolate. Round to two decimal places.fill in the blank 1 of 1$ per bararrow_forwardCome-Clean Corporation produces a variety of cleaning compounds including Grit 337 and Sparkle silver polish. Grit 337 is a coarse cleaning powder that costs $1.20 a pound to make and sells for $7.00 a pound. A small portion of Grit 337 is combined with several other ingredients and further processed into Sparkle silver polish. The silver polish sells for $5.00 per jar. This further processing requires one-fourth pound of Grit 337 per jar of silver polish. The additional variable manufacturing costs per jar of silver polish are: Other ingredients Direct labor Additional variable manufacturing cost Overhead costs associated with processing the silver polish are: Variable manufacturing overhead cost Fixed manufacturing overhead cost (per month) Production supervisor Depreciation of mixing equipment The production supervisor has no duties other than overseeing production of the silver polish. The mixing equipment is special- purpose equipment acquired specifically to produce the silver…arrow_forwardWexpro, Incorporated, produces several products from processing 1 ton of clypton, a rare mineral. Material and processing costs total $71,000 per ton, one-fourth of which is allocated to product X15. Six thousand five hundred units of product X15 are produced from each ton of clypton. The units can either be sold at the split-off point for $17 each, or processed further at a total cost of $8,800 and then sold for $22 each. Required: 1. What is the financial advantage (disadvantage) of further processing product X15? 2. Should product X15 be processed further or sold at the split-off point? 1. 2. Product X15 should bearrow_forward

- Your Corporation processes sugar beets in batches. A batch of sugar beets costs $625 to buy from farmers and $275 to crush in the company's plant. Two intermediate products, beet fiber (750 units) and beet juice (250 units), emerge from the crushing process. The beet fiber can be sold as is for $20 or processed further for $18 to make the end product industrial fiber that is sold for $45. The beet juice can be sold as is for $42 or processed further for $24 to make the end product refined sugar that is sold for $62. How much more profit (loss) does the company make by processing one batch of sugar beets into the end products industrial fiber and refined sugar? Group of answer choices $3,975 $6,000 $4,250 ($4,250) $5,250arrow_forwardBoney Corporation processes sugar beets that it purchases from farmers. Sugar beets are processed in batches. A batch of sugar beets costs $53 to buy from farmers and $18 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $25 or processed further for $18 to make the end product industrial fiber that is sold for $39. The beet juice can be sold as is for $32 or processed further for $28 to make the end product refined sugar that is sold for $79. What is the financial advantage (disadvantage) for the company from processing the intermediate product beet juice into refined sugar rather than selling it as is?arrow_forwardPlease answer in text form without imagearrow_forward

- Wilkin Fruit Drink Company planned to make 400,000 containers of apple juice. It expected to use two cups of frozen apple concentrate to make each container of juice, thus using 800,000 cups (400,000 containers x 2 cups) of frozen concentrate. The standard price of one cup of apple concentrate is $0.25. Actually, Wilkin produced 404,000 containers of apple juice and purchased and used 820,000 cups of concentrate at $0.26 per cup. Required a. Complete the spreadsheet template to calculate price and usage variances. Spreadsheet Tips 2. The cells that label the variances as F or U (favorable (F) or unfavorable (U)) are based on a function called IF. The IF function is needed because the variance can be either favorable or unfavorable. The formula must determine whether actual expenditures exceed budgeted expenditures to determine whether the variance is unfavorable or favorable. As an example, the formula in cell D22 is =IF(B21>E21,"U","F"). The formula evaluates the expression B21>E21.…arrow_forwardCome-Clean Corporation produces a variety of cleaning compounds including Grit 337 and Sparkle silver polish. Grit 337 is a coarse cleaning powder that costs $1.20 a pound to make and sells for $7.40 a pound. A small portion of Grit 337 is combined with several other ingredients and further processed into Sparkle silver polish. The silver polish sells for $5.00 per jar. This further processing requires one-fourth pound of Grit 337 per jar of silver polish. The additional variable manufacturing costs per jar of silver polish are: Other ingredients $ 0.60 Direct labor 1.44 Additional variable manufacturing cost $ 2.04 Overhead costs associated with processing the silver polish are: Variable manufacturing overhead cost 25 % of direct labor cost Fixed manufacturing overhead cost (per month) Production supervisor $ 3,200 Depreciation of mixing equipment $ 1,400 The production supervisor has no duties other than overseeing production of the silver polish. The…arrow_forwardBlazer Chemical produces and sells an ice-melting granular used on roadways and sidewalks in winter. It annually produces and sells 20,000 tons of its granular. Because of this year’s mild winter, projected demand for its product is only 15,000 tons. Based on projected production and sales of 15,000 tons, the company estimates the following income using absorption costing. Sales (15,000 tons at $80 per ton) $ 1,200,000 Cost of goods sold (15,000 tons at $60 per ton) 900,000 Gross profit 300,000 Selling and administrative expenses 300,000 Income $ 0 Its product cost per ton follows and consists mainly of fixed overhead because its automated production process uses expensive equipment. Direct materials $ 13 per ton Direct labor $ 4 per ton Variable overhead $ 3 per ton Fixed overhead ($600,000/15,000 tons) $ 40 per ton Selling and administrative expenses consist of variable selling and administrative expenses of $6 per ton and fixed selling and administrative…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education