FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

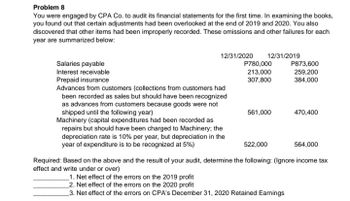

Transcribed Image Text:Problem 8

You were engaged by CPA Co. to audit its financial statements for the first time. In examining the books,

you found out that certain adjustments had been overlooked at the end of 2019 and 2020. You also

discovered that other items had been improperly recorded. These omissions and other failures for each

year are summarized below:

12/31/2020

12/31/2019

Salaries payable

P780,000

213,000

307,800

P873,600

Interest receivable

259,200

384,000

Prepaid insurance

Advances from customers (collections from customers had

been recorded as sales but should have been recognized

as advances from customers because goods were not

shipped until the following year)

Machinery (capital expenditures had been recorded as

repairs but should have been charged to Machinery; the

depreciation rate is 10% per year, but depreciation in the

year of expenditure is to be recognized at 5%)

561,000

470,400

522,000

564,000

Required: Based on the above and the result of your audit, determine the following: (Ignore income tax

effect and write under or over)

_1. Net effect of the errors on the 2019 profit

2. Net effect of the errors on the 2020 profit

_3. Net effect of the errors on CPA's December 31, 2020 Retained Earnings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- From inception of operations to December 31, 2025, Swifty Corporation provided for uncollectible accounts receivable under the allowance method. The provisions are recorded, based on analyses of customers with different risk characteristics. Bad debts written off were charged to the allowance account; recoveries of bad debts previously written off were credited to the allowance account, and no year-end adjustments to the allowance account were made. Swifty's usual credit terms are net 30 days. The balance in Allowance for Doubtful Accounts was $144,200 (Cr.) at January 1, 2025. During 2025, credit sales totaled $9,170,300. the provision for doubtful accounts was determined to be $183,406, $91,703 of bad debts were written off, and recoveries of accounts previously written off amounted to $19,570. Swifty installed a computer system in November 2025, and an aging of accounts receivable was prepared for the first time as of December 31, 2025. A summary of the aging is as follows.…arrow_forwardSpring Garden Flowers had the following balances at December 31, 2024, before the year-end adjustments: E (Click the icon to view the balances.) The aging of accounts receivable yields the following data: E (Click the icon to view the accounts receivable aging schedule.) Requirements Journalize Spring's entry to record bad debts expense for 2024 using the aging-of-receivables method. 1. 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Requirement 1. Journalize Spring's entry to record bad debts expense for 2024 using the aging-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts Debit Credit Dec. 31 Data Table Accounts Receivable Allowance for Bad Debts 66,000 1,615 Requirement 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Allowance for Bad Debts Print Done Data Table Age of Accounts Receivable 0-60 Days Over 60 Days Total…arrow_forwardRaintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only at December 31, the company's fiscal year-end. The 2023 balance sheet disclosed the following: Current assets: Receivables, net of allowance for uncollectible accounts of $36,000 $ 462,000 During 2024, credit sales were $1,780,000, cash collections from customers $1,860,000, and $41,000 in accounts receivable were written off. In addition, $3,600 was collected from a customer whose account was written off in 2023. An aging of accounts receivable at December 31, 2024, reveals the following: Age Group 0-60 days 61-90 days 91-120 days Percentage of Year- End Receivables in Group Percent Uncollectible 70% 20 5% 15 5 20 5 40 Over 120 days Required: 1. Prepare summary journal entries to account for the 2024 write-offs and the collection of the receivable previously written off. 2. Prepare the year-end adjusting entry for bad debts according to each of the…arrow_forward

- Use Newell Brands, Inc.'s financial statement information to answer the following questions. Provide the following account balances for Newell Brands : December 31, 2020 December 31, 2019 Accounts Receivable (gross) Allowance for Doubtful Accounts Accounts Receivable, net Which of the above numbers represents the total amount Newell Brands is owed by customers as of December 31, 2020? Which of the above numbers represents the amount that Newell Brands believes it will not collect from its customers as of December 31, 2020? Which of the above numbers represents the amount that Newell Brands believes it will collect from its customers as of December 31, 2020? Provide the journal entry (both accounts and amounts) that Newell Brands must have made to record its estimate of Bad Debt Expense in 2020. Provide the journal entry (both accounts and amounts) that Newell Brands must…arrow_forwardNonearrow_forwardHi, Please with question, thank you.arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardI have entered every answer for Dec 31, and it keeps telling me i am wrong. Can you help me solve?On December 31, 2021, when its Allowance for Doubtful Accounts had a debit balance of $1,315, Wildhorse Co. estimates that 11% of its accounts receivable balance of $107,400 will become uncollectible and records the necessary adjustment to Allowance for Doubtful Accounts. On May 11, 2022, Wildhorse Co. determined that B. Jared’s account was uncollectible and wrote off $1,207. On June 12, 2022, Jared paid the amount previously written off.Prepare the journal entries on December 31, 2021, May 11, 2022, and June 12, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Choose a transaction date December 31, 2021May 11, 2022June 12, 2022 Enter an account title Enter a debit amount Enter a credit…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education