Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Bed

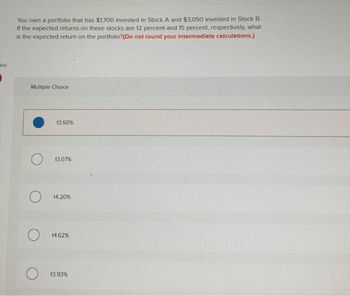

You own a portfolio that has $1,700 invested in Stock A and $3,050 invested in Stock B.

If the expected returns on these stocks are 12 percent and 15 percent, respectively, what

is the expected return on the portfolio? (Do not round your intermediate calculations.)

Multiple Choice

13.50%

13.07%

14.20%

14.62%

13.93%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Stock A has a volatility of 54% and a correlation of 19% with your current portfolio. Stock B has a volatility of 37% and a correlation of 32% with your current portfolio. You currently hold both stocks. Which of the following choices below will increase the volatility of your portfolio: (i) selling a small amount of stock B and investing the proceeds in stock A, or (ii) selling a small amount of stock A and investing the proceeds in stock B? The marginal contribution to risk for stock A is%. (Round to two decimal place.)arrow_forwardYou have $37,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 14.7 percent and Stock Y with an expected return of 7.1 percent. Your goal is to create a portfolio with an expected return of 13 percent. All money must be invested. How much will you invest in Stock X? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardYou own a portfolio that is 21 percent invested in Stock X, 36 percent in Stock Y, and 43 percent in Stock Z. The expected returns on these three stocks are 9 percent, 12 percent, and 14 percent, respectively. What is the expected return on the portfolio?arrow_forward

- Your portfolio is comprised of 30 percent of Stock X, 20 percent of Stock Y, and 50 percent of Stock Z. Stock X has a beta of 1.05, Stock Y has a beta of 0.80, and Stock Z has a beta of 1.43. What is the beta of your portfolio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardConsider the following information: Probability of State of Portfolio Return if State State of Economy Economy Occurs Recession .20 -13 Вoom .80 .19 Calculate the expected return. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return %arrow_forwardYou own a portfolio that is 25% invested in Stock X, 40% in Stock Y, and 35% in Stock Z. The expected returns on these three stocks are 10%, 13%, and 15%, respectively. What is the expected return on the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected returnarrow_forward

- You have $261,000 to invest in a stock portfolio. Your choices are Stock H, with an expected return of 14.1 percent, and Stock L, with an expected return of 11.2 percent. If your goal is to create a portfolio with an expected return of 12.55 percent, how much money will you invest in Stock H and in Stock L? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Investment in Stock H Investment in Stock Larrow_forwardYou have $18,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 13 percent and Stock Y with an expected return of 11 percent. If your goal is to create a portfolio with an expected return of 12.18 percent, how much money will you invest in Stock X and Stock Y? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Stock X Stock Yarrow_forwardYou own a portfolio that has $18,000 invested in Stock A and $17,000 invested in Stock B. The expected returns on these stocks are 15.9 percent and 7.1 percent, respectively. What is the expected return on the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- You own a portfolio that is invested 15 percent in Stock X, 35 percent in Stock Y, and 50 percent in Stock Z. The expected returns on these three stocks are 9 percent, 15 percent, and 12 percent, respectively. What is the expected return on the portfolio? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 3216.)arrow_forwardYou have a portfolio consisting solely of Stock A and Stock B. The portfolio has an expected return of 10.9 percent. Stock A has an expected return of 13.4 percent while Stock B is expected to return 7.3 percent. What is the portfolio weight of Stock A? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardA portfolio is invested 45 percent in Stock G, 40 percent in Stock J, and 15 percent in Stock K. The expected returns on these stocks are 11 percent, 9 percent, and 15 percent, respectively. What is the portfolio's expected return? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education