FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

10. Help me selecting the right answer. Thank you

Transcribed Image Text:**Accounting Journal Entries for Equity Method**

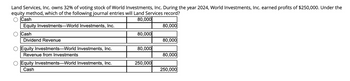

Land Services, Inc. owns 32% of the voting stock of World Investments, Inc. During the year 2024, World Investments, Inc. earned profits of $250,000. Using the equity method, which of the following journal entries should Land Services record?

1. **Option A**

- Debit: Cash $80,000

- Credit: Equity Investments—World Investments, Inc. $80,000

2. **Option B**

- Debit: Cash $80,000

- Credit: Dividend Revenue $80,000

3. **Option C**

- Debit: Equity Investments—World Investments, Inc. $80,000

- Credit: Revenue from Investments $80,000

4. **Option D**

- Debit: Equity Investments—World Investments, Inc. $250,000

- Credit: Cash $250,000

**Explanation of Correct Entry:**

- When using the equity method, the investor recognizes a share of the investee’s profits. Since Land Services owns 32%, they would recognize 32% of $250,000 in profits, which is $80,000. The correct entry would involve increasing the investment account by this amount, signifying an increase in ownership equity resulting from the investee's profits. There is no cash exchange involved directly in recording this share of profits.

**Analysis:**

- **Option A** incorrectly suggests exchanging cash for an increase in the investment account, rather than recognizing the earnings.

- **Option B** treats the earnings as dividend revenue, which is not consistent with the equity method.

- **Option C** correctly represents the increase in the investment account.

- **Option D** reflects an incorrect transaction as it suggests a cash transaction for the entire profit, which does not occur under the equity method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education