FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

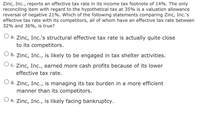

Transcribed Image Text:Zinc, Inc., reports an effective tax rate in its income tax footnote of 14%. The only

reconciling item with regard to the hypothetical tax at 35% is a valuation allowance

reversal of negative 21%. Which of the following statements comparing Zinc, Inc.'s

effective tax rate with its competitors, all of whom have an effective tax rate between

32% and 36%, is true?

O a. Zinc, Inc.'s structural effective tax rate is actually quite close

to its competitors.

O b. Zinc, Inc., is likely to be engaged in tax shelter activities.

O c. Zinc, Inc., earned more cash profits because of its lower

effective tax rate.

O d. Zinc, Inc., is managing its tax burden in a more efficient

manner than its competitors.

O e. Zinc, Inc., is likely facing bankruptcy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lantos Company had a 20 percent tax rate. Given the following pretax amounts, what would be the income tax expense reported on the face of the income statement? Sales revenue Cost of goods sold Salaries and wages expense Depreciation expense Dividend revenue Utilities expense Discontinued operations loss Interest expense $1,000,000 600,000 80,000 110,000 90,000 10,000 100,000 20,000 Example of Answer: 4000 (No comma, space, decimal point, or $ sign)arrow_forward(Corporate income tax) G. R. Edwin Inc. had sales of $5.99 million during the past year. The cost of goods sold amounted to $2.9 million. Operating expenses totaled $2.56 million, and interest expense was $21,000. Use the corporate tax rates shown in the popup window, to determine the firm's tax liability. What are the firm's average and marginal tax rates? The firm's tax liability for the year is $. (Round to the nearest dollar.) The firm's average tax rate is %. (Round to two decimal places.) The firm's marginal tax rate is %. (Round to the nearest integer.) 2 W S X mmand 3 20 E D $ 4 C DOO DDD F4 R F % 5 V FS T G 6 B MacBook Air F6 Y & 7 Data table H Over $18,333,333 35% (Click on the icon in order to copy its contents into a spreadsheet) 44 F7 U N Taxable Income $0-$50,000 $50,001-$75,000 $75,001-$100,000 $100,001-$335,000 39% $335.001-$10.000.000 34% $10,000,001-$15,000,000 35% $15,000,001-$18,333,333 38% * 8 J DII 76 - Print 1 M 9 K DE Marginal Tax Rate 15% 25% MOSISO 19 O Done 1…arrow_forwardAssume that The Bell Company operates in an industry for which NOL carryback is allowed. The Bell Company had the following operating results: Year Income (loss) Tax rate Income tax 2018 40,000 25 % 10,000 2019 40,000 25 % 10,000 2020 50,000 30 % 15,000 2021 (130,000 ) 30 % 0 What is the Deferred tax Asset in 2021?arrow_forward

- Do not give image formatarrow_forward2marrow_forward2. Table is given below shows that marginal tax rates for Alejandro Corporation. Taxable Income of the Company is equal to $44.000. How much will the Company pay tax totally? Average tax rate? (15p) NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS. Taxable Income ($) Tax Rate 0 – 16.000 10% 16.000 – 39.000 12% 39.000 – 55.000 16% 55.000 – 70.000 19% 70.000 – 86.000 23%arrow_forward

- 2. Table is given below shows that marginal tax rates for Alejandro Corporation. Taxable Income of the Company is equal to $44.000. How much will the Company pay tax totally? Average tax rate? ( NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS. Taxable Income ($) Tax Rate 0 - 16.000 10% 16.000 – 39.000 12% 39.000- 55.000 16% 55.000 - 70.000 19% 70.000 – 86.000 23%arrow_forwardJurisdiction B levies a flat 7 percent tax on the first $5 million of annual corporate income. Required: Jersey Incorporated generated $2.7 million income this year. Compute Jersey’s income tax and determine its average and marginal tax rate on total income. Leray Incorporated generated $7.4 million income this year. Compute Leray’s income tax and determine Leray’s average and marginal tax rate on total income. What type of rate structure does Jurisdiction B use for its corporate income tax?arrow_forwardMatador Company is preparing its 2022 financial statements. Matador's bookkeeper has determined Income from Continuing Operations (ICO) but is not certain this number is accurate. Matador has a corporate tax rate of 30%. Use the following information to determine the adjustments, if any, to ICO. (Hint: if you are adjusting ICO, should the adjustments be pre-tax or net of tax?) If you need to increase ICO, enter your answer as a positive number; for instance: 3000 If you need to decrease ICO, enter your answer as a negative number; for instance: -3000 If you determine no change is needed to ICO; enter 0. Put your answers in the provided boxes. 1) During 2022, Matador declared preferred dividends of $70,000, paid $90,000 for dividends, and received $135,000 for dividends on available-for-sale equity securities. The bookkeeper did not include any of these when calculating ICO. Determine the adjustment to ICO. Matador has a corporate tax rate of 30%. 2) Over the past 4 years, Matador has…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education