FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

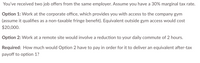

Transcribed Image Text:You've received two job offers from the same employer. Assume you have a 30% marginal tax rate.

Option 1: Work at the corporate office, which provides you with access to the company gym

(assume it qualifies as a non-taxable fringe benefit). Equivalent outside gym access would cost

$20,000.

Option 2: Work at a remote site would involve a reduction to your daily commute of 2 hours.

Required: How much would Option 2 have to pay in order for it to deliver an equivalent after-tax

payoff to option 1?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You own and manage a yard care business in which you charge $50 per visit to care for each yard (your revenue). Your labor, fuel, and other variable costs are 31.1% of revenue, and you have $60,000 in fixed costs. How many visits to care for yards must you perform in a year to break even?arrow_forwardYou run a nail salon. Fixed monthly cost is $5,102.00 for rent and utilities, $5,992.00 is spent in salaries and $1,613.00 in insurance. Also every customer requires approximately $3.00 in supplies. You charge $90.00 on average for each service. You are considering moving the salon to an upscale neighborhood where the rent and utilities will increase to $11,786.00, salaries to $6,735.00 and insurance to $2,228.00 per month. Cost of supplies will increase to $7.00 per service. However you can now charge $167.00 per service. What is the PROFIT or Loss at the crossover point? If a loss include the - Round the quantity to 3 digits when using to calculate the profit Submit Answer format: Number: Round to: 2 decimal places.arrow_forwardif i work for $8.75 an hour for 10 hours a week and the new cars cost is $436, how many weeks including tax would i have to work to meet this goalarrow_forward

- You are currently a worker earning $60,000 per year but are considering becoming an entrepreneur. You will not switch unless you earn an accounting profit that is on average at least as great as your current salary. You look into opening a small grocery store. Suppose that the store has annual costs of $150,000 for labor, $50,000 for rent, and $30,000 for equipment. There is a one-half probability that revenues will be $210,000 and a one-half probability that revenues will be $400,000. Instructions: Enter your answers as a whole number. If you are entering any negative numbers be sure to include a negative sign (−) in front of those numbers. Enter a loss as a negative number. a. In the low-revenue situation, what will your accounting profit or loss be? $ What will your accounting profit or loss be in the high-revenue situation? $ b. On average, how much do you expect your revenue to be? $ Your accounting profit? $ Your economic profit? $…arrow_forwardcan u help mearrow_forwardYou are the manager of a rental car company. A customer, Sandy Furrow, has asked you for an estimate of charges for a nine day rental of an SUV. She expects to drive 670 miles. If the company charges $52.50 per day plus 17 1/2 cents per mile for this category of vehicle, what would be the total rental charge (in $) for Sandy's trip?arrow_forward

- i need answer urgentarrow_forwardGiven the following scenario- Office building, 3 stories, 3000 square feet (SF) gross interior floor space each, 2 tenants per floor, 1 350 sf of the building is used for hallways, common bathrooms, stairs, elevator, and lobby. The owner wants a gross rent of $135,000 per year. (First, establish the Load Factor) What is the rent that the Owner should charge per square foot? If Tenant Z rents 1200 sf of usable area, what will be his monthly rent? If the building has an operating expense ratio of 28% of gross rents, including vacancy and reserves, what is the Net Operating Income? The sale price at a 9% CAP rate?arrow_forwardSuppose you have a job that pays a monthly salary of (g) $_3,900____.Unfortunately, recent events have significantly reduced your company’s cash flow.Your employer says that everyone needs to take a 6.5% pay cut or the company mayhave to close.(a) When the 6.5% pay cut is applied to your original monthly salary, by how many dollars will your monthly pay decrease? Round your result to the nearest cent. (4) (b) What will your reduced monthly salary be after the 6.5% decrease is applied to your original monthly salary? Round your result to the nearest cent. (3) Your employer promises that when business returns to normal, everyone will get a6.5% pay raise to bring their pay back to their original levels.(c) When the 6.5% pay raise is applied to your reduced monthly salary, by how many dollars will your monthly pay increase? Round your result to the nearest cent. (4) (d) What will your new increased monthly salary be after the 6.5% increase is applied to your reduced monthly salary? Round…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education