Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Don't use chat gpt

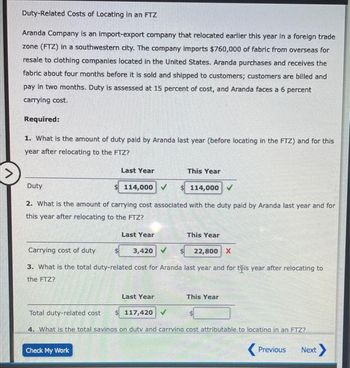

Transcribed Image Text:Duty-Related Costs of Locating in an FTZ

Aranda Company is an import-export company that relocated earlier this year in a foreign trade

zone (FTZ) in a southwestern city. The company imports $760,000 of fabric from overseas for

resale to clothing companies located in the United States. Aranda purchases and receives the

fabric about four months before it is sold and shipped to customers; customers are billed and

pay in two months. Duty is assessed at 15 percent of cost, and Aranda faces a 6 percent

carrying cost.

Required:

1. What is the amount of duty paid by Aranda last year (before locating in the FTZ) and for this

year after relocating to the FTZ?

Duty

Last Year

This Year

114,000 ✔

$114,000 ✔

2. What is the amount of carrying cost associated with the duty paid by Aranda last year and for

this year after relocating to the FTZ?

Last Year

This Year

Carrying cost of duty

3,420

22,800 X

3. What is the total duty-related cost for Aranda last year and for this year after relocating to

the FTZ?

Last Year

This Year

Total duty-related cost

$ 117,420 ✓

4. What is the total savings on duty and carrving cost attributable to locating in an FTZ?

Check My Work

Previous

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Aranda Company is an import-export company that relocated earlier this year in a foreign trade zone (FTZ) in a southwestern city. The company imports $760,000 of fabric from overseas for resale to clothing companies located in the United States. Aranda purchases and receives the fabric about four months before it is sold and shipped to customers; customers are billed and pay in two months. Duty is assessed at 15 percent of cost, and Aranda faces a 6 percent carrying cost. Required: 1. What is the amount of duty paid by Aranda last year (before locating in the FTZ) and for this year after relocating to the FTZ? 2. What is the amount of carrying cost associated with the duty paid by Aranda last year and for this year after relocating to the FTZ? 3. What is the total duty-related cost for Aranda last year and for this year after relocating to the FTZ? 4. What is the total savings on duty and carrying cost attributable to locating in an FTZ? 5. What if some of the fabric turned out to be…arrow_forwardAdams Air is a large airline company that pays a customer relations representative $16,425 per month. The representative, who processed 1,100 customer complaints in January and 1,360 complaints in February, is expected to process 21,900 customer complaints during the year. Required Determine the total cost of processing customer complaints in January and in February.arrow_forwardMunoz Air is a large airline company that pays a customer relations representative $3,900 per month. The representative, who processed 1,180 customer complaints in January and 1,370 complaints in February, is expected to process 23,400 customer complaints during the year.Required Determine the total cost of processing customer complaints in January and in February.arrow_forward

- Elliott, Inc., has four salaried clerks to process purchase orders. Each clerk is paid a salary of 25,750 and is capable of processing as many as 6,500 purchase orders per year. Each clerk uses a PC and laser printer in processing orders. Time available on each PC system is sufficient to process 6,500 orders per year. The cost of each PC system is 1,100 per year. In addition to the salaries, Elliott spends 27,560 for forms, postage, and other supplies (assuming 26,000 purchase orders are processed). During the year, 25,350 orders were processed. Required: 1. Classify the resources associated with purchasing as (1) flexible or (2) committed. 2. Compute the total activity availability, and break this into activity usage and unused activity. 3. Calculate the total cost of resources supplied (activity cost), and break this into the cost of activity used and the cost of unused activity. 4. (a) Suppose that a large special order will cause an additional 500 purchase orders. What purchasing costs are relevant? By how much will purchasing costs increase if the order is accepted? (b) Suppose that the special order causes 700 additional purchase orders. How will your answer to (a) change?arrow_forward[The following information applies to the questions displayed below.]Shadee Corp. expects to sell 630 sun visors in May and 410 in June.Each visor sells for $24. Shadee’s beginning and ending finishedgoods inventories for May are 75 and 45 units, respectively. Endingfinished goods inventory for June will be 60 units.!Suppose that each visor takes 0.80 direct labor hours to produce and Shadee pays itsworkers $8 per hour.Required:Determine Shadee's budgeted direct labor cost for May and June. (Do not round yourintermediate values. Round your answers to 2 decimal places.)$ $May JuneBudgeted Direct Labor Cost 0.00 0.0arrow_forwardProduction workers for Zachary Manufacturing Company provided 4,300 hours of labor in January and 3,400 hours in February. The company, whose operation is labor intensive, expects to use 48,300 hours of labor during the year. Zachary paid a $111,090 annual premium on July 1 of the prior year for an insurance policy that covers the manufacturing facility for the following 12 months. Required Based on this information, how much of the insurance cost should be allocated to the products made in January and to those made in February? (Do not round intermediate calculations.)arrow_forward

