FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

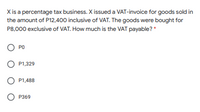

Transcribed Image Text:X is a percentage tax business. X issued a VAT-invoice for goods sold in

the amount of P12,400 inclusive of VAT. The goods were bought for

P8,000 exclusive of VAT. How much is the VAT payable? *

O PO

P1,329

O P1,488

О Р369

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- BC Inc made sales of $14,567 for Monday, December 8th. The sales tax is 7%. What is the dollar amount that would be credited to Sales Tax Payable? Group of answer choices 10196.9 1019.69 Sales Tax is included in the $14,567 Sales Tax Payable would not be creditedarrow_forwardH4. Accountarrow_forwardssume Pebble Inc. on October 15 purchased $4,000 of merchandise on credit. The next day, it recorded sales of $3,200; the cost of sales was $2,800. Q: Record the October 15 and October 16 entries. (Images attached for tax % reference) Alberta: 5% GST, 0% PST Saskatchewan: 5% GST, 6% PST BC: 5% GST, 7% PST Manitoba: 5% GST, 8% PST Quebec: 5% GST, 9.975% QST Ontario: 13% New Brunswick/PEI/Newfoundland/Labrador/Nova Scotia: 15%arrow_forward

- The following accounts of Rex Company are as follows: Sales P480,000; Cost of goods sold P300,000; Sales discounts P20,000; Sales returns and allowances P15,000; Purchase discounts P5,000; Purchase returns and allowances P7,000; Selling Expenses P40,000; General & Administrative expense P45,000; Interest income P5,000. What is the net income? P60,000 P65,000 P55,000 P180,000arrow_forwardB. Co an importer of merchandise for local sales had the following data on the importation: P2, 000,000 20, 000 30, 000 180, 000 40, 000 20, 000 Invoice cost Freight Insurance Customs duty Customs brokerage fees Processing fee Excise tax and other legitimate expenses of importation prior to removal from customs custody The customs duty was based on a dutiable value of the Importation (as determined by the Bureau of customs) of 90, 000 1, 800, 000 How much was the tax base of the value-added tax? How much was the value-added tax on importation?arrow_forwardSales Tax A sale of merchandise on account for $17,400 is subject to a 7% sales tax. (a) Should the sales tax be recorded at the time of sale or when payment is received? (b) What is the amount credited to sales?$ (c) What is the amount debited to Accounts Receivable? If required, round your answers to the nearest cent.$ (d) What is the account to which the $1,218.00 is credited?arrow_forward

- Please helparrow_forwardTt1.arrow_forwardqw.15. Transactions for July, 2022 Batch 1 July 2 Purchased $2,000 of Inventory on account, terms 1/20, n/45. (Tax rate:13%) July 7 Sold to Zoe Financial Company on credit terms 2/15, n/30 $3,000. (Tax rate:13%) Batch 2 July 15 Paid salaries for 2 employees: Luo Jie, $1,300 cheque #10 and Zheng Rui, $1,600 cheque #15 July 17 Paid for the July 2 purchase on cheque #20. Batch Number: 001 Batch Description: Transaction Batch #1 Entry Number: 001 Entry Description: Date: Period: Source: GL - Account Number Account Description Debit Credit Journal Entry Totals Entry Number: 002 Entry Description: Date: Period: Source: GL - Account Number Account Description Debit Credit Journal Entry Totals Batch Totals Batch Number: 002 Batch Description: Transaction Batch #2 Entry Number: 001 Entry Description: Date: Period: Source: GL - Account Number Account Description Debit Credit Journal Entry Totals Entry Number: 002 Entry Description:…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education