FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Answer is d. Unrealized gain of $25,000

Please explain the reasoning and calculations

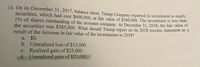

Transcribed Image Text:14. On its December 31, 2017, balance sheet, Trump Company reported its investment in equity

securities, which had cost $600,000, at fair value of $560,000. The investment is less than

1% of shares outstanding of the investee company. At December 31, 2018, the fair value of

the securities was $585,000. What should Trump report on its 2018 income statement as a

result of the increase in fair value of the investments in 2018?

a. $0.

b. Unrealized loss of $15,000.

c. Realized gain of $25,000.

d. Unrealized gain of $25,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the present worth (P) of all the cash flows if F=16000, n=6 years, and i= 8% per year? Select one: O a. $16,480.00 b. $103,824.00 O c. $10,082.71 O d. $34,608.00arrow_forwardPlease provide correct solutionarrow_forwardCash Flow Asset End of year Amount Appropriate Required Return D 1 through 5 $1,500 12% 6 $8,500 By using cell references to the given datea and the function PV, Calculate the value of asset D.arrow_forward

- Compute the IRR statistic for Project E. The appropriate cost of capital is 8 percent. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project E Time: 0 1 2 3 4 5 Cash flow −$1,300 $470 $570 $580 $360 $160 IRR?arrow_forwardBalloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1) (Use appropriate factor(s) from the tables provided.) Initial investnent (for tvo hot air balloons) Useful life Salvage value Annual net income generated BBS'a cost of capital $ 340,000 6 yeara $ 48,000 29,920 124 Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of return. (Round your answer to 2 decimal places.) 2. Payback period. (Round your answer to 2 decimal places.) 3. Net present value (NPV). (Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar.) 4. Recalculate the NPV assuming BBS's cost of capital is 15 percent.…arrow_forward2. Compute the IRR for the investment represented by the following cash flow table: Year 1 4 6. 7. Cash Flow -1200 +350 +300 +250 +200 +150 +100 +50 (in $1000's)arrow_forward

- Present value: Mixed streams Consider the mixed streams of cash flows shown in the following table, a. Find the present value of each stream using a 5% discount rate. b. Compare the calculated present values and discuss them in light of the undiscounted cash flows totaling $70,000 in each case. Is there some discount rate at which the present values of the two streams would be equal? a. The present value of the cash flows of stream A is $. (Round to the nearest dollar.) ←arrow_forwardSubject: acountingarrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education