FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:Prepare a comparative income statement for 20X2 and 20X1 using vertical analysis, and|

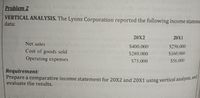

Problem 2

VERTICAL ANALYSIS. The Lyons Corporation reported the following income stateme

data:

20X2

20X1

Net sales

$400.000

$250.000

Cost of goods sold

$280.000

S160.000

Operating expenses

S75.000

$56.000

Requirement:

Prepare a comparative income statement for 20X2 and 20X1 using vertical analysis, ana

evaluate the results.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vertical Analysis Income statement information for Einsworth Corporation follows: Sales $230,000 Cost of goods sold 75,900 Gross profit 154,100 Prepare a vertical analysis of the income statement for Einsworth Corporation. If required, round percentage answers to the nearest whole number. Einsworth Corporation Vertical Analysis of the Income Statement Amount Percentage Sales $230,000 fill in the blank 1% Cost of goods sold 75,900 fill in the blank 2 Gross profit $154,100 fill in the blank 3%arrow_forwardYou are given financial statements and a Dupont analysis for Tesco and Ahold. What do you conclude about the two companies’ performances based on these numbers?arrow_forwardVertical Analysis Income statement information for Einsworth Corporation follows: Sales Cost of goods sold Gross profit $298,000 104,300 193,700 Prepare a vertical analysis of the income statement for Einsworth Corporation. If required, round percentage answers to the nearest whole number. Einsworth Corporation Vertical Analysis of the Income Statement Amount Percentage Sales $298,000 Cost of goods sold 104,300 Gross profit $193,700 % %arrow_forward

- Profit Margin, Investment Turnover, and ROI Cash Company has income from operations of $49,896, invested assets of $198,000, and sales of $712,800. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin fill in the blank 1% b. Investment turnover fill in the blank 2 c. Return on investment fill in the blank 3%arrow_forwardIncome statement information for Einsworth Corporation follows: Sales $586,000 Cost of goods sold 181, 660 Gross profit 404, 340 Prepare a vertical analysis of the income statement for Einsworth Corporation. If required, round percentage answers to the nearest whole number. blank Einsworth Corporation Vertical Analysis of the Income Statement Amount Percentage Sales $586, 000 fill in the blank 1 % Cost of goods sold 181, 660 fill in the blank 2 Gross profit $404, 340 fill in the blank 3 %arrow_forwardCopr. Goedl Uplift, Inc. reported the following financial data for the segmented income statements: Sales $125,000 Variable expenses $63,000 Contribution margin $62,000 Total fixed expenses $42,000 Common fixed expenses $15,000 How much are traceable fixed expenses? $83,000 $20,000 $48,000 $27,000 SUBMIT B 4 5 LO 5arrow_forward

- Cochran corporation, Inc. has the following income statement: Cochran corporation, Inc. Income statement For the year ended December 31, 2021 net sales $240 Cost of goods sold $150 gross profit $90 Operating expenses $65 Net income $25 Using vertical analysis, what percentage is assigned to operating expenses? a. 27,1% b. 43.3% c. 72.2% d. 260.0%arrow_forwardQuestion: Vertical Analysis of the Income statement Company A Company B Net sales 2,300,000 300,000 Cost of goods sold 1,100,000 200,000 Gross profit 1,200,000 100,000 Operating Expenses: Administrative expenses 120,000 20,000 Marketing expenses 220,000 30,000 Research and Development 500,000 10,000 Total Operating expenses 840,000 60,000 Interest expense 200,000 10,000 Net income 160,000 30,000 Required: Prepare a vertical analysis of these two companies. Compare and contrast the financial situation of these two companies assuming that they are in the same industry. Discuss fully.arrow_forwardNeed help with Operating income. What is the formula using the data in the pictures.arrow_forward

- Edison Company reported the following for the current year: $ 84,000 59,000 21,080 63,000 77,080 Net sales Cost of goods sold Net income Beginning balance of total assets Ending balance of total assets Compute (a) profit margin and (b) return on total assets. Complete this question by entering your answers in the tabs below. Profit Margin Ratio Compute the return on total assets. Return On Total Assets Numerator: 7 7 7 Return On Total Assets Denominator: = Return On Total Assets Return on total assets II =arrow_forwardSubject: acountingarrow_forwardProfit Margin, Investment Turnover, and ROI Cash Company has income from operations of $19,754, invested assets of $83,000, and sales of $282,200. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin fill in the blank 1% b. Investment turnover fill in the blank 2 c. Return on investment fill in the blank 3%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education