Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

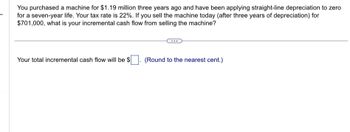

Transcribed Image Text:You purchased a machine for $1.19 million three years ago and have been applying straight-line depreciation to zero

for a seven-year life. Your tax rate is 22%. If you sell the machine today (after three years of depreciation) for

$701,000, what is your incremental cash flow from selling the machine?

Your total incremental cash flow will be $

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 2. Suppose that you are considering speculating on some vacant land located on Bali Hai, an island in the South Pacific. You could acquire the land today for $850,000. You plan on holding it for fifteen years and then selling it. Annual taxes, insurance and upkeep (mowing, clearing of debris, etc.) of the land will be $35,000, paid at the end of the first year. These costs will increase annually at a 2.5% rate until you sell the land at the end of the fifteenth year. If you require an annual rate of return of 20%, what is the minimum amount that you have to net (after commissions, transfer taxes, fees, etc.) on the sale of this land at the end of the final year to earn your required rate of return? (Ignore income taxes)arrow_forward4arrow_forwardIlana Industries Incorporated needs a new lathe. It can buy a new high-speed lathe for $1 million. The lathe will cost $35,000 per year to run, but it will save the firm $125,000 in labor costs and will be useful for 10 years. Suppose that, for tax purposes, the lathe is entitled to 100% bonus depreciation. At the end of the 10 years, the lathe can be sold for $100,000. The discount rate is 8%, and the corporate tax rate is 21%. What is the NPV of buying the new lathe? Note: A negative amount should be indicated by a minus sign. Enter your answer in dollars not in millions. Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forward

- Johnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $32,000 and will be depreciated straight- line over 3 years. It will be sold for scrap metal after 5 years for $8,000. The grill will have no effect on revenues but will save Johnny's $16,000 in energy expenses. The tax rate is 30%. Required: a. What are the operating cash flows in each year? b. What are the total cash flows in each year? c. Assuming the discount rate is 12%, calculate the net present value (NPV) of the cash flow stream. Should the grill be purchased? Complete this question by entering your answers in the tabs below. Required A Required B Required C What are the operating cash flows in each year? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Year 1 2 3 Operating Cash Flowsarrow_forwardJohnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $38,000 and will be depreciated straight-line over 3 years. It will be sold for scrap metal after 5 years for $9,500. The grill will have no effect on revenues but will save Johnny's $19,000 in energy expenses. The tax rate is 30%. Required: What are the operating cash flows in each year? What are the total cash flows in each year? Assuming the discount rate is 12%, calculate the net present value (NPV) of the cash flow stream. Should the grill be purchased? (round answers to 2 decimal places)arrow_forwardJohnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $19,000 and will be depreciated straight-line over 7 years to a salvage value of zero. The grill will have no effect on revenues, but will save Johnny's $20,000 in energy expenses. The tax rate is 31 percent. What are the operating cash flows in years 1 to 7? Enter your answer below. Numberarrow_forward

- Karsted Air Services is now in the final year of a project. The equipment originally cost $23 million, of which 100% has been depreciated. Karsted can sell the used equipment today for $6 million, and its tax rate is 20%. What is the equipment's after-tax salvage value? Write out your answer completely. For example, 13 million should be entered as 13,000,000. Round your answer to the nearest dollar. $arrow_forwardSuppose you sell a fixed asset for $212,000 when its book value is $112,000. If your company’s marginal tax rate is 30 percent, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)?arrow_forwardYou purchased a machine for $1.17 million three years ago and have been applying straight-line depreciation to zero for a seven-year life. Your tax rate is 38%. If you sell the machine today (after three years of depreciation) for $788,000, what is your incremental cash flow from selling the machine?arrow_forward

- You are contemplating the replacement of an old printing machine with a new model costing $63,000. The old machine, which originally cost $40,000, has 6 years of expected life remaining and the current book value of $14,000 versus the current market value of $21,000. The firm's corporate tax rate is 24 percent. If the company sells the old machine at the market value, what is the initial after-tax cash outlay for the new printing machine purchase?arrow_forwardOne year ago, your company purchased a machine used in manufacturing for $105,000. You have learned that a new machine is available that offers many advantages and that you can purchase it for $150,000 today. The CCA rate applicable to both machines is 20%; neither machine will have any long-term salvage value. You expect that the new machine will produce earnings before interest, taxes, depreciation, and amortization (EBITDA) of $45,000 per year for the next 10 years. The current machine is expected to produce EBITDA of $22,000 per year. All other expenses of the two machines are identical. The market value today of the current machine is $50,000. Your company's tax rate is 35%, and the opportunity cost of capital for this type of equipment is 10%. Should your company replace its year-old machine? What is the NPV of replacement? The NPV of replacement is $ (Round to the nearest dollar.) .....arrow_forwardSussman industries purchased a drilling machine for $50,000 and paid cash. Sussman expects to use the machine for ten years after which it will have no value. It will be depreciated straight-line over the ten years. Assume a marginal tax rate of 40%. What are the cash flows associated with the machine?A. At the time of purchase?b. In each of the following ten years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education