Concept explainers

Zhedong plans to use activity-based costing to determine its product costs. The total

|

Department Factory Overhead Production Support ¥1,225,000 Production (factory overhead only) 175,000 Total cost ¥1,400,000 |

Production Support Department Budgeted Activity Cost Setup ¥428,750 Production control 245,000 Quality control 183,750 Materials management 367,500 Total ¥1,225,000 |

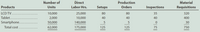

And, Zhedong estimated the following activity-base usage and units produced for each of its three products:(image below)

Instructions

1. Determine the factory overhead cost per unit for the LCD TV, tablet, and smartphone under the single plantwide factory overhead rate method. Use direct labor hours as the activity base.

2. Determine the factory overhead cost per unit for the LCD TV, tablet, and smartphone under activity-based costing. Round your answers to two decimal places.

3. Which method provides more accurate product costing? Why?

Step by stepSolved in 2 steps

- ABC Company uses activity-based costing to allocate MOH. The company has 2 products d and e. The annual production of sales of Product d are 1,000 units and product e is 3000 units. There are three activity cost pool of MOH with an estimated total cost of $69,000. What is the MOH cost per unit for product d under activity-based costing? Expected Activity (Allocation base) Total Activity Cost pool (for MOH) Activity 1 Activity 2 Activity 3 Estimated Cost of MOH Product d Product e $9000 500 500 1000 12000 200 200 500 48,000 500 1100 1600arrow_forwardAssume that company makes only two products: Product A and Product B. The company’s activity-based costing system has allocated $144,000 to an activity called machine setups. It is considering allocating the machine setups cost to its products using either the number of setups or setup hours as the activity measure. It gathered the following data with respect to these two potential activity measures: Product A Product B Number of machine setups 30 45 Number of setup hours per setup 6 6 If the company uses number of setup hours as the activity measure, what is the activity rate for machine setups? rev: 10_30_2021_QC_CS-283805 Garrison 17e Rechecks 2021-11-13 Multiple Choice $11,825 $12,000 $320 $350arrow_forwardNaples Corporation has provided the following data from its activity-based costing accounting system: Indirect factory wages $ 820,000 Factory equipment depreciation $ 410,000 Distribution of resource consumption across activity cost pools: Customer Orders Product Processing Other Total Indirect factor wages 50 % 40 % 10 % 100 % Factory equipment depreciation 10 % 70 % 20 % 100 % The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. How much indirect factory wages and factory equipment depreciation cost would be assigned to the Customer Orders activity cost pool?arrow_forward

- Kesterson Corporation has provided the following information: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Variable administrative expense Fixed selling and administrative expense Cost per Unit $ 6.30 $ 3.30 $ 1.25 $ 1.30 $ 0.60 Cost per Period $ 15,000 $ 4,200 If 7,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to:arrow_forwardHaresharrow_forwardA company uses activity-based costing to calculate the unit cost of its products. The figures for Period 3 are as follows: Production set-up costs: £84,000. Total production is 40,000 units of each of products A and B, and each run is 2,000 units of A or 5,000 units of B. What is the set-up cost per unit of B? A. £0.10 B. £0.08 C. £0.60 D. £0.29arrow_forward

- Savitaarrow_forwardKlumper Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders. Shipments Product sustaining Activity data have been supplied for the following two products: Total Expected Activity Activity Rates $ 7 per direct labor-hour $ 4 per machine-hour $50 per setup $ 170 per order $ 130 per shipment $ 800 per product Number of units produced per year Direct labor-hours Machine-hours Machine setups Production orders Shipments Product sustaining K425 200 1,075 2,200 11 11 22 2 M67 2,000 40 30 2 2 2 2 Required: How much total overhead cost would be assigned to K425 and M67 using the activity-based costing system?arrow_forwardA company has provided the following data from its activity-based costing accounting system: Indirect factory wages $552,000 Factory equipment depreciation $332,000 Distribution of Resource Consumption across Activity Cost Pools: 14 Activity Cost Pools Customer Product Orders Processing Other Total Indirect factory wages 55% 35% 10% 100% Factory equipment depreciation 30% 50% 20% 100% The "Other" activity cost pool consists of the costs of idle capacity and organization- sustaining costs, How much indirect factory wages and factory equipment depreciation cost would NOT be assigned to products using the activity-based costing system? Multiple Choice $552,000 $332.000 $121,600 $0arrow_forward

- Ivanhoe Inc. has conducted the following analysis related to its product lines using a traditional costing system (volume-based) and an activity-based costing system. Both the traditional and activity-based costing systems include direct materials and direct labour costs. Products Product 440X Product 137Y Product 249S (a) Sales Revenue $201,000 172,000 Operating income 87,000 Total Costs Traditional $55,000 74,000 26,000 Additional information related to product usage by these pools is as follows: ABC $50,036 70,668 34,296 For each product line, calculate operating income using the traditional costing system. Product 440X Traditional costing system $ Product 137Y $ Product 249Sarrow_forwardStargate Corporation has established the following standards for the costs of one unit of its product. The standard production overhead costs per unit are based on direct-labor hours. Calculation for standard per unit cost is as follows: Std Cost Std Qty Std Price/Rate Direct Material $ 14.40 6.00 kg $ 2.40 per kg Direct Labor $ 3.00 0.40 hour $ 7.50 per hour Variable Overhead $ 4.00 0.40 hour $ 10.0 per hour Fixed Overhead $ 4.80 0.40 hour $ 12.0 per hour Total $ 26.20 *based on practical capacity of 2,500 direct-labor hour per month During December 2020, Henry purchased 30,000 kg of direct material at a total cost of $75,000. The total wages for December were $20,000, 75% of which were for direct labor. Henry manufactured 4,500 units of product during December 2020, using 28,000kg of the direct material purchased in December and 2,100 direct-labor hours. Actual variable and fixed overhead cost were $23,100…arrow_forwardEdney Company employs a standard cost system for product costing. The per-unit standard cost of its product is: Raw materials Direct labor (2 direct labor hours x $8.00 per hour) Manufacturing overhead (2 direct labor hours x $12.20 per hour) $ 14.00 16.00 24.40 $ 54.40 Total standard cost per unit The manufacturing overhead rate is based on a normal capacity level of 600,000 direct labor hours. The firm has the following annual manufacturing overhead budget: Variable Fixed $ 3,960,000 3,360,000 $ 7,320,000 Edney incurred $434,550 in direct labor cost for 54,100 direct labor hours to manufacture 26,000 units in November. Other costs incurred in November include $296,000 for fixed manufacturing overhead and $342,000 for variable manufacturing overhead. Required: 1. Determine each of the following for November. [Note: Indicate whether each variance is favorable (F) or unfavorable (U).] a. The variable overhead rate (spending) variance. b. The variable overhead efficiency variance. c. The…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education