Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

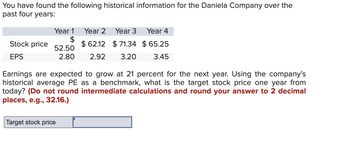

Transcribed Image Text:You have found the following historical information for the Daniela Company over the

past four years:

Year 2 Year 3

Stock price

EPS

Year 1

$

$62.12 $71.34 $65.25

52.50

2.80 2.92 3.20 3.45

Year 4

Earnings are expected to grow at 21 percent for the next year. Using the company's

historical average PE as a benchmark, what is the target stock price one year from

today? (Do not round intermediate calculations and round your answer to 2 decimal

places, e.g., 32.16.)

Target stock price

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Boehm Incorporated is expected to pay a $2.20 per share dividend at the end of this year (i.e., D1 = $2.20). The dividend is expected to grow at a constant rate of 7% a year. The required rate of return on the stock, rs, is 17%. What is the estimated value per share of Boehm's stock? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardA stock had the following year-end prices and dividends. What is the geometric average annual return on this stock Time Price Dividend 0 $23.19 ? 1 $24.90 $0.23 2 $23.18 $0.24 3 $24.86 $0.25arrow_forwardWhizcom Inc. is expected to pay a dividend of $1 next period. Dividends are expected to grow at 2% per year and the investors require a return of 12%. i) Compute the current stock price for Whizcom Inc.ii) What would be the likely stock price in year 5?iii) What would be per annum rate of return implied by a change in prices from time 0 to time 5?arrow_forward

- Financial analysts forecast Limited Brands (LTD) growth rate for the future to be 7.5 percent. LTD's recent dividend was $0.70. What is the value of Limited Brands stock when the required return is 9.5 percent? (Round your answer to 2 decimal places.)arrow_forwardnces A firm is expected to pay a dividend of $1.35 next year and $1.50 the following year. Financial analysts believe the stock will be at their price target of $40 in two years. Compute the value of this stock with a required return of 11.3 percent. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Value of stockarrow_forwardDiana Corporation anticipates a 10 percent growth in net income and dividends. Next year, the company expects earnings per share of P5 and dividends per share of P3. Diana will be having its first public issuance of common stock. The stock will be issued at P40 per share. REQUIREMENTS: 1. What is the P/E ratio? 2. What is the required rate of return on the stock?arrow_forward

- An analyst gathered the following information for a stock and market parameters: stock beta= 1.08; • expected return on the Market = 11.97%; • expected return on T-bills = 1.55%; • current stock Price = $9.01; • expected stock price in one year = $11.14; • expected dividend payment next year = $3.23. Calculate the expected return for this stock. Please share your answer as a percentage rounded to 2 decimal places.arrow_forwardA firm is expected to pay a dividend of $2.85 next year and $3.15 the following year. Financial analysts believe the stock will be at their price target of $110 in two years.Compute the value of this stock with a required return of 13.1 percenarrow_forwardGiven the following information for the stock of Foster Company, calculate the risk premium on its common stock. Current price per share of common stock $47.02 Expected dividend per share next year $2.46 Constant annual dividend growth rate 5.9% Risk-free rate of return 3.9% The risk premium on Foster stock is ___%arrow_forward

- Meadow Dew Corporation currently has an EPS of $4.00, and the benchmark PE for the company is 39. Earnings are expected to grow at 5 percent per year. a. What is your estimate of the current stock price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the target stock price in one year? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Assuming the company pays no dividends, what is the implied return on the company's stock over the next year? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Current stock price b. Target stock price c. Implied return of stock %arrow_forwardThe stock of Business Adventures sells for $30 a share. Its likely dividend payout and end-of-year price depend on the state of the economy by the end of the year as follows: Boom Normal economy Recession Dividend $ 2.00 1.40 0.50 Required: a. Calculate the expected holding-period return and standard deviation of the holding-period return. All three scenarios are equally likely. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expected return Standard deviation Answer is complete and correct. Stock Price $ 40 34 25 14.33 22.60 Expected return Standard deviation b. Calculate the expected return and standard deviation of a portfolio invested half in Business Adventures and half in Treasury bills. The return on bills is 5%. (Do not round intermediate calculations. Round your answers to 2 decimal places.) % % Answer is complete but not entirely correct. 8.75 11.30 % %arrow_forwardAn analyst gathered the following information for a stock and market parameters: stock beta = 1.23; expected return on the Market = 9.32%; expected return on T-bills = 4.75%; current stock Price = $9.08; expected stock price in one year = $13.1; expected dividend payment next year = $3.8. Calculate the expected return for this stock. Please share your answer as a percentage rounded to 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education