ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Your firm is thinking about investing $200,000 in the overhaul of a manufacturing cell in a lean environment. Revenues are expected to be $36,000 in year one and then increasing by $12,000 more each year thereafter. Relevant expenses will be $5,000 in year one and will increase by $2,500 per year until the end of the cell's five-year life. Salvage recovery at the end of year five is estimated to be $8,000. What is the annual equivalent worth of the manufacturing cell if the MARR is 12% per year?

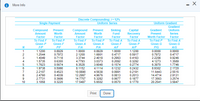

Transcribed Image Text:More Info

Discrete Compounding; i= 12%

Single Payment

Uniform Series

Uniform Gradient

Gradient

Compound

Amount

Present

Compound

Amount

Present

Sinking

Fund

Capital

Recovery

Factor

To Find A

Gradient

Uniform

Worth

Worth

Present

Series

Factor

Factor

Factor

Factor

Factor

Worth Factor

Factor

To Find P To Find A

Given G

P/G

To Find F

To Find P

To Find F

To Find P

To Find A

Given F

P/F

Given P

Given A

Given A

Given F

Given P

Given G

F/P

FIA

P/A

A/F

A/P

A/G

1

1.1200

0.8929

1.0000

0.8929

1.0000

1.1200

0.0000

0.0000

2

1.2544

0.7972

2.1200

1.6901

2.4018

0.4717

0.5917

0.7972

0.4717

3

1.4049

0.7118

3.3744

0.2963

0.4163

2.2208

0.9246

4

1.5735

0.6355

4.7793

6.3528

8.1152

3.0373

0.2092

0.3292

4.1273

1.3589

1.7623

0.5674

3.6048

0.1574

0.2774

6.3970

1.7746

6

1.9738

0.5066

4.1114

0.1232

0.2432

8.9302

2.1720

7

2.2107

0.4523

10.0890

4.5638

0.0991

0.2191

11.6443

14.4714

2.5515

8

2.4760

0.4039

12.2997

4.9676

0.0813

0.2013

2.9131

9

2.7731

5.3282

0.3606

0.3220

14.7757

0.0677

0.1877

17.3563

3.2574

10

3.1058

17.5487

5.6502

0.0570

0.1770

20.2541

3.5847

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A company has invested in machinery that $23,000 to purchase and install and the company purchased a 3 year warranty for $5,000. The warranty covers all maintenance and repairs for three years with no cost to the company. At year 4, the maintenance costs are estimated at $2,000 and will increase by $1,200 per year after that. Operating costs are expected to be $800 every year. The machinery will last nine years. If the interest rate is 6%, what is the machinery's economic life that minimizes the EUAC?arrow_forwardPlease answer as quickly as possible and zoom in for better viewarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Zoysia University must purchase mowers for its landscape department. The university can buy six EVF mowers that cost $8,400 each and have annual, year-end maintenance costs of $1,850 per mower. The EVF mowers will be replaced at the end of Year 4 and have no value at that time. Alternatively, Zoysia can buy seven AEH mowers to accomplish the same work. The AEH mowers will be replaced after seven years. They each cost $7,400 and have annual, year-end maintenance costs of $2,150 per mower. Each AEH mower will have a resale value of $900 at the end of seven years. The university’s opportunity cost of funds for this type of investment is 8 percent. Because the university is a nonprofit institution, it does not pay taxes. It is anticipated that whichever manufacturer is chosen now will be the supplier of future mowers. What is the EAC of each type of mower? (Your answers should be a negative value and indicated by a minus sign. Do not round intermediate calculations and round your answers…arrow_forwardAn integrated, combined cycle power plant produces 280 MW of electricity by gasifying coal. The capital investment for the plant is $460 million, spread evenly over two years. The operating life of the plant is expected to be 25 years. Additionally, the plant will operate at full capacity 77% of the time (downtime is 23% of any given year). The MARR is 8% per year. a. If this plant will make a profit of two cents per kilowatt-hour of electricity sold to the power grid, what is the simple payback period of the plant? Is it a low-risk venture? b. What is the IRR for the plant? Is it profitable? a. The simple payback period of the plant is years. (Round up to one decimal place.) It's a venture. b. The IRR for the plant is %. (Round to one decimal place.) The plant isarrow_forwardToday, you have $35,000 to invest. Two investment alternatives are available to you. One would require you to invest your $35,000 now; the other would require the $35,000 investment two years from now. In either case, the investments will end five years from now. The cash flows for each alternative are provided below. Using a MARR of 13%, what should you do with the $35,000 you have? Click the icon to view the alternatives description. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 13% per year. The FW of the Alternative 1 is $ (Round to the nearest dollar.) More Info Year OT N345 0 1 2 Alternative 1 - $35,000 $15,000 $15,000 $15,000 $13,000 $13,000 Alternative 2 $0 $0 - $35,000 $16,500 $16,500 $16,500 0 Xarrow_forward

- Please do not give solution in image formate thanku. Biomet Implants is planning new online patient diagnostics for surgeons while they operate. The new system will cost $300,000 to install in an operating room, $5000 annually for maintenance, and have an expected life of 10 years. The revenue per system is estimated to be $80,000 in year 1 and to increase by $10,000 per year through year 10. a) Determine NPV to see if the project is economically justified using PW analysis and an MARR of 10% per year. b) Insert a Triangle distribution with minimum at $8000, average 10,000 and maximum at 12000 as the input distribution for the revenue increase. Perform Monte Carlo Simulation and discuss the results.arrow_forwardYou are considering buying a company for $699, 000. If you expect the business to earn $97,000 per year, how long is the discounted payback period if your MARR is 5% ? (in years)arrow_forwardPlease use a financial calculator to solve. Be sure to list your steps. You are evaluating two different silicon wafer milling machines. The Techron I costs $237,000, has a three-year life, and has pretax operating costs of $62, 000 per year. The Techron II costs $ 415,000, has a five - year life, and has pretax operating costs of $ 35,000 per year. For both milling machines, use straight - line depreciation to zero over the project's life and assume a salvage value of $39, 000. If your tax rate is 21 percent and your discount rate is 8 percent, compute the EAC for both machines. (Your answer should be a negative value and indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forward

- A deep water port for imported liquefied natural gas (LNG) is needed for three years. At the end of the third year, it will cost more to dismantle the LNG facility than it produces in revenues. The cash flows are estimated as follows: The IRR for this LNG facility is closest to which choice below? Choose the closest answer below. A. The IRR for the LNG facility is 9.5% per year. B. The IRR for the LNG facility is 4.7% per year. C. The IRR for the LNG facility is 12.2% per year. D. The IRR for the LNG facility is 14.6% per year. EOY 0 1 2 3 Net Cash Flow - $54 million 44 million 40 million - 24 millionarrow_forwardWhat would be the annual worth on this investment?arrow_forwardThe following cash flows result from a potential construction project for your company: 1. Receipts of $505,000 at the start of the contract and $1,200,000 at the end of the fourth year 2. Expenditures at the end of the first year of $400,000 and at the end of the second year of $900,000 3. A net cash flow of $0 at the end of the third year. Using an appropriate rate of return method (Approximate ERR), for a MARR of 20%, should your company accept this project (Perform all calculations using 5 significant figures and round your answer to one decimal place. Also remember that text answers are case-sensitive):? Answers entered using text are case sensitive! What is the approximate ERR for this project? Number Should your company undertake this project? (Enter either 'Yes' or 'No'): %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education