- Production workers for Adams Manufacturing Company provided 5,000 hours of labor in January and 2,100 hours in February. The company, whose operation is labor intensive, expects to use 48,000 hours of labor during the year. Adams paid a $100,800 annual premium on July 1 of the prior year for an insurance policy that covers the manufacturing facility for the following 12 months. Required Based on this information, how much of the insurance cost should be allocated to the products made in January and to those made in February? Note: Do not round intermediate calculations. Month January February Allocated Costarrow_forwardProduction workers for Thornton Manufacturing Company provided 5,200 hours of labor in January and 3,100 hours in February. The company, whose operation is labor intensive, expects to use 48,500 hours of labor during the year. Thornton paid a $101,850 annual premium on July 1 of the prior year for an insurance policy that covers the manufacturing facility for the following 12 months. Required Based on this information, how much of the insurance cost should be allocated to the products made in January and to those made in February? (Do not round intermediate calculations.) Month Allocated Cost January Februaryarrow_forwardGenuine Spice Inc. began operations on January 1 of the current year. The company produces8-ounce bottles of hand and body lotion called Eternal Beauty. The lotion is sold wholesale in12-bottle cases for $100 per case. There is a selling commission of $20 per case. The Januarydirect materials, direct labor, and factory overhead costs are as follows: Part A—Break-Even AnalysisThe management of Genuine Spice Inc. wishes to determine the number of cases required tobreak even per month. The utilities cost, which is part of factory overhead, is a mixed cost. Thefollowing information was gathered from the first six months of operation regarding this cost: Instructions1. Determine the fixed and variable portions of the utility cost using the high-low method.2. Determine the contribution margin per case.3. Determine the fixed costs per month, including the utility fixed cost from part (1).4. Determine the break-even number of cases per month.arrow_forward

- Required information [The following information applies to the questions displayed below.] Shadee Corp. expects to sell 520 sun visors in May and 350 in June. Each visor sells for $25. Shadee's beginning and ending finished goods inventories for May are 70 and 60 units, respectively. Ending finished goods inventory for June will be 60 units. Each visor requires a total of $4.00 in direct materials that includes an adjustable closure that the company purchases from a supplier at a cost of $2.00 each. Shadee wants to have 30 closures on hand on May 1, 21 closures on May 31, and 23 closures on June 30. Additionally, Shadee's fixed manufacturing overhead is $1,300 per month, and variable manufacturing overhead is $1.75 per unit produced. Required: 1. Determine Shadee's budgeted cost of closures purchased for May and June. 2. Determine Shadee's budget manufacturing overhead for May and June. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine…arrow_forwardSunland Horticulture provides and maintains live plants in office buildings. The company's 884 customers are charged $37 per month for this service, which includes weekly watering visits. The variable cost to service a customer's location is $17 per month. The company incurs $2,194 each month to maintain its fleet of four service vans and $3.004 each month in salaries. Sunland pays a bookkeeping service $2 per customer each month to handle all invoicing and accounting functions A.) picture one B.) What is the expected monthly operating income if 174 customers are added? Operating income $________ C.) second picturearrow_forwardGenuine Spice Inc. began operations on January 1 of the current year. The company produces eight- ounce bottles of hand and body lotion called Eternal Beauty. The lotion is sold wholesale in 12-bottle cases for $100 per case. There is a selling commission of $20 per case. The January direct materials, direct labor, and factory overhead costs are as follows:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning