Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

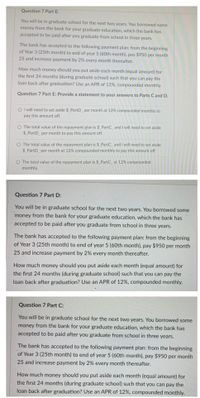

Transcribed Image Text:Question 7 Part E:

You will be in graduate school for the next two years. You borrowed some

money from the bank for your graduate education, which the bank has

accepted to be paid after you graduate from school in three years.

The bank has accepted to the following payment plan: from the beginning

of Year 3 (25th month) to end of year 5 (60th month), pay $950 per month

25 and increase payment by 2% every month thereafter.

How much money should you put aside each month (equal amount) for

the first 24 months (during graduate school) such that you can pay the

loan back after graduation? Use an APR of 12%, compounded monthly.

Question 7 Part E: Provide a statement to your answers to Parts C and D.

O I will need to set aside $ PartD per month at 12% compounded monthly to

pay this amount off.

O The total value of the repayment plan is $ PartC_ and I will need to set aside

$_PartD per month to pay this amount off.

O The total value of the repayment plan is $ PartC_and I will need to set aside

$_PartD per month at 12% compounded monthly to pay this amount off.

O The total value of the repayment plan is $_PartC_ at 12% compounded

monthly.

Question 7 Part D:

You will be in graduate school for the next two years. You borrowed some

money from the bank for your graduate education, which the bank has

accepted to be paid after you graduate from school in three years.

The bank has accepted to the following payment plan: from the beginning

of Year 3 (25th month) to end of year 5 (60th month), pay $950 per month

25 and increase payment by 2% every month thereafter.

How much money should you put aside each month (equal amor

the first 24 months (during graduate school) such that you can pay the

for

loan back after graduation? Use an APR of 12%, compounded monthly.

Question 7 Part C:

You will be in graduate school for the next two years. You borrowed some

money from the bank for your graduate education, which the bank has

accepted to be paid after you graduate from school in three years.

The bank has accepted to the following payment plan: from the beginning

of Year 3 (25th month) to end of year 5 (60th month), pay $950 per month

25 and increase payment by 2% every month thereafter.

How much money should you put aside each month (equal amount) for

the first 24 months (during graduate school) such that you can pay the

loan back after graduation? Use an APR of 12%, compounded monthly.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You receive a credit card application from Shady Banks Savings and Loan offering an introductory rate of 1.8 percent per year, compounded monthly for the first six months, increasing thereafter to 17 percent compounded monthly. Assuming you transfer the $6,900 balance from your existing credit card and make no subsequent payments, how much interest will you owe at the end of the first year? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardBeginning three months from now, you want to be able to withdraw $2,600 each quarter from your bank account to cover college expenses over the next four years. If the account pays .66 percent interest per quarter, how much do you need to have in your bank account today to meet your expense needs over the next four years?arrow_forwardYou loan a friend $200 and are repaid $120 at the end of the first month and $30 at the end of each month for the next three months. What is your rate of return?arrow_forward

- Stafford loans are the most popular form of student loan in the United States. The current interest rate on a Stafford loan is 4.34% per year. If you borrow $29,000 to help pay for your college education at the beginning of your freshman year, how much will you have to pay at the end of your freshman, sophomore, junior, and senior years for this loan? This is a total of four years over which the original loan will be repaid. The annual loan payment will be ______arrow_forwardAssume that you will have a 10-year, $10,000 loan to repay when you graduate from college next month. The loan, plus 8 percent annual interest on the unpaid balance, is to be repaid in 10 annual installments of $1,490 each, beginning one year after you graduate. You have accepted a wellpaying job and are considering an early settlement of the entire unpaid balance in just three years (immediately after making the third annual payment of $1,490). Prepare an amortization schedule showing how much money you will need to save to pay the entire unpaid balance of your loan three years after your graduation. (Round amounts to the nearest dollar.)arrow_forwardYou have just completed your four-year degree at Southwest Minnesota State University (SMSU)! Your student loans that you have accumulated while studying at SMSU total $25,000. Since you have graduated, you must now begin repaying these student loans. The loan’s annual interest rate is six percent (6%) and it requires four equal end-of-year payments. a) Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances. B) What is the total amount that you will repay over this four-year period (principal + interest)? c) What portion or percentage are the total “Interest Payments” of the initial loan value of $25,000?arrow_forward

- Tuition of $1219 will be due when the spring term begins in 3 months. What amount should a student deposit today, at 6.47%, to have enough to pay the tuition? The student should deposit $ (Simplify your answer. Round to the nearest dollar as needed.)arrow_forwardA chiropractic student receives a 10-year PLUS Loan for $50,000 to complete the last 2 years of the program. If the interest rate of the loan is 5.48% and the student begins repaying the loan 2 years after graduation, what will the student's monthly payments be (in dollars)? (Assume the loan has a deferred payment plan. Round your answer to the nearest cent.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education