Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

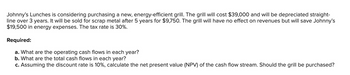

Transcribed Image Text:Johnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $39,000 and will be depreciated straight-

line over 3 years. It will be sold for scrap metal after 5 years for $9,750. The grill will have no effect on revenues but will save Johnny's

$19,500 in energy expenses. The tax rate is 30%.

Required:

a. What are the operating cash flows in each year?

b. What are the total cash flows in each year?

c. Assuming the discount rate is 10%, calculate the net present value (NPV) of the cash flow stream. Should the grill be purchased?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Johnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $32,000 and will be depreciated straight- line over 3 years. It will be sold for scrap metal after 5 years for $8,000. The grill will have no effect on revenues but will save Johnny's $16,000 in energy expenses. The tax rate is 30%. Required: a. What are the operating cash flows in each year? b. What are the total cash flows in each year? c. Assuming the discount rate is 12%, calculate the net present value (NPV) of the cash flow stream. Should the grill be purchased? Complete this question by entering your answers in the tabs below. Required A Required B Required C What are the operating cash flows in each year? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Year 1 2 3 Operating Cash Flowsarrow_forwardJohnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $38,000 and will be depreciated straight-line over 3 years. It will be sold for scrap metal after 5 years for $9,500. The grill will have no effect on revenues but will save Johnny's $19,000 in energy expenses. The tax rate is 30%. Required: What are the operating cash flows in each year? What are the total cash flows in each year? Assuming the discount rate is 12%, calculate the net present value (NPV) of the cash flow stream. Should the grill be purchased? (round answers to 2 decimal places)arrow_forwardJohnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $19,000 and will be depreciated straight-line over 7 years to a salvage value of zero. The grill will have no effect on revenues, but will save Johnny's $20,000 in energy expenses. The tax rate is 31 percent. What are the operating cash flows in years 1 to 7? Enter your answer below. Numberarrow_forward

- Your firm needs a machine which costs $120,000, and requires $33,000 in maintenance for each year of its 5 year life. After 5 years, this machine will be replaced. The machine falls into the MACRS 5-year class life category. Assume a tax rate of 35 percent and a discount rate of 15 percent. What is the depreciation tax shield for this project in year 5?arrow_forwardThe owner of a bicycle repair shop forecasts revenues of $160,000 a year. Variable costs will be $50,000, and rental costs for the shop are $30,000 a year. Depreciation on the repair tools will be $10,000. Prepare an income statement for the shop based on these estimates. The tax rate is 20%. Calculate the operating cash flow for the repair shop using the three methods given below: Dollars in minus dollars out. Adjusted accounting profits. Add back depreciation tax shield.arrow_forwardEskom, Inc. has 4-year project in South Africa with an annual operating cash flow of $47,500. Eskom spent $21,600 on an Electricity Supply Solar Tower to start the project. At the end of the project, the Electricity Supply Solar Tower will have a book value of $4,340, but can be salvaged for $5,430. If Eskom’s tax rate is 35%, what is the cash flow in Year 4? Note: Net working capital of $3,850 was needed at the start of the project. That money will be recovered at the end of the project. a. $48,699 b.$57,162 c. $54,880 d. $56,399 e. $18,392arrow_forward

- The Hangover Diner is considering a project to build a new diner next to Saint Joseph's University with an initial cost of $555,000. Construction will take 2 years. The diner will open in year 3, so no cash will be received in the first 2 years. At the end of the third year, the diner expected to produce a cash inflow of $100,000. Starting in the fourth year the cash flows are expected to grow by 2.50% per year forever. What is the project's net present value today at a 15% discount rate? O -$22,711 $44,274 O $49,915 $58,552arrow_forwardThe owner of a bicycle repair shop forecasts revenues of $196,000 a year. Variable costs will be $59.000, and rental costs for the shop are $39.000 a year. Depreciation on the repair tools will be $19.000. a. Prepare an income statement for the shop based on these estimates. The tax rate is 20% Calculate the operating cash flow for the repair shop using the three methods given below Now calculate the operating cash flow 1. Dollars in minus dollars out 2. Adjusted accounting profits, in 3.Add back depreciation tax shieldarrow_forwardJohnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $29,000 and will be depreciated straight-line over 8 years to a salvage value of zero. The grill will have no effect on revenues, but will save Johnny's $13,000 in energy expenses. The tax rate is 37 percent. What are the operating cash flows in years 1 to 8?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education