FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:E Calculator

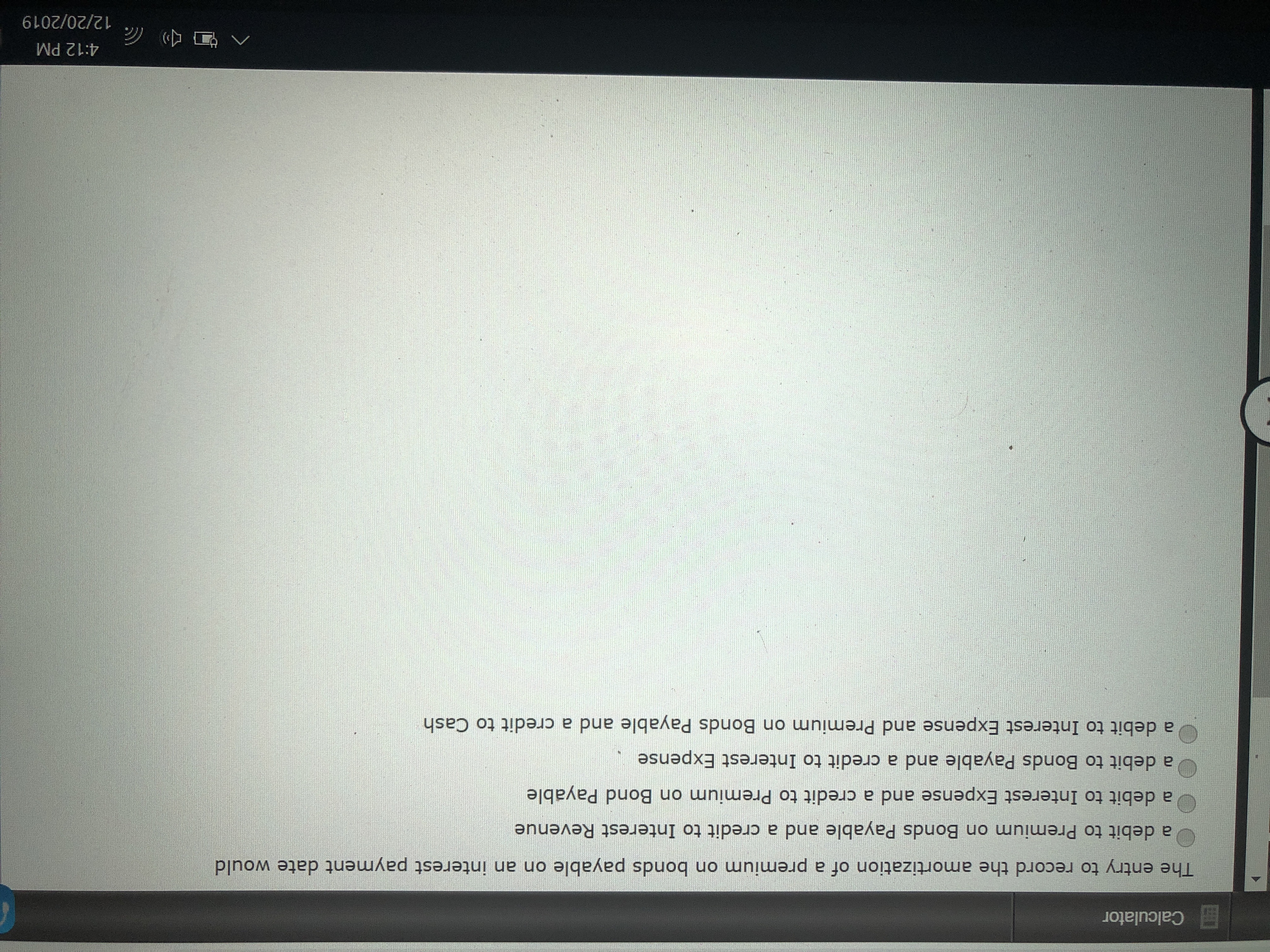

The entry to record the amortization of a premium on bonds payable on an interest payment date would

