ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

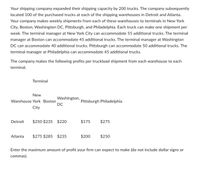

Transcribed Image Text:Your shipping company expanded their shipping capacity by 200 trucks. The company subsequently

located 100 of the purchased trucks at each of the shipping warehouses in Detroit and Atlanta.

Your company makes weekly shipments from each of these warehouses to terminals in New York

City, Boston, Washington DC, Pittsburgh, and Philadelphia. Each truck can make one shipment per

week. The terminal manager at New York City can accommodate 55 additional trucks. The terminal

manager at Boston can accommodate 45 additional trucks. The terminal manager at Washington

DC can accommodate 40 additional trucks. Pittsburgh can accommodate 50 additional trucks. The

terminal manager at Philadelphia can accommodate 45 additional trucks.

The company makes the following profits per truckload shipment from each warehouse to each

terminal.

Terminal

New

Washington,

Warehouse York Boston

DC

Pittsburgh Philadelphia

City

Detroit

$250 $235 $220

$175

$275

Atlanta

$275 $285 $235

$200

$250

Enter the maximum amount of profit your firm can expect to make (do not include dollar signs or

commas).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- A manufacturer sells a particular product in both Brazil and the U.S. In Brazil, the manufacturer has been selling 4,900 units per year of the product at a price of $200 and a contribution margin of 25 percent. For sales of this product in Brazil, calculate the breakeven sales level for a $20 price increase. Show your work. In the U.S., the manufacturer’s price for this product is $400 and the contribution margin is 50 percent. The manufacturer knows that, because of gray market commerce, every one-unit change of sales of this product in Brazil leads to a 0.15-unit sales change in the opposite direction in the U.S. Given this information, recalculate the breakeven sales level in Brazil described in Part a. Show your work. Using the course material, describe the concept of a price corridor. Then explain how the difference between the breakeven you calculated in Part (b) and the one you calculated in Part (a) is helpful for applying the price-corridor concept in this situation.arrow_forwardA company manufactures two types of leaf blowers: an electric Turbo model and a gas-powered Tornado model. The company's production plan calls for the production of at least 690 blowers per month. It costs $74 to produce each Turbo model and $111 to manufacture each Tornado model, and the company has at most $63,640 per month to use for production. Find the number of units that should be produced to maximize profit for the company, and the maximum profit, if the profit on each Turbo model is $35 and the profit on each Tornado model is $40. The maximum value is $ by producing integers or decimals.) units of the Turbo model and units of the Tornado model. (Typearrow_forwardJenny Tanaka wants to buy a new car, and the annual gasoline expense is a major consideration. Her present car gets 25 miles per gallon (mpg), and she is considering purchasing a new car that gets 40 mpg. Jenny now drives about 12,000 miles per year and pays $3.25 per gallon of gasoline. She therefore calculates an annual gasoline consumption of 480 gallons for her 25 mpg car (12,000 miles/25 mpg) compared to 300 gallons consumed per year for the 40 mpg car (12,000 miles/40 mpg). Since driving the higher- mileage car would use 180 gallons less per year, Jenny estimates the new car will save her $585 in gasoline expense per year (180 gallons 3 $3.25 per gallon). Suppose Jenny buys the 40 mpg car. According to economic theory, Jenny's actual annual savings on gasoline will be 7 1 C 1 U C VI 10 V K W S TACAZEC 10 GUNS TOMBER 2 than her initial estimate of $585.arrow_forward

- EMERGENCY! Production just informed management that one of its five glycol squeezers has been destroyed by a rogue computer virus. Production capability is now only 23000 gallons at most. The squeezer cannot be fixed and IceLess cannot afford a replacement. This breakdown will NOT lower fixed costs. This breakdown will not change variable cost per unit, either. If only 23000 gallons are produced, and the earning target remains $94400 above fixed costs, what price per gallon must now be charged? (show your calculations What is the Contribution Margin Ratio (CMR) if the price is $8.82 per gallon? At a price of $10.95 per gallon, what will be the DOL (assume 23000 gallons are sold , that $94400 above fixed costs is to be earned, and that other costs are as initially given)(show your calculations).arrow_forwardYou manufacture ceramic lawn ornaments. After several months your accountant tells you that your profit P(n) can be modeled by the function P(n)= -0.002n^2+5.2n-1208 where n is number of ornaments sold each month. A) How many ornaments must you make and sell to break even. B) How many ornaments must you make and sell to maximize profit. C) What is the maximum profit. D) How many ornaments must you make and sell in order to earn a profit of $1657.arrow_forwardThranduil company’s market research department is working on the pricing of a product. The field research shows that average demand is expected to be 8000 units at price 50 TL. From this point, each 1 TL change in price will negatively affect demand with a magnitude of 100 units. Fixed and variable costs are confronted for producing the product. According to the information obtained from the financial department, 200,000 TL is the estimate of fixed costs and 20 TL is the estimate of variable costs per unit produced. Assume that all units produced are sold.Which of the following prices is the one that maximizes the company's profit?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education