FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

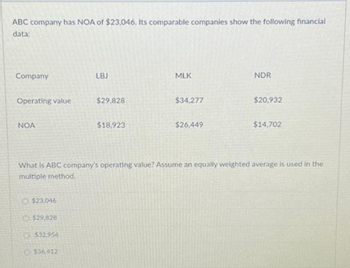

Transcribed Image Text:ABC company has NOA of $23,046. Its comparable companies show the following financial

data:

Company

Operating value

NOA

$23,046

$29,828

$32.956

LBJ

$36412

$29,828

$18,923

MLK

$34,277

$26,449

NDR

$20,932

What is ABC company's operating value? Assume an equally weighted average is used in the

multiple method.

$14,702

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Help with the chart belowarrow_forwardIf Roten Rooters, Inc., has an equity multiplier of 2.46, total asset turnover of 1.63, current ratio of 2.20, and profit margin of 11.6 percent, then its ROE is _______%. Round it to two decimal places.arrow_forwardPlease answer Required 13,14,15,16arrow_forward

- Spelman Corporation has Sales of $36,800, Depreciation Expense of $3,000, Interest Expense of $2,000, Cost of Goods Sold of $15,000, other costs of $7,800, and an average tax rate of 34 percent. What is the firm's profit margin? Please record your answer using the following format (12.54). Record your answer to two decimal places. While the answer should be given as a percentage, do NOT place a "%" directly after the number. Do not type the parentheses: just type the number!arrow_forwardSDJ, Inc., has net working capital of $1,175, current liabilities of $6,981, and inventory of $1,092. What is the current ratio?arrow_forwardSanedrin Company has an earnings per share (EPS) of $4.50, a value per share of $45 and a market value of $38. Calculate the price/earnings ratio (P/E).arrow_forward

- Book rences Required: a. Firm D has net income of $64,296, sales of $1,368,000, and average total assets of $760,000. Calculate the firm's margin, turnover, and ROI. b. Firm E has net income of $120,218, sales of $1,939,000, and ROI of 8.68%. Calculate the firm's turnover and average total assets. c. Firm F has ROI of 12.40%, average total assets of $1,540,000, and turnover of 0.8. Calculate the firm's sales, margin, and net income. Complete this question by entering your answers in the tabs below. Required A Required B Required C Firm D has net income of $64,296, sales of $1,368,000, and average total assets of $760,000. Calculate the firm's margin, turnover, and ROI. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Margin Turnover ROI % % Required B >arrow_forwardHow do I solve this?arrow_forwardRogers, Incorporated, has an equity multiplier of 1.44, total asset turnover of 1.73, and a profit margin of 11 percent. What is the company's ROE? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forward

- Ace Industries has current assets equal to $10 million. The company's current ratio is 2.0, and its quick ratio is 1.5. What is the firm's level of current liabilities? What is the firm's level of inventories? Do not round intermediate calculations. Round your answers to the nearest dollar. Current liabilities: $ Inventories: $arrow_forwardCompare the Solvency, Liquidity and Profitability for the two companiesarrow_forwardSoCal Edison reported the following data for operating revenue and net income for 2001 through 2005. Year Operating Revenue (Millions), X Net Income (Millions), Y 2001 2270 96.9 2002 1482 89.1 2003 2138 103.9 2004 2260 81.6 2005 2600 78.1 Using Excel, determine the least-squares regression line and interpret its slope. Estimate the net income if the operating revenue figure is $2500 million.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education