a debit to Premium on Bonds Payable and a credit to Interest Revenue

a debit to Interest Expense and a credit to Premium on Bond Payable

a debit to Bonds Payable and a credit to Interest Expense

a debit to Interest Expense and Premium on Bonds Payable and a credit to Cash

4:12 PM

12/20/2019

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- The journal entry a company makes for the issuance of bonds when the contract rate is less than the market rate would be Oa. debit Cash and Discount on Bonds Payable, credit Bonds Payable Ob. debit Cash, credit Bonds Payable Oc. debit Cash, credit Premium on Bonds Payable and Bonds Payable Od. debit Bonds Payable, credit Casharrow_forward#51 When an investor's accounting period ends on a date that does not coincide with an interest receipt date for bonds held as an investment, the investor must Question 51 options: a make an adjusting entry to debit Interest Receivable and to credit Interest Revenue for the amount of interest accrued since the last interest receipt date. b make an adjusting entry to debit Interest Receivable and to credit Interest Revenue for the total amount of interest to be received at the next interest receipt date. c notify the issuer and request that a special payment be made for the appropriate portion of the interest period. d do nothing special and ignore the fact that the accounting period does not coincide with the bond's interest period.arrow_forwardQ20arrow_forward

- Assuming a 360-day year, the interest charged by the bank, at the rate of 6%, on a 90-day, discounted note payable of $106,407 isarrow_forwardQuestion 9 consist of noninterest-bearing demand deposits and interest-bearing checking accounts. O Negotiable CDs. O Transaction accounts. O Non-transaction accounts. Savings and time deposits.arrow_forwardThe following table describes your bank account balance before and after each time point as well as deposit and withdrawal history from April 1, 2020 to April 1, 2021. Date Balance before Deposit Withdrawal Balance after Apr. 1, 2020 300 300 Jul. 1, 2020 350 100 250 Dec. 1, 2020 280 200 480 Apr. 1, 2021 500 500 Calculate the dollar-weighted interest rate during the entire period. O less than 33% at least 33%, but less than 34% at least 34%, but less than 35% at least 35%, but less than 36% at least 36%, but less than 37% at least 37% Question 9 (Continued from the last question.) Calculate the time-weighted interest rate during the entire period. less than 33% at least 33%, but less than 34% at least 34%, but less than 35% at least 35%, but less than 36% at least 36%, but less than 37% at least 37%arrow_forward

- Please don't provide solution in an image format thank youarrow_forwardim.3arrow_forwardA $2,600 credit balance in the Premium on Bonds Payable account represents which of the following? Select one: a. An overpayment for a bond purchase b. An underpayment for a bond purchase c. The current amount of amortization expense d. The unamortized amount of premium earned on a bond issuearrow_forward

- b. The interest payment on June 30, Year 2, and the amortization of the bond premium, using the straight-line method. Round to the nearest dollar. Bonds Payable Cash Discount on Bonds Payable Interest Expense Interest Receivable 3. Determine the total interest expense for Year 1. Round to the nearest dollar. 4. Will the bond proceeds always be greater than the face amount of the bonds when the contract rate is greater than the market rate of interest? 5. Compute the price of $23,854,460 received for the bonds by using Present value at compound interest, and Present value of an annuity. Round to the nearest dollar. Your total may vary slightly from the price given due to rounding differences. Present value of the face amount Present value of the semiannual interest payments Price received for the bondsarrow_forwardA. Amount of interest charge for each note B. Amount boweower would receive C. Amount payer would receive at maturity D. Effective ratearrow_forwardCrane Corp. owes $ 283,000 to Cheyenne Trust. The debt is a 10-year, 12% note due December 31, 2020. Because Crane Corp. is in financial trouble, Cheyenne Trust agrees to extend the maturity date to December 31, 2022, reduce the principal to $ 236,000, and reduce the interest rate to 6%, payable annually on December 31. (a) Prepare the journal entries on Crane's books on December 31, 2020, 2021, 2022. (b) Prepare the journal entries on Cheyenne Trust's books on December 31, 2020, 2021, 2022. Click here to view factor tables. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answer to O decimal places eg. 58,971. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education