ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

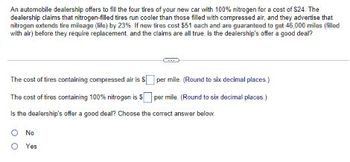

Transcribed Image Text:An automobile dealership offers to fill the four tires of your new car with 100% nitrogen for a cost of $24. The

dealership claims that nitrogen-filled tires run cooler than those filled with compressed air, and they advertise that

nitrogen extends tire mileage (life) by 23%. If new tires cost $51 each and are guaranteed to get 46,000 miles (filled

with air) before they require replacement and the claims are all true is the dealership's offer a good deal?

The cost of tires containing compressed air is $

The cost of tires containing 100% nitrogen is $

Is the dealership's offer a good deal? Choose the correct answer below.

per mile. (Round to six decimal places.)

per mile. (Round to six decimal places.)

No

O Yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Hilton Enterprises sells a product for $119 per unit. The variable cost is $68 per unit, while fixed costs are $436,968. Determine (a) the break-even point in sales units and (b) the break-even point if the selling price were increased to $124 per unit. a. Break-even point in sales units units b. Break-even point if the selling price were increased to $124 per unit unitsarrow_forwardA small automotive supply company manufactures fuel gauges for various types of cars. The company has fixed costs of $1,885,000 per year. The average cost of manufacturing a fuel gauge is $21.88. The average price the fuel gauge sells for is $48.20 The company manufactures its products 252 days per year. What is the minimum number of fuel guages per day that the company must produce in order to break even?arrow_forwardIf a 5,000 gallon metal tank to hold hazardous materials cost $250,000. What would be the expected cost of constructing a 10,000 gallon tank for the same purpose given the power-sizing exponent of 0.5 Group of answer choices $375,000 $353,553 $477,561 .$500,000arrow_forward

- A construction manager just starting in private practice needs a van to carry crew and equipment. She can lease a used van for $3,777 per year, paid at the beginning of each year, in which case maintenance is provied. Alternatively, she can buy a used van for $5,669 and pay for maintenance herself. She expects to keep the van for three years at which time she could sell it for $1,110. What is the most she should pay for uniform annual maintenance to make it worthwhile to buy the van instead of leasing it, if her MARR is 20%?arrow_forwardThe demand values for the following 4 weeks for a company is as follows: 300, 200, 400, 430. The weekly regular time production capacity is 260 units. At each week up to 150 more units can be produced in over time with an additional cost of $40 over the regular time production costs. 15% of the produced units become scrap due to quality problems. There is an inventory cost of $12 per unit per quarter. 150 units are available at the beginning of week1 and the company wants to have at least 200 units at the end of week4. Formulate a linear programming model that can be used to minimize the total cost of meeting the next four weeks' demand.arrow_forwardYour boss has asked you to evaluate the economics of replacing 1,000 60-Watt incandescent light bulbs (ILBs) with 1,000 compact fluorescent lamps (CFLs) for a particular lighting application. During your investigation you discover that 13-Watt CFLs costing $2.00 each will provide the same illumination as standard 60-Watt ILBs costing $0.50 each. Interestingly, CFLs last, on average, eight times as long as incandescent bulbs. The average life of an ILB is one year over the anticipated usage of 1,000 hours each year. Each incandescent bulb costs $2.00 to install/replace. Installation of a single CFL costs $3.00, and it will also be used 1,000 hours per year. Electricity costs $0.12 per kiloWatt hour (kWh), and you decide to compare the two lighting options over an 8-year study period. If the MARR is 12% per year, compare the economics of the two alternatives and write a brief report of your findings for the boss.arrow_forward

- MINIMIZE the amount and what is the minimum amount of pounds?arrow_forwardNeeded to be solved correctly in 10 minutes and get the thumbs up please show neat and clean work Please do in 10 minutes onlyarrow_forwardPlease no written by hand solutions One area of concern when it comes to Starlink is the cost. For example, at the beginning of February 2023, FiberOne, a broadband internet provider in Nigeria, was providing internet with speeds of up to 500Mbps, which is fast. The installation fee was N32,231 (about US$70) and the monthly subscription cost around N100,000 (US$220). Starlink in Nigeria, meanwhile, costs about N276,000 (US$599) once- off for the kit and installation, then charges a monthly subscription fee of about [N19,800] (US$43). Starlink is cheaper in the long term than both fibre optic and mobile internet providers. But can an average rural Nigerian household with a monthly income of less than N28,000 (US$60) afford it? Given that average incomes are similarly low in most rural and remote parts of Africa, there's a risk that Starlink's targeted users on the continent won't be able to use the service. The reason that Starlink is able to charge a lower monthly price for their…arrow_forward

- An automobile dealership offers to fill the four tires of your new car with 100% nitrogen for a cost of $20.00. The dealership claims that nitrogen-filled tires run cooler than those filled with compressed air, and they advertise that nitrogen extends tire mileage (life) by 25%. If new tires cost $50.00 and are guaranteed to get 50,000 miles (filled with air) before they require replacement, is the dealership’s offer a good dealarrow_forwardM. Cotteleer Electronics supplies microcomputer circuitry to a company that incorporates microprocessors into refrigerators and other home appliances. One of the components has an annual demand of 250 units, and this is constant throughout the year. Carrying cost is estimated to be $1 per unit per year, and the ordering (setup) cost is $20 per order. a) To minimize cost, how many units should be ordered each time an order is placed? b) How many orders per year are needed with the optimal policy? c) What is the average inventory if costs are minimized? d) Suppose that the ordering (setup) cost is not $20, and Cotteleer has been ordering 150 units each time an order is placed. For this order policy (of Q 5 150) to be optimal, determine what the ordering (setup) cost would have to be.arrow_forwardA company manufactures two types of leaf blowers: an electric Turbo model and a gas-powered Tornado model. The company's production plan calls for the production of at least 690 blowers per month. It costs $74 to produce each Turbo model and $111 to manufacture each Tornado model, and the company has at most $63,640 per month to use for production. Find the number of units that should be produced to maximize profit for the company, and the maximum profit, if the profit on each Turbo model is $35 and the profit on each Tornado model is $40. The maximum value is $ by producing integers or decimals.) units of the Turbo model and units of the Tornado model. (Typearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education