FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

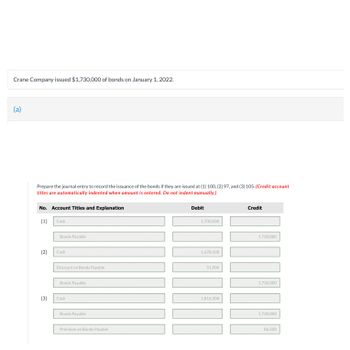

Transcribed Image Text:Crane Company issued $1,730,000 of bonds on January 1, 2022.

(a)

Prepare the journal entry to record the issuance of the bonds if they are issued at (1) 100, (2) 97, and (3) 105. (Credit account

titles are automatically indented when amount is entered. Do not indent manually.)

No. Account Titles and Explanation

(1)

(2)

(3)

Cash

Bonds Payable

Cash

Discount on Bonds Payable

Bonds Payable

Cash

Bonds Payable

Premium on Bonds Payable

Debit

1,730,000

1,678,100

51,900

1,816,500

Credit

1,730,000

1,730,000

1,730,000

86,500

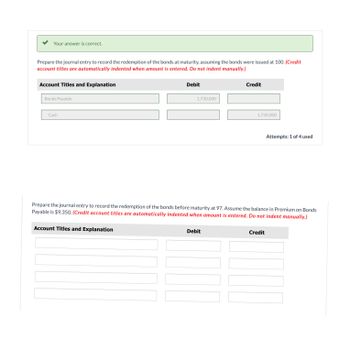

Transcribed Image Text:Your answer is correct.

Prepare the journal entry to record the redemption of the bonds at maturity, assuming the bonds were issued at 100. (Credit

account titles are automatically indented when amount is entered. Do not indent manually.)

Account Titles and Explanation

Bonds Payable

Cash

Debit

Account Titles and Explanation

1,730,000

Credit

Debit

1,730,000

Prepare the journal entry to record the redemption of the bonds before maturity at 97. Assume the balance in Premium on Bonds

Payable is $9,350. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Attempts: 1 of 4 used

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An $800,000 bond issue on which there is an unamortized premium of $57,000 is redeemed for $785,000. Journalize the redemption of the bonds. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardThe journal entry a company makes for the issuance of bonds when the contract rate is less than the market rate would be Oa. debit Cash and Discount on Bonds Payable, credit Bonds Payable Ob. debit Cash, credit Bonds Payable Oc. debit Cash, credit Premium on Bonds Payable and Bonds Payable Od. debit Bonds Payable, credit Casharrow_forwardA $515,000 bond issue on which there is an unamortized discount of $36,000 is redeemed for $463,000. Journalize the redemption of the bonds. If an amount box does not require an entry, leave it blank.arrow_forward

- 5. Compute the price of $94,580,761 received for the bonds by using the tables shown in Present Value Tables. (Round to the nearest dollar.) Present value of the face amount Present value of the semiannual interest payments Price received for the bondsarrow_forwardb. The interest payment on June 30, Year 2, and the amortization of the bond premium, using the straight-line method. Round to the nearest dollar. Bonds Payable Cash Discount on Bonds Payable Interest Expense Interest Receivable 3. Determine the total interest expense for Year 1. Round to the nearest dollar. 4. Will the bond proceeds always be greater than the face amount of the bonds when the contract rate is greater than the market rate of interest? 5. Compute the price of $23,854,460 received for the bonds by using Present value at compound interest, and Present value of an annuity. Round to the nearest dollar. Your total may vary slightly from the price given due to rounding differences. Present value of the face amount Present value of the semiannual interest payments Price received for the bondsarrow_forwardA $485,000 bond issue on which there is an unamortized discount of $35,000 is redeemed for $470,000. Required: Journalize the redemption of the bonds. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTSGeneral Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 113 Allowance for Doubtful Accounts 114 Notes Receivable 115 Interest Receivable 121 Inventory 122 Supplies 131 Prepaid Insurance 140 Land 151 Building 152 Accumulated Depreciation-Building 153 Equipment 154 Accumulated Depreciation-Equipment LIABILITIES 210 Accounts Payable 221 Salaries Payable 231 Sales Tax Payable 241 Notes Payable 242 Interest Payable 251 Bonds Payable 252 Discount on Bonds Payable 253 Premium on Bonds Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends REVENUE 410 Sales 610 Interest Revenue 611 Gain on Redemption of Bonds EXPENSES…arrow_forward

- Bonds Payable has a balance of $1,091,000 and Discount on Bonds Payable has a balance of $13,092. If the issuing corporation redeems the bonds at 98, what is the amount of gain or loss on redemption?arrow_forwardA $920,000 bond issue on which there is an unamortized premium of $65,000 is redeemed for $821,000. Journalize the redemption of the bonds. If an amount box does not require an entry, leave it blank.arrow_forwardA $291,000 bond was redeemed at 98 when the carrying amount of the bond was $286,635. What amount of gain or loss would be recorded as part of this transaction? Select the correct answer. loss on bond redemption of $4,365. gain on bond redemption of $5,820. gain on bond redemption of $1,455. loss on bond redemption of $1,455.arrow_forward

- journal entries I need help with I can not understand (a)Record the bond issue (b)Record the first semiannual interest payment. (c)Record the second semiannual interest payment.arrow_forwardConcord Hills Ltd. issued five-year bonds with a face value of $180,000 on January 1. The bonds have a coupon interest rate of 5% and interest is paid semi-annually on June 30 and December 31. The market interest rate was 3% when the bonds were issued at a price of 109. Determine the balance in the Bonds Payable account immediately following the first interest payment. Balance in bonds payable accountarrow_forwardA $500,000 bond issue on which there is an unamortized discount of $35,000, is redeemed for $475,000. What journal entry would you make to record the redemption of the bond? Make it below:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education