Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

What is the sales volume variance for total revenue on these accounting question?

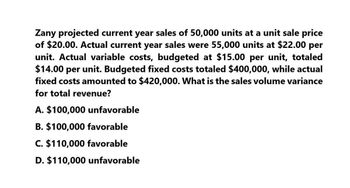

Transcribed Image Text:Zany projected current year sales of 50,000 units at a unit sale price

of $20.00. Actual current year sales were 55,000 units at $22.00 per

unit. Actual variable costs, budgeted at $15.00 per unit, totaled

$14.00 per unit. Budgeted fixed costs totaled $400,000, while actual

fixed costs amounted to $420,000. What is the sales volume variance

for total revenue?

A. $100,000 unfavorable

B. $100,000 favorable

C. $110,000 favorable

D. $110,000 unfavorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Lowell Manufacturing Inc. has a normal selling price of 20 per unit and has been selling 125,000 units per month. In November, Lowell Manufacturing decided to lower its price to 19 per unit expecting it can increase the units sold by 16%. a. Compute the normal revenue with a 20 selling price. b. Compute the planned revenue with a 19 selling price. c. Compute the actual revenue for November, assuming 135,000 units were sold in November at 19 per unit. d. Compute the revenue price variance, assuming 135,000 units were sold in November at 19 per unit. e. Compute the revenue volume variance, assuming 135,000 units were sold in November at 19 per unit. f. Analyze and interpret the lowering of the price to 19.arrow_forwardTaylor Corporation is analyzing the cost behavior of three cost items, A, B, and C, to budget for the upcoming year. Past trends have indicated the following dollars were spent at three different levels of output: In establishing a budget for 14,000 units, Taylor should treat A, B, and C costs as: a. semivariable, fixed, and variable, respectively. b. variable, fixed, and variable, respectively. c. semivariable, semivariable, and semivariable, respectively. d. variable, semivariable, and semivariable, respectively.arrow_forwardThe production cost for UV protective sunglasses is $5.50 per unit and fixed costs are $19,400 per month. How much is the favorable or unfavorable variance if 14,000 units were produced for a total of $97,000?arrow_forward

- Please given correct answer general accountingarrow_forwardMarathon Sports Equipment Company projected sales of 79,000 units at a unit sales price of $12 for the year. Actual sales for the year were 74,000 units at $14 per unit. Variable costs were budgeted at $3 per unit, and the actual amount was $6 per unit. Budgeted fixed costs totaled $377,000, while actual fixed costs amounted to $415,000. What is the sales volume variance for total revenue? ..... O A. $88,000 favorable O B. $60,000 favorable O C. $60,000 unfavorable O D. $88,000 unfavorablearrow_forwardTop managers of Rouse Industries predicted 2025 sales of 14,900 units of its product at a unit price of $10.00. Actual sales for the year were 14,000 units at $13.00 each Variable costs were budgeted at $3.60 per unit, and actual variable costs were $3.70 per unit Actual fixed costs of $49,000 exceeded budgeted fixed costs by $2,500. Prepare Rouse Industries' flexible budget performance report. What variance contributed most to the year's favorable results? What caused this variance? Prepare a flexible budget performance report for the year. First, complete the flexible budget performance report through the contribution margin line, then complete the report through the operating income line. Finally, compute the total variances (Enter a 0 for any zero balances. Label the variance as favorable (F) or unfavorable (U), in the input field after the amount you enter For any $0 variances, leave the Favorable (F)/Unfavorable (U) input field blank.) Units Sales Revenue Variable Costs…arrow_forward

- Top managers of Root Industries predicted 2025 sales of 14,500 units of its product at a unit price of $9.50. Actual sales for the year were 14,300 units at $11.00 each. Variable costs were budgeted at $3.40 per unit, and actual variable costs were $3.50 per unit. Actual fixed costs of $44,000 exceeded budgeted fixed costs by $5,000 Prepare Root Industries' flexible budget performance report. What variance contributed most to the year's favorable results? What caused this variance? Prepare a flexible budget performance report for the year. First, complete the flexible budget performance report through the contribution margin line, then complete the report through the operating income line. Finally, compute the total variances. (Enter a 0 for any zero balances. Label the variance as favorable (F) or unfavorable (U), in the input field after the amount you enter. For any $0 variances, leave the Favorable (F)Unfavorable (U) input field blank.) Units Sales Revenue Variable Costs…arrow_forwardTop managers of White Industries predicted 2024 sales of 14,700 units of its product at a unit price of $8.00. Actual sales for the year were 14,000 units at $10.50 each Variable costs were budgeted at $2.40 per unit, and actual variable costs were $2.50 per unit. Actual fixed costs of $47,000 exceeded budgeted fixed coats by $5,200. Prepare White's flexible budget performance report. What variance contributed most to the year's favorable results? What caused this variance? Prepare a flexible budget performance report for the year, First, complete the flexible budget performance report through the contribution margin line, then complete the report through the operating income line. Finally, compute the total variances. (Enter a "0" for any zero balances. For any 50 variances, leave the Favorable (FyUnfavorable (U) input blank) Units Sales Revenue Vanable Costs Contribution Margin Budget Amounts Per Unit White Industries Flexible Budget Performance Report For the Year Ended December 31,…arrow_forwardBased on a predicted level of production and sales of 22,000 units, a company anticipates total variable costs of $99,000, fixed costs of $30,000, and operating income of $36,000. Based on this information, the budgeted amount of sales for 20,000 units would be: O $165,000. O $141,900. O $150,000. O $181.500. O $117.272.arrow_forward

- Midnight Sun Outfitters projected sales of 76,000 units for the year at a unit sales price of $12.00. Actual sales for the year were 72,000 units at $15.00 per unit. Variable costs were budgeted at $4.50 per unit, and the actual variable cost was $4.75 per unit. Budgeted fixed costs totaled $378,000, while actual fixed costs amounted to $410,000. What is the sales volume variance for operating income? Group of answer choices $30,000 favorable $166,000 unfavorable $30,000 unfavorable $136,000 unfavorablearrow_forwardTop managers of Cole Industries predicted 2018 sales of 14,600 units of its product at a unit price of $7.00. Actual sales for the year were 14,000 units at $10.50 each. Variable costs were budgeted at $2.60 per unit, and actual variable costs were $2.70 per unit. Actual fixed costs of $43,000 exceeded budgeted fixed costs by $4,500. Prepare Cole's flexible budget performance report. What variance contributed most to the year's favorable results? What caused this variance? Prepare a flexible budget performance report for the year. First, complete the flexible budget performance report through the contribution margin line, then complete the report through the operating income line. Finally, compute the total variances. (Enter a "0" for any zero balances. For any $0 variances, leave the Favorable (F)/Unfavorable (U) input blank.) Cole Industries Flexible Budget Performance Report For the Year Ended December 31, 2018 1 2 3 4 5…arrow_forwardBhaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College