ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

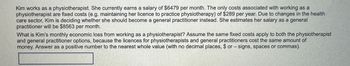

Transcribed Image Text:Kim works as a physiotherapist. She currently earns a salary of $6479 per month. The only costs associated with working as a

physiotherapist are fixed costs (e.g. maintaining her licence to practice physiotherapy) of $289 per year. Due to changes in the health

care sector, Kim is deciding whether she should become a general practitioner instead. She estimates her salary as a general

practitioner will be $8563 per month.

What is Kim's monthly economic loss from working as a physiotherapist? Assume the same fixed costs apply to both the physiotherapist

and general practitioner options, because the licences for physiotherapists and general practitioners cost the same amount of

money. Answer as a positive number to the nearest whole value (with no decimal places, $or - signs, spaces or commas).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- All Smiles Dental Clinic would like to develop a hygienistmaster schedule for the treatment of patients. Five full timehygienists are scheduled six days a week, and each hygien-ist can treat 10 patients per day. If the number of patientsexpected is greater than the hygienist capacity scheduled, additional hygienists may be hired on a daily basis from atemporary worker employment agency. The agency requiresone day notice. Based on your knowledge of MPS, completethe following prototype schedule shown in Figure 11.48arrow_forwardYour company has a customer who is shutting down a production line, and it is your responsibility to dispose of the extrusion machine. The company could keep it in inventory for a possible future product and estimates that the reservation value is $350,000. Your dealings on the secondhand market lead you to believe that if you commit to a price of $400,000, there is a 0.5 chance you will be able to sell the machine. If you commit to a price of $450,000, there is a 0.2 chance you will be able to sell the machine. If you commit to a price of $500,000, there is a 0.15 chance you will be able to sell the machine. These probabilities are summarized in the following table. For each posted price, enter the expected value of attempting to sell the machine at that price. (Hint: Be sure to take into account the value of the machine to your company in the event that you are not be able to sell the machine.) Posted Price Probability of Sale Expected Value ($) ($) $500,000…arrow_forwardThe COVID-19 pandemic has caused an unprecedented increase in savings in many countries around the world. In the EU, the savings rate of households has jumped from 12.5% to 17%. In 2008-2009, it had moved from 12.5% to 14% (Dossche and Zlatanos 2020). Even if the source of 2020 surge in savings is different from the one of 2008, it is obvious that this increase does not result in more investment and growth. QUESTION: 1. Evaluate if and how increased savings in recession can influence consumption, export, and investmentarrow_forward

- One of the most important things an HMO should do to stay profitable is to make sure a) the medical costs’ rate of growth is below the rate of growth of premiums (revenues), and b) customer satisfaction does not slip. True Falsearrow_forwardHow would you explain the concept of a QALY? When is it appropriate to use QALYs instead of simply improved life expectancy as the outcome measure in an economic evaluation?arrow_forwardHealthcare costs as a share of GDP has been on the rise for the last several decades. What are three different explanations for these increasing costs? Which factor accounts for most of the increase?arrow_forward

- Medical bills may be paid by any of the following methods except shifting consumption from one period to another. reducing your welfare loss. charity. family or friends. third party insurance companies.arrow_forwardTully is a graduating high school senior deciding between three alternative combinations of education-work options. He could start working immediately and earn $30,000 working in a burrito truck in period one. His salary would increase to $60,000 in period 2 as he would become chef, and then fall in period 3 to $50,000 as he would become too physically tired to work too much in the kitchen. His first alternative is to spend $15,000 to attend Da-Lousy University for economics and earn an undergrad degree in period 1. Upon obtaining his degree he would earn $80,000 as an economist for periods 2 and 3. The final option is for Tully to complete a doctorate degree in economics after finishing his undergrad degree. There would be no direct costs as he would get scholarships, but he could not work in period 2 while he completed his PhD. After finishing his PhD he would earn $200,000 as an Econ Prof at Kings University in period 3. His discount rate is 15 percent per period. What should Tully…arrow_forwardIn order to increase economic activity, a city proposes to allow diesel-powered delivery vehicles to operate in residential neighborhoods. Diesel exhaust contains soot which is a major cause of asthma and other respiratory ailments leading to a decrease in the quality of life in these communties. A neighborhood group opposed to this proposal hires you to conduct a valuation study to show the decrease in the quality of life. a) What specific valuation method should you use? b) How would you use that method? c) What are some problems that might result from your use of that method?arrow_forward

- Chelsea Menken, of Providence, Rhode Island, recently graduated with a degree in food science and now works for a major consumer foods company earning $70,000 per year with about $54,000 in take-home pay. She rents an apartment for $1,200 per month. While in school, she accumulated about $38,000 in student loan debt on which she pays $385 per month. During her last fall semester in school, she had an internship in a city about 100 miles from her campus. She used her credit card for her extra expenses and has a current debt on the account of $7,000. She has been making the minimum payments on the account of about $240 a month. She has assets of $14,000. D a. Calculate Chelsea's debt payments-to-disposable income ratio. Round your answer to two decimal places. b. Calculate Chelsea's debt-to-income ratio. Round your answer to two decimal places. c. Comment on Chelsea's debt situation and her use of student loans and credit cards while in college.arrow_forwardHi! Can you help me with the question below? Todd has a job that presents zero risk of death or injury, but has always craved something more exciting. His current annual salary is $50,000. He has been offered a job on an Alaskan fishing boat that will pay$55,000 annually. This new job offer, however, comes with a 10% risk of severe injury that will cause Todd to have no income. Which of the following is true? (Assume the severe injury has no relevant implications besides reducing Todd’s income) A) Todd will definitely take the new job if he’s risk averse.B) Todd will definitely take the new job if he’s risk neutral.C) Todd will definitely decline the new job if he’s risk averse or risk neutral.D) Todd will definitely accept the new job if he’s risk seeking.E) Not enough information to determine.arrow_forwardIn 2011, Kevin Jones, Texas Tigers quarterback, agreed to an eight-year, $50 million contract that at the time made him the highest-paid player in professional football history. The contract included a signing bonus of $11 million and called for annual salaries of $2.5 million in 2011, $1.75 million in 2012, $4.15 million in 2013, $4.90 million in 2014, $5.25 million in 2015, $6.2 million in 2016, $6.75 million in 2017, and $7.5 million in 2018. The $11 million signing bonus was prorated over the course of the contract so that an additional $1.375 million was paid each year over the eight-year contract period. With the salary paid at the beginning of each season, what is the worth of his contract at an interest rate of 6%?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education