FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

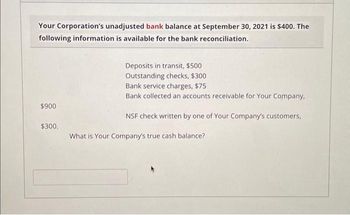

Transcribed Image Text:Your Corporation's unadjusted bank balance at September 30, 2021 is $400. The

following information is available for the bank reconciliation.

$900

$300.

Deposits in transit, $500

Outstanding checks, $300

Bank service charges, $75

Bank collected an accounts receivable for Your Company,

NSF check written by one of Your Company's customers,

What is Your Company's true cash balance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- G. From the following particulars, you are required to find out the errors in cash book and bank statement by preparing Bank Reconciliation Statement as on March 31, 2021, ABC Corporation. (i) Bank balance overdraft as per cash book (ii) Check recorded for collection but not sent to the bank (iii) Credit side of the cash book cast short..... (iv) Premium on proprietor's Life Insurance Policy (LIP) paid on standing order.. (v) Bank Charges recorded twice in the cash book (vi) Customer's check returned by the bank as dishonored (vii) Bill Receivable collected by the bank directly on the behalf of company (viii) Check received entered twice in the cash book. (ix) Check issued but dishonored on technical grounds (x) A checks deposited into the bank of worth P 45,000 but check was not collected by bank 80,000 10,000 1,000 .5,000 100 4,000 .20,000 ..6,000 3,000 P 8,000arrow_forwardThe 31 August 2021 bank statement of Bach Ltd has just arrived from United Bank. To prepare Bach’s bank reconciliation, you gather the following data: a) Bach’s Cash account has a balance of $2,900 on 31 August. b) The bank statement includes two dishonoured cheques from customers: B. Smith, $400 and A. Green, $110. c) The following cheques appear in the cash payments journal of Bach but have not yet been cleared by the bank at 31 August: Cheque no. Amount 237 $190 288 170 291 520 294 630 d) Bach collects from a few customers by EFT. The August bank statement lists a $1,300 EFT deposit for a collection on account. e) The bank statement includes two special deposits that Bach hasn’t recorded yet: $970 for dividend revenue, and $80 interest revenue which Bach earned on its bank balance during August. f) The bank statement lists a $30 bank service charge and a $15 excess transaction…arrow_forward1) The "I am Definitely Switching My Major to Accounting Company" received its bank statement for the month ended October 31, 2023. To prepare the bank reconciliation $22do you gather the following data: - a) The balance per the bank statement is $16,292 b) The checkbook balance is $15,650 c) The bank statement shows an NSF Check from one of the company's customers in the amount of $895.00 d) There is a bank service charge of $45.00 on the bank statement e) Outstanding checks total $847.00 and deposits in transit total $1416.00 f) The bank statement shows collection of a note receivable in the amount of $2000 plus interest of $200.00 less a bank fee of $49.00 Required: Prepare a bank reconciliation using the above informationarrow_forward

- 1. Based on the above information, prepare a bank reconciliation for the Wisconsin Company.2. Prepare the necessary general journal entries to bring Cash to the reconciled balance.3. Post to the Cash t-accountarrow_forwardThe treasurer preparing the October bank reconciliation identified the following items: Cash balance per the company's records $32,700, Deposits in Transit $4,300, Outstanding Checks $2,200, Interest earned on the checking account $200, Customer NSF check $400. What is the company's adjusted cash balance at Oct. 31? A. $34,900 B. $32,700 C. $32,500 D. $34,800arrow_forwardNonearrow_forward

- Your firm’s cash book shows a credit bank balance of $1,240 at 30 April 2021. On comparison with the bank statement, you determine that there are unpresented cheques totalling $450, and a receipt of $140 which has not yet been passed through the bank account. The bank statement shows bank charges of $75 which have not been entered in the cash book.Please provide solution. The balance on the bank statement is: ______ Dr./Cr.arrow_forwardSerato Company keeps all its cash in a checking account. An examination of the entity’s accounting records and bank statement for the month ended December 31, 2020 revealed a bank statement balance of P8,469,000 and a book balance of P8,524,000. A deposit of P950,000 placed in the bank’s night depository on December 29 does not appear on the bank statement. Checks outstanding on December 31 amount to P270, 000. The bank statement shows that on December 25, the bank collected a note for Serato Company and credited the proceeds of P935,000 to the entity’s account. The proceeds included P35,000 interest, all of which Serato Company earned during the current period. Serato Company has not yet recorded the said collection. Serato Company discovered that check number 1000759 written in December for P183,000 in payment of an account had been recorded in the…arrow_forwardIn the normal operation of business you receive a check from a customer and deposit it into your checking account. With your bank statement you are advised that this check for $775 is NSF. The bank also informs you that due to the amount of activity on your business account the monthly service charge is $75. During a bank reconciliation, you will: a. add both values from balance according to books. b. subtract both values from balance according to books. c. add both values from balance according to bank. d. subtract both values from balance according to bank.arrow_forward

- At August 31, Saladino Coffee has the following bank information: cash balance per bank Rp5.200.000, outstanding checks Rp1.462.000, deposits in transit Rp1.211.000, and a bank debit memo Rp110.000. Determine the adjusted cash balance per bank at July 31. Cash balance per bank Rp 5.200.000,00 Add : Deposits in Transit Rp 1.211.000,00 Rp 6.411.000,00 Less Outstanding Checks Rp 1.462.000,00 Adjusted cash balance per bank Rp 4.949.000,00 The information below relates to the Cash account in the ledger of Saladino Coffee Balance Rp 10.094.000 Rp 884.000 Collection of electronic funds transfer Interest earned on checking accounts NSF check: R. Doll Rp 26.000 Rp 245.000 Safety deposit box rent Rp 35.000 Cash balance per books Rp10.094.000 Add: *** ... Less NSF Check Rp245.000 Adjusted cash balance per booksarrow_forwardIdentify whether each of the following items would on appear on the bank side or the book side of a bank reconciliation. Enter Bank or Book below. Bank service charges Outstanding checks Deposits in transit NSF check Interest on a checking account The company properly wrote a check for $95.80 that the bank incorrectly paid as $9.58. The bank printed checks for the depositor for a fee. Bank debit memorandum Bank credit memorandum The bank collected a $1,000 note for the depositor.arrow_forwardNovak Enterprises owns the following assets at December 31, 2025. Cash in bank-savings account $67,800 Cash on hand Cash refund due from IRS 8,710 Cash to be reported $ 33,800 What amount should be reported as cash? Checking account balance Postdated checks Certificates of deposit (180-day) $22,500 850 94,980arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education