Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Provide working Solution

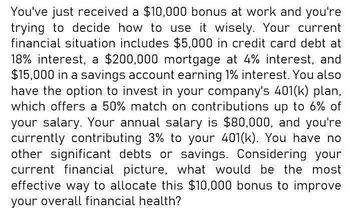

Transcribed Image Text:You've just received a $10,000 bonus at work and you're

trying to decide how to use it wisely. Your current

financial situation includes $5,000 in credit card debt at

18% interest, a $200,000 mortgage at 4% interest, and

$15,000 in a savings account earning 1% interest. You also

have the option to invest in your company's 401(k) plan,

which offers a 50% match on contributions up to 6% of

your salary. Your annual salary is $80,000, and you're

currently contributing 3% to your 401(k). You have no

other significant debts or savings. Considering your

current financial picture, what would be the most

effective way to allocate this $10,000 bonus to improve

your overall financial health?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Provide Answer with all working Stepsarrow_forwardIts your first day of work and you are enrolling in the company sponsored 401(k) plan. The company has a generous match policy (dollar for dollar up to 4% of salary). 4% of your salary would mean a $1,200 annual contribution. Looking at the funds you choose for investments in the plan, it's fair to assume an 8% before tax annual return and you assume 45 years until retirement. How much will you have in your 401(k) plan upon retirement? Assume one annual contribution at the end of every year.arrow_forwardA credit card company wants your business. If you accept their offer and use their card, they willdeposit 1% of your monetary transactions into a savings account that will earn a guaranteed 5% peryear. If your annual transactions total an average of $20,000, how much will you have in this savingsplan after 15 years.arrow_forward

- Your business finance course has motivated you to begin investing for retirement in your company's 401K plan. Your first $370 monthly investment will be made one month from today and you plan to retire 43 years from today. How much more will you have to invest each month, if you wait for 15 years before starting to invest to end up with the same amount of money at retirement? Assume a rate of return of 0.60 percent per month for your investments. Group of answer choices $1,196.80 $902.79 $826.81 $527.88 $611.34arrow_forwardResearching retirement savings online, you found an article from NewRetirement.com with recommendations from financial guru, Dave Ramsey and others. Dave Ramsey recommends investing 15% of every paycheck into a Roth IRA and pre-tax retirement accounts. If your household earns $75,000 annually and you adhere to Ramsey's recommendation, how much will your retirement account be worth if your 15% ordinary annuity earns 9% annually for 30 years? (Use Table 13.1) Note: Do not round intermediate calculations. Round your answer to the nearest dollar. Answer is complete but not entirely correct. $ 1,533,460 Worth of retirement account,arrow_forwardYou are meeting with a financial planner to begin saving for retirement. Your starting salary is $65,000 in year one and you expect to receive pay increases at a rate of 3% each year for the first 30 years of your career, then maintain your salary until you retire. Your financial planner advised you to invest 10% of your yearly salary into a retirement account to maintain a similar lifestyle in retirement. You expect to work for the next 40 years. How much will you have in the account when you retire if your retirement account produces an average return of 9% per year?arrow_forward

- you want to buy a car and finance $20,000 to do so. You can afford a payment of up to $45p per month. The bank offers three choices for the loan: a four-year loan with an APR of 7%, a five- year loan with an APR of 7.5%, and a six-year loan with an APR of 8%. Which option best meets your needs, assuming you want to pay the least amount of interest?arrow_forwardYou plan to use a 15 year mortgage obtained from a local bank to purchase a house worth $124,000.00. The mortgage rate offered to you is 7.75%. You will make a down payment of 20% of the purchase price. a. Calculate your monthly payments on this mortgage. List in a spreadsheet the cash flow the bank expects to receive from you. Submit the spreadsheet with your answers. b. Calculate the amount of interest and principal for the 60th payment. Show your work. c. Calculate the amount of interest and principal to be paid on the 180th payment. Show your work. d. What is the amount of interest paid over the life of this mortgage?arrow_forwardA friend asks to borrow $55 from you and in return will pay you $58 in one year. Ifyour bank is offering a 6% interest rate on deposits and loans: How much would you have in one year if you deposited the $55 instead? How much money could you borrow today if you pay the bank $58 in one year? Should you loan the money to your friend or deposit it in the bank?arrow_forward

- After a conversation with your banker, you’ve agreed to a 20% down payment on your $182,188 home. To keep this problem and your calculations relatively brief, assume that the bank has offered you a mortgage loan for $145,750 that carries a 6% interest rate, semiannual payments of $26,905, and a 3-year term. Remember, the process is the same when you are preparing for either 6 semiannual payments of nearly $27,000 or 360 monthly payments of $873.85 for a 30-year conventional mortgage.Complete the following loan amortization table by entering the correct answers. Notes: 1. As all values are denominated in U.S. dollars, you do not have to enter any dollar signs. 2. Round all interest payments down to the nearest whole dollar. 3. Rounding creates a situation in which the numbers in the loan’s final payment are often unequal. Notice in this problem, the ending balance for payment 6 is –$2. Therefore, your final payment would actually be reduced by $2 to $26,903. In the real world,…arrow_forwardYou lend a friend $10,000, which your friend will repay in 5 equal annual end-of-year payments of $3,000, with the first payment to be received 1 year from now. What rate of return does your loan receive? I need to be able to use excel and manually calculate as well.arrow_forwardSuppose that you start working for a company at age 25. You are offered two rather unlikely, but quite enticing, retirement plans from which you are allowed to choose one. [Round all answers to the nearest dollar.] Retirement plan 1: When you retire, you will receive $16,000 for each year of service. Retirement plan 2: When you start work, the company deposits $2500 into a savings account that is guaranteed to pay a yearly rate of 16%. When you retire, the account will be closed and the balance given to you. A. Determine the amount you would receive under plan 1, if you retired at age 55. $ B. Determine the amount you would receive under plan 1, if you retired at age 65. C. Determine the amount you would receive under plan 2, if you retired at age 55. D. Determine the amount you would receive under plan 2, if you retired at age 65.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education