Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Acompany is evaluating the addition of equipment to its presentoperations. They need to

purchase equipment for $160,000. The five year MACRS GDS Recovery Method is

appropriate forthe investment and the total tax rate (federal plus state) is 40%. Gross revenue

is expected to be $30,000/year while maintenance costs are expected to be $5,000/year. It is

expected that the operation will be shut down at the end of the fourth year with a salvage value

of $20,000.

2-Draw a BTCFD

Expert Solution

arrow_forward

Step 1

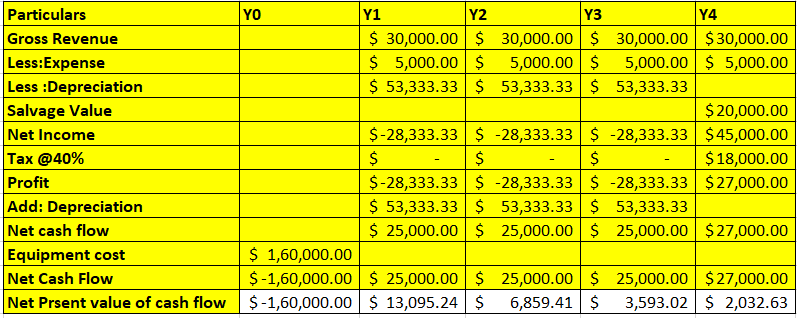

Consider the life of equipment under a special class with life 3 Years.

And WACC be 10% For calculation of NPV of cash flows

The following table depicts the Net present value of cash flow

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Caradoc Machine Shop is considering a four-year project to improve itsproduction efficiency. Buying a new machine press for $410,000 isestimated to result in $150,000 in annual pre-tax cost savings. The pressfalls into Class 8 for CCA purposes (CCA rate of 20% per year), and it willhave a salvage value at the end of the project of $55,000. The press alsorequires an initial investment in spare parts inventory of $20,000, alongwith an additional $3,100 in inventory for each succeeding year of theproject. If the shop’s tax rate is 35% and its discount rate is 9%.Calculate the NPV of this project. (Do not round your intermediatecalculations. Round the final answer to 2 decimal places. Omit $ sign inyour response.)NPV $ Should the company buy and install the machine press?arrow_forwardDataPoint Engineering is considering the purchase of a new piece of equipment for $200,000. It has an eight-year midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $100,000 in nondepreciable working capital. $25,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and taxes for the next six are shown in the following table. Use Table 12–11, Table 12–12. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Need help with subpart D-1, previously asked question and was a-c were answered. Year Amount 1 $ 173,000 2 152,000 3 108,000 4 103,000 5 89,000 6 71,000 The tax rate is 25 percent. The cost of capital must be computed based on the following: Cost(aftertax) Weights Debt Kd 5.50 % 30 % Preferred stock Kp 9.20 10…arrow_forwardAcompany is evaluating the addition of equipment to its presentoperations. They need to purchase equipment for $160,000. The five year MACRS GDS Recovery Method is appropriate forthe investment and the total tax rate (federal plus state) is 40%. Gross revenue is expected to be $30,000/year while maintenance costs are expected to be $5,000/year. It is expected that the operation will be shut down at the end of the fourth year with a salvage value of $20,000.1-Prepare a table showing your development of the ATCF's.arrow_forward

