FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

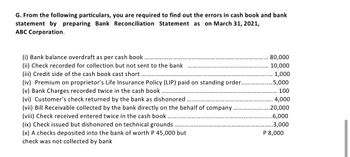

Transcribed Image Text:G. From the following particulars, you are required to find out the errors in cash book and bank

statement by preparing Bank Reconciliation Statement as on March 31, 2021,

ABC Corporation.

(i) Bank balance overdraft as per cash book

(ii) Check recorded for collection but not sent to the bank

(iii) Credit side of the cash book cast short.....

(iv) Premium on proprietor's Life Insurance Policy (LIP) paid on standing order..

(v) Bank Charges recorded twice in the cash book

(vi) Customer's check returned by the bank as dishonored

(vii) Bill Receivable collected by the bank directly on the behalf of company

(viii) Check received entered twice in the cash book.

(ix) Check issued but dishonored on technical grounds

(x) A checks deposited into the bank of worth P 45,000 but

check was not collected by bank

80,000

10,000

1,000

.5,000

100

4,000

.20,000

..6,000

3,000

P 8,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A check written by the company for $272 is incorrectly recorded by a company as $227. On the bank reconciliation, the $45 error should be added to the balance per bank. added to the balance per books. deducted from the balance per bank. deducted from the balance per books. O O O Oarrow_forward6, 7, A bank reconciliation for October 31 follows. Bank statement balance Add: Deposit in transit Deduct: Outstanding checks Adjusted bank balance View transaction list < 1 2 Note: Enter debits before credits. Date October 31 Bank Reconciliation October 31 Journal entry worksheet Cash $ 6,482 3 291 6,773 79 $ 6,694 Prepare the necessary journal entries based on the bank reconciliation. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Book balance Add: 4 Collection of a note Interest earned Deduct: NSF check Bank service charges Adjusted book balance Record the $400 collection of a note receivable by the bank on our behalf. Saved General Journal $ 400 64 Debit 63 61 $ 6,354 Credit 464 6,818 124 $6,694arrow_forwardIf a company made a bank deposit on September 30 that did not appear on the bank statement dated September 30, in preparing the September 30 bank reconciliation, the company should: Multiple Choice Add the deposit to the bank statement balance. Skip the bank reconciliation this month. Add the deposit to the book balance of cash. Deduct the deposit from the bank statement balance. Deduct the deposit from the September 30 book balance and add it to the October 1 book balance.arrow_forward

- TSLA Co. found that the receipt of a check from a customer was properly recorded in th accounting records for $7,426 but improperly credited by the bank in the amount of $4,726. When preparing that month's bank reconciliation, the company should: Add $2,700 to the bank statement balance of cash. Add $2,700 to the book balance of cash. educt $2,700 from the book balance of cash O Deduct $2,700 from the bank statement balance of cash.arrow_forwardIdentify whether each of the following items would on appear on the bank side or the book side of a bank reconciliation. Enter Bank or Book below. Bank service charges Outstanding checks Deposits in transit NSF check Interest on a checking account The company properly wrote a check for $95.80 that the bank incorrectly paid as $9.58. The bank printed checks for the depositor for a fee. Bank debit memorandum Bank credit memorandum The bank collected a $1,000 note for the depositor.arrow_forwardCrane Company is a very profitable small business. It has not, however, given much consideration to internal control. For example, in an attempt to keep clerical and office expenses to a minimum, the company has combined the jobs of cashier and bookkeeper. As a result, Bret Turrin handles all cash receipts, keeps the accounting records, and prepares the monthly bank reconciliations. The balance per the bank statement on October 31, 2022, was $18,890.00. Outstanding checks were No. 62 for $149.00, No. 183 for $171.00, No. 284 for $262.00, No. 862 for $222.00, No. 863 for $277.00, and No. 864 for $202.00. Included with the statement was a credit memorandum of $209.00 indicating the collection of a note receivable for Crane Company by the bank on October 25. This memorandum has not been recorded by Crane. The company's ledger showed one Cash account with a balance of $22,311.00. The balance included undeposited cash on hand. Because of the lack of internal controls, Bret took for personal…arrow_forward

- Coasters Co. issued a note receivable to a customer. The customer made payment directly to the Coaster’s bank. The payment appeared on the month-end bank statement. How would this payment be adjusted in the bank reconciliation? Add to company records (book side) Subtract from company records (book side) Subtract from bank statement (bank side) Add to bank statement (bank side)arrow_forwardUsing the reconciling items below, prepare a bank reconciliation for the September 30, 2021 year end. For every item on the bank reconciliation, explain what supporting evidence you would obtain to test the item (be specific, do not just say “look at supporting documentation”). Also, provide your conclusion – based on your bank reconciliation, is the cash balance in the client’s books correct? If not – quantify the error. 1. Cash balance per client $100,000 2. Cash balance per the bank statement $100,000 3. The company wrote mailed the following cheques on September 30, 2021, which did not get cashed until October 2, 2021. a. Cheque 1234 $2,000 b. Cheque 2345 $4,000 c. Cheque 3456…arrow_forwardItems on company bank statement: 1. Bank correction of an error from posting another customers check(disbursement) to the company account 2. EFT deposit 3. Loan proceeds 4. NSF. Using the following format indicate whether each item would appear as a debit or credit memo on the bank statement and whether the item would increase or decrease the balance of the company account.arrow_forward

- I need help with questionarrow_forwardWhich of the following items will not appear on the Books side of the reconciliation? A a non-sufficient funds check of $75 was returned to the bank and deduct it from the bank balance. Be a deposit was in transit in not yet deposited in the bank. See the bank charge a service fee of $20 on the bank statement. D the bank collected in notes receivable of $1000 for the businessarrow_forwardHow do I solve for problem 1?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education