FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

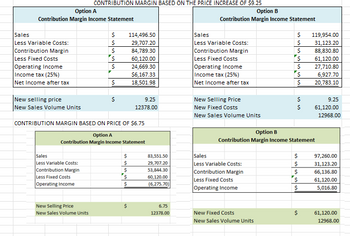

Lorenzo, the owner of a local poster shop, comes to you for help. While his shop has been breaking even for the past two years, it has not been able to generate a profit. For him to keep the shop open, he needs to earn at least $12,000 in operating income next year.

Review the contribution margin income statements for Lorenzo's shop and find the following:

1)Explain the benefits and advantages to the company for each scenario.

2)Explain the disadvantages to the company for each scenario.

Transcribed Image Text:Option A

Contribution Margin Income Statement

CONTRIBUTION MARGIN BASED ON THE PRICE INCREASE OF $9.25

Option B

Contribution Margin Income Statement

Sales

$

114,496.50

Sales

$

119,954.00

Less Variable Costs:

$

29,707.20

Less Variable Costs:

$

31,123.20

Contribution Margin

$

84,789.30

Contribution Margin

$

88,830.80

Less Fixed Costs

60,120.00

Less Fixed Costs

$

61,120.00

Operating Income

$

24,669.30

Operating Income

$

27,710.80

Income tax (25%)

$6,167.33

Income tax (25%)

$

6,927.70

Net Income after tax

$

18,501.98

Net Income after tax

$

20,783.10

New selling price

$

9.25

New Selling Price

$

9.25

New Sales Volume Units

12378.00

New Fixed Costs

$

61,120.00

New Sales Volume Units

12968.00

CONTRIBUTION MARGIN BASED ON PRICE OF $6.75

Option B

Option A

Contribution Margin Income Statement

Contribution Margin Income Statement

Sales

$

83,551.50

Sales

$

97,260.00

Less Variable Costs:

$

29,707.20

Less Variable Costs:

$

31,123.20

Contribution Margin

$

53,844.30

Contribution Margin

$

66,136.80

Less Fixed Costs

$

60,120.00

Less Fixed Costs

$

61,120.00

Operating Income

$

(6,275.70)

Operating Income

$

5,016.80

New Selling Price

$

New Sales Volume Units

6.75

12378.00

New Fixed Costs

New Sales Volume Units

es

61,120.00

12968.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Rerun the NPV analysis for Helen. Did she correctly determine a positive NPV related to her investment for this 8 year period? State the NPV amount. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardYou decide to earn extra money during your Engineering program by running an uber service. You purchase a car for $60,000, which you expect to sell for $18,000 at the end of the 6-year degree. You expect annual costs for insurance, maintenance and other expenses to total $7000 per year. You project to have approximately 20 customers per shift, who you will drive 8km on average. You plan on driving 80 days each year. What is the levelized cost per km of driving? MARR = 6%. The answer is within 5 cents of which of the following? Question 11 options: 1.00 1.10 1.20 1.30 None of the abovearrow_forwardKaren has been working with a small travel agency for the past few years to learn the business and to better understand what costs are necessary to run it. Now, having been in the business world for a few years, she's ready to start her own travel agency, specializing in "off the grid" locations. She knows there will be both overhead costs and labor costs, since she intends to hire one assistant. The following chart outlines her estimates thus far. Annual net operating cash flowsa Initial asset investment Asset life in years Salvage value of asset at end of useful life Tax rate (a) $3,800 $9,800 NPV $ 8 *After assistant and overhead costs, but does not include a salary for Karen. As a new business owner, Karen only expects to earn a 5% rate of return. She conducted an initial NPV anlaysis for an 8-year interval, recognizing that she'll make some significant adjustments after that point. Her initial analysis revealed a positive NPV. Click here to view the factor table Karen's…arrow_forward

