Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

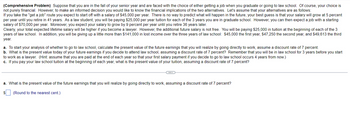

Transcribed Image Text:(Comprehensive Problem) Suppose that you are in the fall of your senior year and are faced with the choice of either getting a job when you graduate or going to law school. Of course, your choice is

not purely financial. However, to make an informed decision you would like to know the financial implications of the two alternatives. Let's assume that your alternatives are as follows:

If you take the "get a job" route you expect to start off with a salary of $45,000 per year. There is no way to predict what will happen in the future, your best guess is that your salary will grow at 5 percent

per year until you retire in 41 years. As a law student, you will be paying $25,000 per year tuition for each of the 3 years you are in graduate school. However, you can then expect a job with a starting

salary of $70,000 per year. Moreover, you expect your salary to grow by 9 percent per year until you retire 36 years later.

Clearly, your total expected lifetime salary will be higher if you become a lawyer. However, the additional future salary is not free. You will be paying $25,000 in tuition at the beginning of each of the 3

years of law school. In addition, you will be giving up a little more than $141,000 in lost income over the three years of law school: $45,000 the first year, $47,250 the second year, and $49,613 the third

year.

a. To start your analysis of whether to go to law school, calculate the present value of the future earnings that you will realize by going directly to work, assume a discount rate of 7 percent.

b. What is the present value today of your future earnings if you decide to attend law school, assuming a discount rate of 7 percent? Remember that you will be in law school for 3 years before you start

to work as a lawyer. (Hint: assume that you are paid at the end of each year so that your first salary payment if you decide to go to law school occurs 4 years from now.)

c. If you pay your law school tuition at the beginning of each year, what is the present value of your tuition, assuming a discount rate of 7 percent?

a. What is the present value of the future earnings that you will realize by going directly to work, assuming a discount rate of 7 percent?

$ (Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- A prospective MBA student earns $60,000 per year in her current job and expects that amount to increase by 13% per year. She is considering leaving her job to attend business school for two years at a cost of $40,000 per year. She has been told that her starting salary after business school is likely to be $130,000 and that amount will increase by 11% per year. Consider a time horizon of 10 years, use a discount rate of 9%, and ignore all considerations not explicitly mentioned here. Assume all cash flows occur at the start of each year (i.e., immediate, one year from now, two years from now,..., nine years from now). Also assume that the choice can be implemented immediately so that for the MBA alternative the current year is the first year of business school. What is the net present value of the more attractive choice? Please round your answer to the nearest dollar.arrow_forwardAs the owner of a small startup, you are faced with a fewmajor financial decisions concerning the expansion orpotential sale of your business. Based on the followingdetails, you must calculate the Present Value, Future Value,Loan Amortization and NPV/Firm Value.Present Value:You are required to have $250,000 seven years from nowfor new manufacturing equipment. Not sure how much youwill need to save as a lump-sum today, you calculate thepresent value (for the beginning of the period) with thefollowing additional details. Interest Rate of 6% with nofuture deposits.Future Value:To take advantage of the rising interest rate environmentthrough the actions of the Federal Reserve, you decide toinvest in U.S. Treasury Bills maturing in one year. Curious toknow what your investment will be worth one year fromtoday, you calculate the future value (for the end of theperiod) based on the following details. Number of period isone, interest rate is 5.25% (compounded monthly), no futuredeposits,…arrow_forwardCharlotte has just finished her MBA and started a career in banking investment, she wanted to have a new car as soon as possible. The price of the car is $ 28,320. She must also have clothes and coats for the job which costs $ 3,248. The salary for his job this year is $ 42,000 and next year it will be increasing to $ 46,000. The cost of living this year is $ 34,000. Charlotte plans to make the difference between income and expenditure for consumption by borrowing. Interest on the loan is 15% per year. Charlotte wants to pay the loan and interest within a year. How much money is left for next year that Charlotte can spend (consume)?arrow_forward

- 4arrow_forwardYou have just finished your undergraduate degree and you have two career options: Option 1: Accepting a job offer with the starting salary of $75,000 per year (paid at the end of the year) and an annual raise of 2% pa (guaranteed). You will work in this company for 40 years. Option 2: Choosing a graduate program which will cost you $28,000 per year for the next two years (paid at the beginning of each year). Following the graduate school, you can get a job that offers the initial salary of $85,000 (paid at the end of the Year 3) with an annual raise of 3% pa (guaranteed). You will work in this company for 38 years. a. If you use the discount rate of 10% pa, which option is more lucrative for you? b.At what discount rate will you be indifferent between these two career options? (Hint: You need to use the incremental cash flows to answer this question) c. If option 2 (i.e., work after grad school) comes with a signing bonus (paid at the beginning of Year 3), at what signing bonus will…arrow_forwardYou have chosen biology as your college major because you would like to be a medical doctor. however, you find that the probability of being accepted to medical school is about 20 percent. if you are accepted to medical school, then your starting salary when you graduate will be $260,000 per year. however, if you are not accepted, then you would choose to work in a zoo, where you will earn $30,000 per year. without considering the additional years you would spend in school if you study medicine or the time value of money. What is your expected starting salary? WHat is the standard deviation of that starting salary?arrow_forward

- i need answer urgentarrow_forward16. You are thinking about going to graduate school to earn a master's degree, which you hope will allow you to earn more money. Which of the following is NOT an incremental cash flow associated with your decision to extend your schooling versus going into the workforce when you finish your undergraduate degree? A) the cost-of-living expenses, such as rent and food, while you are in graduate school B) the cost of tuition C) the lost income you could have earned by working rather than staying in school D) the cost of books and other supplies required for your graduate studiesarrow_forwardYou graduated college six years ago with an undergraduate degree in Finance. Although satisfied withyour current job, your goal is to become an investment banker, and you wonder if an MBA degree wouldallow you to achieve that goal. After examining schools, you have narrowed your choice to eitherWilton University or Mount Perry College. Although internships are encouraged by both schools, to getcredit for the internship, no salary can be paid. Other than internships, neither school will allowstudents to work while enrolled on the MBA program. However, thanks to a bequest from yourgrandmother, your savings account has enough money to cover the entire cost of the MBA programYou currently work a money management firm, earning $53, 000 annually. Your salary is expected toincrease 3% per year until retirement. You expect to work for 38 more years. Your current job includesa fully paid health insurance plan. Your current average tax rate is 26%.The Ritter College of Business at Wilton…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education