- Spotted Potato is evaluating project A, which would require the purchase of a piece of equipment for $550,000. During year 1, project A is expected to have relevant revenue of $312,000.00, relevant costs of $105,000.00, and some depreciation. Spotted Potato would need to borrow $550,000 for the equipment and would need to make an interest payment of $40,000 to the bank in year 1. Relevant net income for project A in year 1 is expected to be $96000.00 and operating cash flows for project A in year 1 are expected to be $167000.00. Straight-line depreciation would be used. What is the tax rate expected to be in year 1? 29.41% (plus or minus 3 bps) 13.51% (plus or minus 3 bps) 70.59% (plus or minus 3 bps) 34.53% (plus or minus 3 bps) none of the answers are within 3 bps of the correct answerarrow_forwardFitzgerald Computers is considering a new project whose data are shown below. The required equipment has a 3-year tax life, after which it will have zero book value, and it will be depreciated by the straight-line method over 3 years. Revenues and other operating costs are expected to be constant over the project's 4-year life. What is the project's Year 4 cash flow? $65,000 Equipment cost (depreciable basis) Straight-line depreciation rate Sales revenues, each year Operating costs (excl. deprec.) Tax rate a. $27,500 b. $28,438 c. $22,750 d. $21,000 e. $30,333 33.33% $60,000 $25,000 35.0%arrow_forwardFirm Z has invested $4 million in marketing campaign to assess the demand for the product Minish. This product will be in the market next year and will last five years. Revenues are projected to be $50 million per year along with expenses of $20 million. The firm spends $15 million immediately on equipment that will be depreciated using MACRS depreciation to zero. Additionally, it will use some fully depreciated existing equipment that has a market value of $4 million. Finally, Minish will have no incremental cash or inventory requirements (products will be shipped directly from the contract manufacturer to customers). But, receivables are expected to account for 15% of annual sales. Payables are expected to be 15% of the annual cost of goods sold (COGS) between year 1 and year 4. All accounts payables and receivables will be settled at the end of year 5. Based on this information and WACC in the first part of the question, find the NPV of the project. Identify the IRR of the…arrow_forward

- RealTurf is considering purchasing an automatic sprinkler system for its sod farm by borrowing the entire $30,000 purchase price. The loan would be repaid with four equal annual payments at an interest rate of 12%/year. It is anticipated that the sprinkler system would be used for 9 years and then sold for a salvage value of $2,000. Annual operating and maintenance expenses for the system over the 9-year life are estimated to be $9,000 per year. If the new system is purchased, cost savings of $15,000 per year will be realized over the present manual watering system. RealTurf uses a MARR of 15%/year for economic decision making. Based on a present worth analysis, is the purchase of the new sprinkler system economically attractive?arrow_forwardMemanarrow_forwardA firm can purchase a centrifugal separator (5-year MACRS property) for $22,000. The estimated salvage value is $4,000 after a useful life of six years. Operating and maintenance (O&M) costs for the first year are expected to be $2,200. These O&M costs are projected to increase by $1,000 per year each year thereafter. The income tax rate is 24% and the MARR is 11% after taxes. What must the uniform annual benefits be for the purchase of the centrifugal separator to be economical on an after-tax basis? CAN YOU DO THIS PROBLEM BY HAND? AND NOT USING EXCEL I WOULD REALLY APPRECIATE IT!!!!arrow_forward

- Land Development Corporation is considering the purchase of a bulldozer. The bulldozer will cost $100,000 and will have an estimated salvage value of $30,000 at the end of six years. The asset will generate annual before-tax revenues of $80,000 over the next six years. The asset is classified as a five-year MACRS property. The marginal tax rate is 40%, and the firm's market interest rate is known to be 18%. All dollar figures represent constant dollars at time zero and are responsive to the general inflation rate J.(a) With 1=6% compute the after-tax cash flows in actual dollars.(b) Determine the real rate of return of this project on an after-tax basis.(c) Suppose that the initial cost of the project will be financed through a local bank at an interest rate of 12% and with an annual payment of $24,323 over six years. With this additional condition, the rework part (a).(d) From your answer to part (a), determine the PW loss due to inflation.(e) From your answer to part (c), determine…arrow_forwardCeltic Inc. is considering a 16-year project that will generate before tax cash flow of $18,000 peryear for 16 years. The project requires a machine that costs $96,000. The CCA rate is 20% andthe salvage value is $9,600. Celtic has cash of $66,000 and needs to borrow the balance at 6%interest rate to purchase the machine. Celtic is required to repay $10,000 at year 4 and theremaining balance at year 16. The corporate tax rate is 30%.If the weighted average cost of capital is 11% and the machine is the only asset in the assetclass, calculate the NPV of the project using the WACC approach.arrow_forwardThe Scampini Supplies Company recently purchased a new delivery truck. The new truck has an after-tax cost of $23,500, and it is expected to generate after-tax cash flows of $7,250 per year. The truck has a 5-year expected life. The expected year-end abandonment values (after-tax salvage values) for the truck are given below. The company's WACC is 8%. After-Tax Year 0 Annual After-Tax Cash Flow Abandonment Value ($23,500) 1 7,250 2 7,250 3 7,250 7,250 $17,500 15,000 13,000 8,000 7,250 4 5 a. What is the truck's optimal economic life? Round your answer to the nearest whole number. year(s) b. Would the introduction of abandonment values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project? -Select- varrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education