Concept explainers

You currently have two loans outstanding: a car loan and a student loan. The car loan requires that you pay $308 per month, starting next month for 35 more months. Your student loan requires that you pay $132 per month, starting next month for the next 105 months.

A debt consolidation company gives you the following offer: It will pay off the balances of your two loans today and then charge you $455 per month for the next 48 months, starting next month. If your investments earn 3.55% APR, compounded monthly, how much would you save or lose by taking the debt consolidation company’s offer?

If you lose, state your answer with a negative sign (e.g., -25,126)

An Annuity is a series of payments of fixed amounts and at fixed intervals.

These can be of two types:

- Ordinary – payment is made at the end of each period

- Annuity Due – payment is made at the beginning of each period

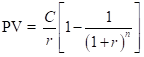

PV of ordinary annuity can be calculated as:

Where C denotes the fixed installment;

r denotes the rate of interest; 3.55% annually or 0.002958 monthly

n denotes number of instalments;

Step by stepSolved in 2 steps with 3 images

- You receive a credit card application from Shady Banks Savings and Loan offering an introductory rate of 3.9 percent per year, compounded monthly for the first six months, increasing thereafter to 18.8 percent per year, compounded monthly. Assuming you transfer the $19,000 balance from your existing credit card and make no subsequent payments, how much interest will you owe at the end of the first year? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Interest owedarrow_forwardYou receive a credit card application from Shady Banks Savings and Loan offering an introductory rate of 1.8 percent per year, compounded monthly for the first six months, increasing thereafter to 17 percent compounded monthly. Assuming you transfer the $6,900 balance from your existing credit card and make no subsequent payments, how much interest will you owe at the end of the first year? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardYou have a loan outstanding. It requires making nine annual payments of $5,000 each at the end of the next nine years. Your bank has offered to allow you to skip making the next eight payments in lieu of making one large payment at the end of the loan's term in nine years. If the interest rate on the loan is 4%, what final payment will the bank require you to make so that it is indifferent to the two forms of payment? The final payment the bank will require you to make is $ (Round to the nearest dollar.) Iarrow_forward

- A local finance company quotes a 17 percent interest rate on one-year loans. So, if you borrow $30,000, the interest for the year will be $5,100. Because you must repay a total of $35,100 in one year, the finance company requires you to pay $35,100/12, or $2,925.00, per month over the next 12 months. a. What rate would legally have to be quoted? b. What is the effective annual rate?arrow_forwardBowflex’s television ads say you can get a Treadclimber that sells for $12,000 for 5 annual payments of $3,000. What annual rate of interest are you paying on this loan? PLEASE BREAK DOWNarrow_forwardGustavo wants to borrow $900 for 20 days from a payday loan store. The payday loan finance charge is $12 per $100 borrowed up to $400, and $10 per 100 on the amount over $400. What is the dollar amount of interest I am paying? What is the APR of this loan?arrow_forward

- You have a loan outstanding. It requires making nine annual payments of $4,000 each at the end of the next nine years. Your bank has offered to allow you to skip making the next eight payments in lieu of making one large payment at the end of the loan's term in nine years. If the interest rate on the loan is 9%, what final payment will the bank require you to make so that it is indifferent to the two forms of payment? The final payment the bank will require you to make is $52084.15. (Round to the nearest cent.)arrow_forwardStafford loans are the most popular form of student loan in the United States. The current interest rate on a Stafford loan is 4.34% per year. If you borrow $29,000 to help pay for your college education at the beginning of your freshman year, how much will you have to pay at the end of your freshman, sophomore, junior, and senior years for this loan? This is a total of four years over which the original loan will be repaid. The annual loan payment will be ______arrow_forwardDiane is deciding between two personal loans. For each loan, the loan amount is $7500. Use the ALEKS loan calculator for the following. Also use the regular ALEKS calculator, as necessary. Write your answers to the nearest cent. ALEKS Loan Calculator Loan amount: $ Loan term: Interest rate: Calculate years % Monthly payment: (a) For Loan A, the interest rate is 6.15% per year and the loan term is 7 years. Find the total amount to repay Loan A. S (b) For Loan B, the interest rate is 6.15% per year and the loan term is 5 years. Find the total amount to repay Loan B. (c) For which loan would she pay less, and by how much? Loan A The total amount paid is $ less. Loan B The total amount paid is $less. X Ľarrow_forward

- You have a loan outstanding. It requires making four annual payments of $1000 each at the end of the next four years. Your bank has offered to allow you to skip making the next three payments in lieu of making one large payment at the end of loan's term in four years. If the interest rate on the loan is 7%, what final payment will the bank require you to make so that it is indifferent to the two forms of payment? Round answer to nearest dollararrow_forwardYou have a loan outstanding. It requires making seven annual payments of $4,000 each at the end of the next seven years. Your bank has offered to allow you to skip making the next six payments in lieu of making one large payment at the end of the loan's term in seven years. If the interest rate on the loan is 6%, what final payment will the bank require you to make so that it is indifferent to the two forms of payment?arrow_forwardAn online lending company is offering simple interest personal loans based on consumer creditscores. With your credit score, you can borrow $5000 for 3 years at an interest rate of 17.73%. Howmuch money will you pay the lending company at the end of 3 years?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education