FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

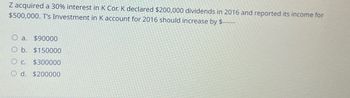

Transcribed Image Text:Z acquired a 30% interest in K Cor. K declared $200,000 dividends in 2016 and reported its income for

$500,000. T's Investment in K account for 2016 should increase by $----

O a.

$90000

O b. $150000

Oc

$300000

Od. $200000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 10. Help me selecting the right answer. Thank youarrow_forwardChico Pop Co. stock price and dividend history are as follows: Year Beginning of year price 2014 $100 $110 $90 $95 2015 2016 2017 1.37% An investor buys three shares of Chico Pop at the beginning of 2014, buys another two shares at the beginning of 2015, sells one share at the beginning of 2016, and sells all four remaining shares at the beginning of 2017. What is the dollar-weighted average return for this investor? O 2.18% -1.07% Dividend paid at year end $2 O -2% $3 $4 $5arrow_forward1. Initial Value Method vs Equity Method (Spring 2015 Midterm) On January 1, 2012, Franel Co. acquired all of the common stock of Hurlem Corp. For 2012, Hurlem earned net income of $360, 000 and paid dividends of $190,000. Amortization of the patent allocation that was included in the acquisition was $6,000. How much difference would there have been in Franels income with regards to the effect of the investment, between using the equity method or using the initial value method of internal recordkeeping?arrow_forward

- Crane Inc. earns $400000 and pays cash dividends of $100000 during 2020. Blossom Corporation owns 60000 of the 200000 outstanding shares of Crane Inc.How much revenue from investment should Blossom report in 2020? $30000 $150000 $90000 $120000arrow_forwardVipul k Don't upload any image pleasearrow_forwardM6arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education