- You have been offered two different jobs for the upcoming summer. Since both are full-time positions, you must choose to work only one of the jobs. The first job is in an office. The pay will be $320 per week. The office is located 20 miles from your home, so you estimate that you will spend $25 per week on gas. You will also have to pay $25 per week for parking. Because you are required to dress professionally, you will need to purchase some new clothes. You estimate that you will spend $350 on new clothes for this job during the summer. The second job is at an amusement park. The pay will be $220 per week. The amusement park is also 20 miles from your home, but you can carpool with a friend. Your share of the gas will be $12.50 per week. There is no charge for parking. The amusement park will furnish you with a uniform, so you won't need to buy any special clothes. Assuming that your summer break will allow you to work 12 weeks, which job will provide you with more money? Please…arrow_forwardLamphere Lawn Care provides lawn and gardening services. The price of the service is fixed at a flat rate for each service, and most costs of providing the service are the same, given the similarity in the lawns and lots. The owner budgets income by estimating two factors that fluctuate with the economy: the contribution margin associated with each service call and the number of customers who will request lawn service. Looking at next year, the owner develops the following estimates of contribution margin (price less variable cost of the service, including labor) and the estimated number of service calls. Although the owner understands that it is not strictly true, the owner assumes that the cost of fuel and the number of customers are independent. Contribution Margin per Service Call (Price - Scenario Excellent Fair Poor Excellent Fair Poor Excellent In addition to the variable costs of service, the owner estimates that other costs are $49,000 plus $8 for each service call in excess…arrow_forward--you live in the mobile home for four years, but your roommate also pays you $3,000 a year, paid to you at the beginning of each year. The cost of the mobile home is $15,000, paid immediately. At the end of four years, you can sell the mobile home for $9,000. You have no maintenance on the home because you were such a smart manager Using Present Value, what is the cost of your college housing (positive or negative), assuming an interest rate of 8%?arrow_forward

- A businessman bought a used building and found that the roof insulation was insufficient. He estimated that with 6 inches of foam insulation he could lower his heating bill by $25 a month and the cost of air conditioning by $20 a month. Assuming that the first six months of the year are winter and the next six are summer, how much can you afford to spend on insulation if you expect to have the building for only two years? Assume i=1 ½ % per month.arrow_forwardBilly Bob just paid cash for a run-down bed & breakfast in upstate New York. He plans to refurbish it and then start a heavy duty marketing campaign to bring in the tourists. Your task is to help him figure out how many rooms he has to rent each night to break even. Here are the key assumptions you will need to complete the analysis: -Billy Bob’s cost of just keeping the B & B open for business in $500.00 per day. (Rent and Utilities) -He has 10 rooms available to rent. -He calculates the variable cost of renting a room to be $20.00. (Maid Service, towel and sheet cleaning) -He figures he can rent a room for $125.00 per night. 1. Assuming he rents all 10 rooms, what is Billy-Bob's total fixed cost per day. (Remember fixed cost is the cost that doesn’t vary with sales or production.) 2. Assuming Billy Bob rents all 10 rooms, what is his variable cost for the day? (Remember variable costs changes with sales and production). 3. What is Billy Bob’s total cost for the day when he…arrow_forwardYou are a real estate agent thinking of placing a sign advertising your services at a local bus stop. Thesign will cost $4,300 and will be posted for one year. You expect that it will generate additionalrevenue of $817 a month. What is the payback period?arrow_forward

- Ernie Bilko has a business idea. He wants to rent an abandoned gas station for just the months of November and December. He will convert the gas station into a drive-through Christmas wrapping station. Customers will drive in, drop off their gifts, return the next day, and pick up their wrapped gifts. He needs $338,500 to rent the gas station, purchase wrapping paper, hire workers, and advertise. If he borrows this amount at 6 and 1/2% interest for those two months, what size lump sum payment will he have to make to pay off the loan? (Round your answer to the nearest cent.)arrow_forward(Consider This) Mason, a professional house painter, needs his tax return prepared; in which situation below would he choose to hire Madison, the CPA, rather than sacrifice time (and income) from house painting? The CPA can prepare the tax return in 2 hours and would charge $50 per hour, Mason would take 10 hours to prepare the tax return and sacrifice $15 per hour. The CPA can prepare the tax return in 10 hours and would charge $50 per hour, Mason would take 10 hours to prepare the tax return and sacrifice $15 per hour. The CPA can prepare the tax return in 2 hours and charge $100 per hour; Mason would take 10 hours to prepare the tax return and sacrifice $15 per hour. Mason would not hire Madison in any of these situations described.arrow_forwardPlease help me with c. Thanks!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education