FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

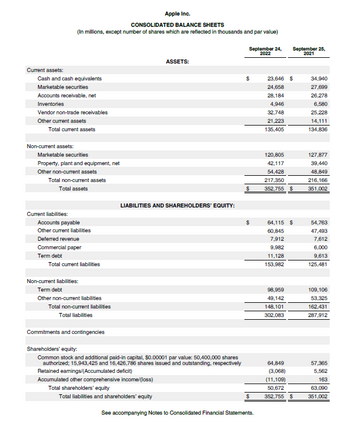

How many shares of common stock are outstanding at year-end(Refer to the

Transcribed Image Text:Current assets:

Cash and cash equivalents

Apple Inc.

CONSOLIDATED BALANCE SHEETS

(In millions, except number of shares which are reflected in thousands and par value)

Marketable securities

Accounts receivable, net

Inventories

Vendor non-trade receivables

Other current assets

Total current assets

Non-current assets:

Marketable securities

Property, plant and equipment, net

Other non-current assets

Total non-current assets

Total assets

Current liabilities:

Accounts payable

Other current liabilities

Deferred revenue

Commercial paper

Term debt

Total current liabilities

Non-current liabilities:

Term debt

Other non-current liabilities

LIABILITIES AND SHAREHOLDERS' EQUITY:

ASSETS:

Total non-current liabilities

Total liabilities

Commitments and contingencies

Shareholders' equity:

Common stock and additional paid-in capital, $0.00001 par value: 50,400,000 shares

authorized; 15,943,425 and 16,426,786 shares issued and outstanding, respectively

Retained eamings/(Accumulated deficit)

Accumulated other comprehensive income/(loss)

Total shareholders' equity

Total liabilities and shareholders' equity

September 24,

2022

$

$

See accompanying Notes to Consolidated Financial Statements.

23,646 $

24,658

28,184

4,946

32,748

21,223

135,405

120,805

42,117

54,428

217,350

352,755 $

September 25,

2021

64,115 $

60,845

7,912

9,982

11,128

153,982

98,959

49,142

148,101

302,083

64,849

(3,068)

(11,109)

50,672

352,755 $

34,940

27,699

26,278

6,580

25,228

14,111

134,836

127,877

39,440

48,849

216,166

351,002

54,763

47,493

7,612

6,000

9,613

125,481

109,106

53,325

162,431

287,912

57,365

5,562

163

63,090

351,002

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- For a recent 2-year period, the balance sheet of Bramble Company showed the following stockholders' equity data at December 31 (in millions). Additional paid-in capital Common stock Retained earnings Treasury stock Total stockholders' equity Common stock shares issued Common stock shares authorized Treasury stock shares (a) Answer the following questions. 2025 Par value of common stock $ $900 663 7,200 1,764 221 500 2024 36 $810 654 $6,999 $5,878 5,310 896 218 500 28 1. What is the par value of the common stock? (Round par value to 2 decimal places, e.g. 3.15.)arrow_forwardFinancial Statements from the End-of-Period Spreadsheet Demo Consulting is a consulting firm owned and operated by Jesse Flatt. The following end-of-period spreadsheet was prepared for the year ended August 31, 20V9: Demo Consulting End-of-Period Spreadsheet For the Year Ended August 31, 20Y9 Unadjusted Adjusted Trial Balance Adjustments Trial Balance Account Title Dr. Cr. Dr. Cr. Dr. Cr. Cash 10,710 10,710 Accounts Receivable 25,500 25,500 Supplies 2,700 2,270 430 Land 22,190 22,190 Office Equipment 20,910 20,910 Accumulated Depreciation 2,830 1,350 4,180 Accounts Payable 6,890 6,890 Salaries Payable 330 330 Common Stock 8,600 8,600 Retained Earnings 17,410 17,410 Dividends 3,320 3,320 Fees Earned 70,770 70,770 Salary Expense 19,130 330 19,460 Supplies Expense 2,270 2,270 Depreciation Expense 1,350 1,350 Miscellaneous Expense 2,040 2,040 106,500 106,500 3,950 3,950 108,180 108,180 Based on the preceding spreadsheet, prepare an income statement for Demo Consulting. Demo Consulting…arrow_forwardRequired: 1. How many common shares are outstanding on each cash dividend date? January 5 April 5 July 5 October 5 Outstanding common sharesarrow_forward

- How many shares of common stock are outstanding at August 3? How many shares of preferred stock are outstanding at August 3?arrow_forwardOo.135. Subject :- Accountarrow_forwardRequired: Prepare the stockholders' equity section of the balance sheet for For Feet's Sake as of December 31, 2024. (Amounts to be deducted should be indicated by a minus sign.) FOR FEET'S SAKE Balance Sheet (Stockholders' Equity Section) December 31, 2024 Stockholders' equity: Retained earnings Common stock Additional paid-in capital Total paid-in capital Total stockholders' equity S 0arrow_forward

- Required information The following information applies to the questions displayed below.) Sun Corporation received a charter that authorized the issuance of 80,000 shares of $7 par common stock and 19,000 shares of $100 par, 5 percent cumulative preferred stock. Sun Corporation completed the following transactions during its first two years of operation. Year 1 Jan. 5 Bold 12,000 whares of the $7 par common atock for $9 par share. 12 Bold 1,900 sharen of the 5 perceat preferred stoek for $110 per share. Apr. 5 Bold 16,000 uhares of the $7 par common stock for $11 per share. Dec.31 During the year, earned 5312, 500 in cash revenun and paid $236,100 for cash opersting expenann. 31 Declared the canh đividend on the outatanding aharea of preferred atock tor Year 1. the dividend will be paid on February 15 to atoekholders of record on January 10, Year 2. Year 2 Feb.15 Paid the cash dividend declared on December 31, Year 1. Mar. 3 Sold 2, 850 shares of the $100 par preferred stoek for $120…arrow_forwardThe equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow.5. How much net income did the company earn this year?arrow_forwardHickory Inc. experienced the following stockholders' equity transactions (listed in chronological order) during it's first year of operations. Based on these transactions, calculate the balances that would appear in the stockholders' equity accounts listed below. Formatting: Please round to the nearest dollar and do not use dollar signs (i.e. enter '1,000' rather than '$1,000'). All numbers should be positive. Common Stock, 100,000 shares of $1 par value common stock authorized Preferred Stock, 50,000 shares of $10 par value preferred stock authorized 1 Issued 5,000 common shares at $30 per share 2 Exchanged 4,000 preferred shares for a piece of equipment with a fair value of $49,000. 3 Issued 2,500 common shares at $25 per share 4 Purchased 500 of own common shares on the open market at $24 per share 5 Declared a 30% common stock dividend. Common stock was trading at $23 per share on the date of declaration.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education