Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

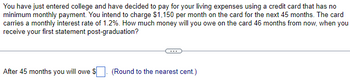

Transcribed Image Text:You have just entered college and have decided to pay for your living expenses using a credit card that has no

minimum monthly payment. You intend to charge $1,150 per month on the card for the next 45 months. The card

carries a monthly interest rate of 1.2%. How much money will you owe on the card 46 months from now, when you

receive your first statement post-graduation?

After 45 months you will owe $

(Round to the nearest cent.)

Expert Solution

arrow_forward

Step 1

Solution:

An equal amount paid each period is known as annuity.

Future value of annuity = PMT x [(1+r)n - 1] / r

where, PMT = equal periodic amount

r = periodic interest rate

n = number of periods

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You plan on making deposits of $1,000 into a savings account at the end of every year in college. If you graduate in 5 years and the account earns an annual rate of 8%, how much will you have at graduation? PLEASE BREAK IT DOWNarrow_forwardBeginning three months from now, you want to be able to withdraw $2,600 each quarter from your bank account to cover college expenses over the next four years. If the account pays .66 percent interest per quarter, how much do you need to have in your bank account today to meet your expense needs over the next four years?arrow_forwardYou decide to quit using your credit card and want to pay off the balance of $9,500 in 4 years. Your interest rate is 14.75% compounded monthly. What will your monthly payments be? How much interest do you pay?arrow_forward

- Michael has a credit card debt of $70,000 that has a 14% APR, compounded monthly. The minimum monthly payment only requires him to pay the interest on his debt. He receives an offer for a credit card with an APR of 6% compounded monthly. If he rolls over his debt onto this card and makes the same monthly payment as before, how long will it take him to pay off his credit card debt?arrow_forwardSuppose Jorge Otero has set up an annuity due with a certain credit union. At the beginning of each month, $140 is electronically debited from his checking account and placed into a savings account earning 6% interest compounded monthly. What is the value (in $) of Jorge's account after 17 months? (Round your answer to the nearest cent.)arrow_forwardTuition of $1219 will be due when the spring term begins in 3 months. What amount should a student deposit today, at 6.47%, to have enough to pay the tuition? The student should deposit $ (Simplify your answer. Round to the nearest dollar as needed.)arrow_forward

- You decide to make monthly $2000 deposits into an account that pays 4% compounded monthly. If your first deposit was on January 1, 2019, then how much is in the account immediately after the deposit on January 1, 2025?arrow_forwardOn March 1, 2021, you opened an account with a deposit of $500. You plan to continue to make $500 deposits every year until March 1, 2040, when you will make your last deposit. How much will be in the account on March 1, 2050 if the account earns 5% annually?arrow_forwardYou currently have two loans outstanding: a car loan and a student loan. The car loan requires that you pay $322 per month, starting next month for 34 more months. Your student loan is requires that you pay $145 per month, starting next month for the next 46 months. A debt consolidation company gives you the following offer: It will pay off the balances of your two loans today and then charge you $511 per month for the next 37 months, starting next month. If your investments earn 4.14% APR, compounded monthly, how much would you save or lose by taking the debt consolidation company’s offer? If you lose, state your answer with a negative sign (e.g., -25,126)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education